by Calculated Risk on 10/20/2010 11:08:00 AM

Wednesday, October 20, 2010

Wells Fargo Conference Call on Foreclosure-Gate

From the Wells Fargo conference call (ht Brian):

Let me shift to give you an overview of the foreclosure and mortgage securitization issues. These are issues obviously that are very important to consumers, mortgage investors, and shareholders. But we believe that these issues have been somewhat overstated and, to a certain extent, misrepresented in the marketplace.And on servicing fees:

I would like to be clear here on how they impact Wells Fargo specifically. So starting on slide 26 first [previous post], as John already mentioned , foreclosure at Wells Fargo is a last resort , not a first resort . We work very early with customers who are beginning to experience problems paying their mortgages and continue to do so for the length of time that the problems are being experienced.

80% of customers who are 60 days or more delinquent work with us, and when they do we are successful in helping seven out of every 10 avoid foreclosure. We attempt to contact customers on average over 75 times by phone and nearly 50 times by letter during the roughly 16 months that it takes for foreclosures to be completed once a borrower becomes (technical difficulty ).

Second, our foreclosure and securitization policies, practices, and controls in our view, are sound. To help ensure accuracy over the years, Wells Fargo has built control processes that link customer information with foreclosure procedures and documentation requirements . Our process specifies that affidavit signers and reviewers are the same team member, not different people, and affidavits are properly notarized. Not all banks in our understanding do it this way. If we find errors, we fix them; promptly as we can. We ensure loans in foreclosure are assigned to the appropriate party as necessary to comply with local laws and investor requirements.

Analyst: We are reading all of these headlines that are impacting the mortgage business in one way or another, I guess the thing that jumps out to me is the servicing business really hasn't been priced for what we are seeing right now. Maybe the cost to you in the repurchase is a little bit less; but for some other competitors it seems like it is going to be a pretty high cost. So how do you think about just pricing I guess on the origination side as well as on the servicing side for your current production and going forward?The analyst seems to be asking if Wells Fargo is considering increasing their servicing fee. It is important to remember that servicing is counter-cyclical and that these are the worst of times for servicers. Not only are foreclosures up, but they are also seeing a high level of refinancing because of low mortgage rates (and each loan has an upfront fixed cost, so the servicers sometimes doesn't have time to recoup the upfront costs). But during more normal times, servicing is a real cash cow for the industry - and any increase would suggest insufficient competition and should be opposed by regulators.

WFC CEO: We're always looking at -- as we are looking at this business, first of all there is great scale here. You're right with your comments that when you have problem portfolios it costs more money. ...

Analyst: I guess what I'm getting at is the servicing fees that you get as an industry I think are relatively modest to probably what some of the costs are either to modify some of these loans -- obviously the foreclosure process. So it just feels that that is going to be a much bigger burden for the business going forward, and it might make sense to start repricing some of that business right now.

WFC CFO: The industry might do that, and of course we look at that. But clearly for the 8% that is past due, that is expensive. There is no question about that. But you got to look at a whole, at a portfolio -- from a portfolio perspective. The industry will react to it. If this is a prolonged issue, I am sure new servicing will -- might be considered differently.

Wells Fargo on Foreclosures: "Procedures sound, no moratorium"

by Calculated Risk on 10/20/2010 10:49:00 AM

From Wells Fargo:

“With respect to recent industry-wide foreclosure issues, there are several important facts to know about Wells Fargo. Foreclosure is always a last resort, and we work hard to find other solutions through multiple discussions with customers over many months before proceeding to foreclosure. We are confident that our practices, procedures and documentation for both foreclosures and mortgage securitizations are sound and accurate. For these reasons, we did not, and have no plans to, initiate a moratorium on foreclosures."And a couple of pages from the Quarterly Supplement:

Click on slide for larger image in new window.

Click on slide for larger image in new window.Here is the slide from the Wells Fargo supplement. Not only are they arguing that their foreclosure process and procedures are "sound", but they argue that "Legal documents related to securitization properly transferred ownership".

However last week the Financial Times reported:

In a sworn deposition on March 9 seen by the FT, Xee Moua, identified in court documents as a vice-president of loan documentation for Wells, said she signed as many as 500 foreclosure-related papers a day on behalf of the bank.Note: I'm not analyzing Wells Fargo, just reporting on their comments.

Ms Moua ... said that the only information she verified was whether her name and title appeared correctly ... Asked whether she checked the accuracy of the principal and interest that Wells claimed the borrower owed – a crucial step in banks’ legal actions to repossess homes – Ms Moua said: “I do not.”

excerpt with permission

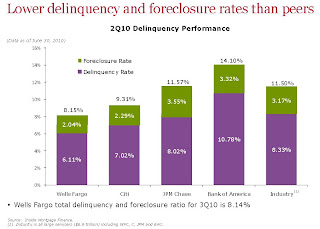

The next slide shows the delinquency and foreclosure rates for the large servicers.

The next slide shows the delinquency and foreclosure rates for the large servicers.BofA (Countrywide) and JPM Chase (WaMu) have the highest combined delinquency and foreclosure rates. BofA is the largest servicer with over 14 million loans ($2.2 trillion) at the end of Q2. Wells Fargo is second with about 12 million loans ($1.8 trillion), and JPM Chase is third with about 9.5 million loans ($1.35 trillion).

MBA: Mortgage Purchase Activity Declines

by Calculated Risk on 10/20/2010 07:39:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 11.2 percent from the previous week. The seasonally adjusted Purchase Index decreased 6.7 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.34 percent from 4.21 percent, with points decreasing to 0.81 from 1.02 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index declined to near the lows of earlier this year, but this is just one week - the decline might be related to the Columbus Day holiday or to the recent slight change in FHA lending standards.

Note that the 30 year contract rate at 4.34% is just up from the record low of 4.21%.

AIA: Architecture Billings Index shows expansion, first time since Jan 2008

by Calculated Risk on 10/20/2010 12:00:00 AM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

Reuters reports that the American Institute of Architects’ Architecture Billings Index increased to 50.4 in September from 48.2 in August. Any reading above 50 indicates expansion.

"The strong upturn in design activity in the commercial and industrial sector certainly suggests that this upturn can possibly be sustained," said Kermit Baker, AIA's chief economist. "But we will need to see consistent improvement over the next few months in order to feel comfortable about the state of the design and construction industry."The ABI press release is not online yet.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. This is the first time the index has been above 50 since Jan 2008.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So, if the index stays at 50 or above, this suggests there will probably be further declines in CRE investment for the next 9 to 12 months.

Tuesday, October 19, 2010

Foreclosure-Gate: The Investigations and some comments on other issues

by Calculated Risk on 10/19/2010 08:42:00 PM

From Zachary Goldfarb at the WaPo: Task force probing whether banks broke federal laws during home seizures

Goldfarb writes that the Financial Fraud Enforcement Task Force is looking into whether the mortgage servicers misled federal housing agencies, and also "into whether the submission of flawed paperwork during the foreclosure process violated mail or wire fraud laws". There will be a meeting tomorrow (Wednesday), followed by a briefing by "HUD Secretary Shaun Donovan and the task force executive director, Robb Adkins".

White House press secretary Robert Gibbs ... said the administration is strongly supporting a parallel probe by every state's attorney general. Foreclosure law is largely the domain of state courts.And from David Streitfeld at the NY Times: States Continue Foreclosure Inquiries

“There has been an attempt by some of the major servicers to indicate there are no problems,” said Patrick Madigan, Iowa’s assistant attorney general. “We’re not at the end of this process. We’re at the beginning.”My comment: I fully support these investigations, but I've downplayed "foreclosure-gate" because I thought the impact on housing and the economy would be minor - depending of course on the length of the foreclosure delays. Many other people disagree with my view - and please remember I'm not always right.

It is important to separate out two other issues. The first is MERS (the "Mortgage Electronic Registration System"). There are many interesting issues with MERS - and plenty of litigation - but my feeling is that the defects are curable, and these issues will have little impact on the economy. Since I think the impact will be minor, once again I've mostly been ignoring these issues.

The third issue is repurchase requests based on Reps and Warranties for mortgages. This is an important story for the banks. I've been mentioning the increasing push-backs from the GSEs (Fannie and Freddie). That isn't a new story. The important development today was that several major bond investors are pressuring BofA to repurchase defective mortgages. Although I've been following this story, I haven't mentioned it - and some people think I've been "behind the curve". Could be.

The key questions are how many loans will eventually be pushed-back and how long it will take. Usually this process takes a long time and involves analyzing numerous loan files for defects. And these weren't GSE loans for a reason - the loans had significant risk layering (stated income, option ARMs, high LTV, and high debt-to-income ratios etc.) and these risk factors were fully disclosed to the investors. I expect this to be a slow process and be a drag on bank earnings for some time, but not be another major event like the collapse of Lehman. Once again I think the impact on the economy will be minor (my focus is on housing and the economy).

Housing Starts and the Unemployment Rate

by Calculated Risk on 10/19/2010 05:50:00 PM

An update by request ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows single family housing starts and the unemployment rate (inverted) through September. Note: Of course there are many other factors too, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) rebounded a little last year,and then moved sideways for some time, before declining again in May.

This is what I expected when I first posted the above graph over a year ago. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.Usually near the end of a recession, residential investment1 (RI) picks up as the Fed lowers interest rates. This leads to job creation and also household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However this time, with the huge overhang of existing housing units, this key sector isn't participating. Earlier today, NY Fed President William Dudley said the NY Fed's estimate was that "there are roughly 3 million vacant housing units more than usual". If that estimate is correct (I think it is too high), then it would take several years of housing starts at the current level, combined with more normal household growth, to eliminate the excess supply.

1 RI is mostly new home sales and home improvement.