by Calculated Risk on 10/21/2010 10:00:00 AM

Thursday, October 21, 2010

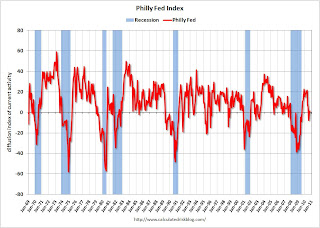

Philly Fed Index "steady" in October

Here is the Philadelphia Fed Index: Business Outlook Survey

Results from the Business Outlook Survey suggest that regional manufacturing activity was steady in October. Although the broad survey measures showed marginal improvement this month, the new orders index continued to suggest weak demand for manufactured goods.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of –0.7 in September to 1.0 in October. The index had been negative for two consecutive months (see Chart). Indexes for new orders and shipments continued to indicate weakness this month: The new orders index increased 3 points but remained negative for the fourth consecutive month.

...

Firms reported near steady employment again this month, but lower average work hours for existing employees. The percentage of firms reporting increases in employment (20 percent) narrowly edged out the percentage of firms reporting decreases (17 percent). The index for employment was slightly positive for the second consecutive month but increased just 1 point. Indicative of still weak activity, more firms reported declines in average work hours for existing employees (22 percent) than reported increases (16 percent).emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

This index turned down sharply in June and July and was negative in August and September (indicating contraction). The index was barely positive in October, and the internals (new orders, employment) are still weak.

These surveys are timely, but noisy. However this is further evidence of a slowdown in manufacturing. This was slightly worse than the consensus view of a reading of 1.8 (slight expansion).

Weekly Initial Unemployment Claims: Moving Sideways

by Calculated Risk on 10/21/2010 08:40:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Oct. 16, the advance figure for seasonally adjusted initial claims was 452,000, a decrease of 23,000 from the previous week's revised figure of 475,000 [revised up from 462,000]. The 4-week moving average was 458,000, a decrease of 4,250 from the previous week's revised average of 462,250.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 4,250 to 458,000.

The 4-week moving average has been moving sideways at an elevated level since last December - almost a year - and that suggests a weak job market.

Note: most revisions have been slightly up over the last year or so. The average revision has been up just over 2,000, but the revision last week was up 13,000.

Wednesday, October 20, 2010

WSJ: Here come the GSE Put-Backs

by Calculated Risk on 10/20/2010 10:56:00 PM

From Nick Timiraos at the WSJ: Regulator for Fannie Set to Get Litigious

[The FHFA] hired a law firm specializing in litigation as the agency considers how to move forward with efforts to recoup billions of dollars on soured mortgage-backed securities purchased from banks and Wall Street firms.Back in July, the Federal Housing Finance Agency announced: FHFA Issues Subpoenas for PLS Documents

...

In a statement, the FHFA said it is analyzing requested information and that "no decisions for future action have been made."

FHFA, as Conservator of Fannie Mae and Freddie Mac (the Enterprises), has issued 64 subpoenas to various entities, seeking documents related to private-label mortgage-backed securities (PLS) in which the two Enterprises invested. The documents will enable the FHFA to determine whether PLS issuers and others are liable to the Enterprises for certain losses they have suffered on PLS.The GSEs have a huge advantage over other investors because the FHFA can issue subpoenas. The article mentions estimates that the banks could face put-backs ranging from $24 billion to as high as $179 billion. Quite a range and the actual amount will probably be towards the lower end of the range, and this will play out over a long period (unless there is a settlement).

Note: It is difficult for private investors to obtain the actual loan documents - and that is one of the hurdles the investors asking BofA to repurchase loans need to overcome. Yves Smith at Naked Capitalism points out some of the difficulties: More on Why the PIMCO, BlackRock, Freddie, NY Fed Letter to Countrywide on Putbacks Is Way Overhyped. However the private investors can obtain the required voting rights (usually 25% to 50% depending on the deal), and essentially force the trustee to make the servicer turnover the loan documentation. As I mentioned last night, put-backs could be a big issue for the banks, although I think it will play out over several years and not be a serious issue for the economy.

Comerica and Wells Fargo: Some color on C&I borrowing

by Calculated Risk on 10/20/2010 07:03:00 PM

Just a little color ... this sounds like a sluggish recovery with little new investment. The following comments from Comerica and Wells Fargo on Commercial & Industrial (C&I) lending this morning are mixed. Perhaps a little improvement, but not much. Here are the excerpts from the transcripts (ht Brian).

From Comerica Incorporated conference call:

Analyst: Can you talk about what you saw from your more traditional borrowers during the quarter? Any signs of lines being drawn down or increased optimism?And from Wells Fargo:

Dale Green, EVP, Comerica: Yeah, this is Dale. Number one, as we indicated, the usage was up a bit from about 45% to about 46%, it’s good to see that. We haven’t seen that in a while. If you look at the backlogs and you look at the growth from new customers, and increases to existing customers, it’s kind of spread across most of our businesses. Currently the dealer business is showing growth. The energy business has indicated they are showing growth, those backlogs continue to look good, and what we call the commitments to commit, or the approved deals that we’re waiting to close are up rather substantially this quarter over last quarter, and again, that’s generally across most of the segments. Middle market, technology and life sciences, and so forth. So the quality of the backlog, if you will, is good in the sense that there are more deals that have been approved that are waiting to close, and the level of activity is generally a little better than it’s been. So I would say that we are cautiously optimistic, but you know, this is an uncertain time. So while we’re seeing some improvements, and we’re happy to see it, we’re happy to see better usage, there’s still an economy here that most business people will tell you is concerning, troubling, uncertain.

...

Analyst: I know you talked about utilization rate and everything in terms of demand firming up on commercial lending, but just trying to get an idea of how soon we can see growth commercial offset so CRE roll off in terms of loan growth.

Dale Greene: I hope soon, but the reality is that number one, in terms of new CRE types of opportunities, there are very few new opportunities, so we’ll continue to see the run off of the commercial real estate book as part of a design, if you will. Clearly, as we talked about before, is I had one against growth. While we are seeing some positive trends in the non-CRE, the rest of the C & I book – it’s still very difficult to predict, because there’s just that uncertainty, and so I wouldn’t sit here and tell you exactly when you might see it. It might be a while. I mean, John talked about unemployment rates, and the growth and the economy still being on very muted labels. I don’t know that that’s going to change anytime in the near term, therefore, what we’re doing is the things we’ve done for years. We’re calling on customers, we’re calling on prospects, we’re looking for the core middle market opportunities, particularly in Texas and California. We have loads of good opportunities, we have a better quality backlog, but it will take some time, I think, to see any significant growth, if you will, in the C & I book. It’s just going to be sort of ongoing, quarter to quarter, a block and a tackle kind of an effort.

Ralph Babb, CEO: As Dale was mentioning, we’re staying very close to our customers, and what we’re hearing from our customers, and we have a lot of customers who are doing very well. They are not, because of the uncertainty in the economy, and other things that affect their particular business, investing for the future. They’re really taking care of what’s happening today, and until there is a confidence factor build out there along with the economy showing a steady improvement, I don’t think you’re going to see loans consistently pick up in the industry. You monitor the numbers, I’m sure, just like we do, as to how the industry in total is working. We saw a little bit of that in Q1 and Q2, where things began to pick up, and then all of a sudden the economy slowed back down again, and the estimates that I’ve heard and look at, over the next couple of quarters and into next year, are not significant in pickup. I hope that that’s not correct.

Analyst: So what is the percentage of the C&I loan utilization? I will use that as a measure for how much loan demand there is. What is your feeling about loan demand?

WFC CFO: Roughly in the low 30s on commercial line utilization, and that has been relatively consistent for a couple of quarters now. Again as we say, we are seeing somewhat increased activity, but it is not as robust as we would like to see it be. As I said we think we are picking up market share because we have got so many relationships and all the other cross-sell. So we'll just have to see when demand comes back.

WFC CEO: One of the keys, is our increase in commitments is much greater than what is happening in the portfolio, the outstandings. So we are making investments today, spending money today, to win new clients, service existing clients, that we're not seeing the benefit of yet.

Economix: Tom Lawler answers questions on foreclosures

by Calculated Risk on 10/20/2010 04:06:00 PM

From Economix: Answers to Your Questions on the Foreclosure Crisis. Here is one:

Q: Is it the case that many foreclosures are initiated by processors who receive high fees for foreclosing and have no incentive to pursue workouts of loans? — hmgbird, VirginiaThere are several more questions at Economix.

A. For mortgage servicers who also own (or whose company also owns) the loans, the answer is no, at least in instances where a loan workout is expected to result in lower losses than foreclosing on a home.

For mortgage servicers who service loans for others, the answer is a bit trickier.

In theory, such servicers are supposed to work to minimize losses for the investors for whom they service loans. In practice, however, many so called “third-party” servicers, especially the “mega” servicers, were not adequately staffed to handle effectively the surge in problem loans, which to deal with effectively requires many more resources/staff than is the case just for processing loan payments.

For these servicers, it is not always possible to recoup the costs associated with the massive staff increases and systems changes needed to develop effective loss mitigation/workout strategies from investors, while recouping costs by just doing things the “old” way and foreclosing on properties has been relatively straightforward. So ... the net answer is “in some cases, yes.”

Fed's Beige Book: Economic Activity increased at "modest pace"

by Calculated Risk on 10/20/2010 02:00:00 PM

Note: This is based on information collected on or before October 8, 2010.

From the Federal Reserve: Beige book

Reports from the twelve Federal Reserve Districts suggest that, on balance, national economic activity continued to rise, albeit at a modest pace, during the reporting period from September to early October.And on real estate:

...

Manufacturing activity continued to expand, and several Districts reported gains in production or new orders across a wide range of industries. The only exceptions were the Philadelphia and Richmond Districts, where activity softened compared with the previous reporting period. Exports boosted manufacturing activity according to contacts in the Cleveland, Chicago, and Kansas City Districts.

Housing markets remained weak. Most District Beige Book reports suggested overall home sales were sluggish or declining and were below year-ago levels. ... Single-family construction activity was at very low levels, but had improved somewhat in the Chicago, St. Louis, and Kansas City Districts. ... Respondents' outlooks suggested sales and construction would remain subdued through year-end.Pretty weak, but still growing in September and early October.

...

Conditions in the commercial real estate sector remained subdued. Reports suggested rental rates continued to decline for most commercial property types. The one exception was the apartment sector, where higher leasing activity led to fewer concessions, most notably in Manhattan. Office, industrial and retail rental markets remained weak ... Industry contacts appeared to believe that the commercial real estate and construction sectors would remain weak for some time.