by Calculated Risk on 10/22/2010 10:00:00 AM

Friday, October 22, 2010

State Unemployment Rates in September: "Little changed" from August

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Eleven states now have double digit unemployment rates. A number of other states are close.

Nevada tied a series high at 14.4% and now has the highest state unemployment rate. Michigan held the top spot for over 4 years until May.

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in September. Twenty-three states and the District of Columbia recorded unemployment rate decreases, 11 states registered rate increases, and 16 states had no rate change, the U.S. Bureau of Labor Statistics reported today.

...

In September, Nevada’s unemployment rate held at 14.4 percent, again the highest among the states. The states with the next highest rates were Michigan, 13.0 percent, and California, 12.4 percent. North Dakota continued to register the lowest jobless rate, 3.7 percent, followed by South Dakota and Nebraska, at 4.4 and 4.6 percent, respectively.

Geithner calls for reducing trade imbalances

by Calculated Risk on 10/22/2010 08:37:00 AM

From a letter .S. Treasury Secretary Timothy Geithner sent to his G-20 counterparts:

“First, G-20 countries should commit to undertake policies consistent with reducing external imbalances below a specified share of GDP over the next few years, recognizing that some exceptions may be required for countries that are structurally large exporters of raw materials. This means that G-20 countries running persistent deficits should boost national savings by adopting credible medium-term fiscal targets consistent with sustainable debt levels and by strengthening export performance.And the proposal has plenty of opposition - no surprise - from the WSJ: G-20 Proposal on Curbing Trade Imbalances Faces Opposition

Conversely, G-20 countries with persistent surpluses should undertake structural, fiscal and exchange rate policies to boost domestic sources of growth and support global demand. Since our current account balances depend on our own policy choices as well as on the policies pursued by other G-20 countries, these commitments require a cooperative effort.

“Second, to facilitate the orderly rebalancing of global demand, G-20 countries should commit to refrain from exchange rate policies designed to achieve competitive advantage by either weakening their currency or preventing the appreciation of an undervalued currency.

G-20 emerging market countries with significantly undervalued currencies and adequate precautionary reserves need to allow their exchange rates to adjust fully over time to levels consistent with economic fundamentals. G-20 advanced countries will work to ensure against excessive volatility and disorderly movement in exchange rates.

Together these actions should reduce the risk of excessive volatility in capital flows for emerging economies that have flexible exchange rates.

Japan and Germany, whose export-led growth models have built up major trade surpluses, are opposing such a solution at the meeting of G-20 finance ministers and central bankers in Gyeongju.

"The idea of setting numerical targets is unrealistic," Japanese Finance Minister Yoshihiko Noda said Friday.

Thursday, October 21, 2010

Shanghai Composite Update

by Calculated Risk on 10/21/2010 10:38:00 PM

Just an update ... it seems like the Shanghai and the S&P 500 (and oil prices too - not shown) are all moving together.

This graph shows the Shanghai SSE Composite Index and the S&P 500 (in blue).

The SSE Composite index is at 2,963.50, up about 14% since late August. The S&P 500 and oil are both up about 10% over the same period.

FOMC and QE2

by Calculated Risk on 10/21/2010 06:17:00 PM

A few people have asked me for a summary of the views of current FOMC members concerning QE2. Although no one has committed, here is my best guess based on recent speeches or other information ... there appears to be a majority of FOMC member who will vote "Yes", not counting the three labeled as "probably".

| Person, Position | FOMC Membership | QE2 Position |

|---|---|---|

| Ben S. Bernanke, Board of Governors, Chairman | FOMC | Yes |

| Janet L. Yellen, Fed Vice Chairman, Board of Governors | FOMC | Yes |

| William C. Dudley, New York, FOMC Vice Chairman | FOMC | Yes |

| James Bullard, St. Louis | FOMC | Yes |

| Elizabeth A. Duke, Board of Governors | FOMC | Yes (probably) |

| Thomas M. Hoenig, Kansas City | FOMC | No |

| Sandra Pianalto, Cleveland | FOMC | Yes |

| Sarah Bloom Raskin, Board of Governors | FOMC | Yes (probably) |

| Eric S. Rosengren, Boston | FOMC | Yes |

| Daniel K. Tarullo, Board of Governors | FOMC | Yes (probably) |

| Kevin M. Warsh, Board of Governors | FOMC | Undecided |

| Charles L. Evans, Chicago | Alternate | Yes |

| Richard W. Fisher, Dallas | Alternate | Undecided |

| Narayana Kocherlakota, Minneapolis | Alternate | Undecided |

| Charles I. Plosser, Philadelphia | Alternate | No |

| Christine M. Cumming, First Vice President, New York | Alternate | Unknown |

Hotel Performance: RevPAR up 9.4% compared to same week in 2009

by Calculated Risk on 10/21/2010 02:17:00 PM

Hotel occupancy is one of several industry specific indicators I follow ...

Important: Even though the occupancy rate is close to 2008 levels, 2010 is a much more difficult year for the hotel industry than 2008. RevPAR (revenue per available room) is up 9.4% compared to 2009, but still down 7.8% compared to 2008 - and 2008 was a very difficult year for the hotel industry.

From HotelNewsNow.com: STR: Economy ADR performance falls short

Overall occupancy increased 8.3% to 63.8%, ADR was up 0.9% to US$100.40, and RevPAR ended the week up 9.4% to US$64.09.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 7.9% compared to last year (the worst year since the Great Depression) and 6.1% below the median for 2000 through 2007.

The occupancy rate is about at the levels of 2008, but RevPAR is still down 7.8%.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

FHFA Projections for Fannie and Freddie draws, and House Price Assumptions

by Calculated Risk on 10/21/2010 11:35:00 AM

From the FHFA: FHFA Releases Projections Showing Range of Potential Draws for Fannie Mae and Freddie Mac

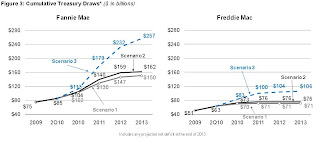

To date, the Enterprises have drawn $148 billion from the Treasury Department under the terms of the [Preferred Stock Purchase Agreements] PSPAs. Under the three scenarios used in the projections, cumulative Enterprise draws range from $221 billion to $363 billion through 2013.The key to the size of future draws is the trajectory of house prices. The following graph shows the three house projections used by the FHFA:

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the FHFA:

Stronger Near-term Recovery (FHFA Scenario 1) “Increased access to credit supports the above baseline growth. As a result, the recent increases in house prices are sustained, although additional increases are minimal in 2010 and 2011.” The peak to-trough decline is 31%. From the trough in 1Q09 to the end of the forecast period house prices increase by 5%.My current projection is for further house price declines of 5% to 10%, as measured by the Case-Shiller and Corelogic repeat sales indexes. That would put the peak-to-trough decline around 36% or so. So my guess is somewhere between scenarios 2 & 3.

Current Baseline (FHFA Scenario 2) "Small remaining home price declines" contribute to a 34% peak-to-trough decline. From the trough in 3Q11 to the end of the forecast period house prices increase by 8%.

Deeper Second Recession (FHFA Scenario 3) “As a result of restricted access to credit and continuing high unemployment, the moderate

rebound in housing construction that occurred over the first half of 2009 not only pauses but reverses course." The peak-to-trough decline is 45%. From the trough in 1Q12 to the end of the forecast period house prices increase by 11%.

And this graph shows the projected draws for each of the above scenarios.

And this graph shows the projected draws for each of the above scenarios.My guess is the draw will be somewhat over scenario 2, but well below the FHFA's scenario 3.