by Calculated Risk on 10/24/2010 01:27:00 PM

Sunday, October 24, 2010

Schedule for Week of Oct 24th

The previous post is the Summary for Week ending Oct 23rd

The key economic report for the coming week is the Q3 advance GDP report to be released on Friday. There are also three important housing reports to be released early in the week: Existing home sales on Monday, Case-Shiller house prices on Tuesday, and New Home sales on Wednesday.

CoreLogic House Price Index for August. This release will probably show further declines in house prices. The index is a weighted 3 month average for June, July and August.

Making Home Affordable Program (HAMP) for September and the “Housing Scorecard”

8:30 AM ET: Chicago Fed National Activity Index (September). This is a composite index of other data.

8:30 AM: Fed Chairman Bernanke, Welcoming Remarks at Mortgage Foreclosures and the Future of Housing Finance in Arlington, VA. I don't expect anything newsworthy from Bernanke, but there are a number of interesting topics at this two day conference on housing issues (see agenda at link).

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for an increase to 4.30 million on a Seasonally Adjusted Annual Rate (SAAR) in September from 4.13 million in August. Housing economist Tom Lawler is projecting 4.5 million SAAR. In addition to sales, the level of inventory and months-of-supply will be very important (since months-of-supply impacts prices). Months-of-supply should still be in double digits in September. Note: there will probably be no impact on September sales from the "robo-signer" foreclosure moratorium.

10:30 AM: Dallas Fed Manufacturing Survey for October. The Texas survey showed a slight expansion last month (at 4.0), and is expected to show a slight expansion again in October.

Various Fed Speeches: St. Louis Fed President Bullard (1:30 PM), NY Fed President Dudley (4:30 PM), and Kansas City Fed President Hoenig (8 PM) are all scheduled to speak.

9:00 AM: S&P/Case-Shiller Home Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August. The consensus is for a slight decline in prices month-over-month in August.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October. The consensus is for the index to be flat after showing contraction (-2) last month.

10:00 AM: 10:00 FHFA House Price Index for August. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

10:00 AM: Conference Board's consumer confidence index for October. The consensus is for an increase to 50 from 48.5 last month. This is down sharply from earlier this year.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly over the last few months even with record low mortgage rates.

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 1.6% increase in durable goods orders after declining 1.3% in August.

10:00 AM: New Home Sales for September from the Census Bureau. The consensus is for a slight increase in sales to 300K (SAAR) in September from 288K in August. New home sales collapsed in and have averaged only 293K (SAAR) over the last four months. Prior to the last four months, the previous record low was 338K in Sept 1981.

8:30 AM: The initial weekly unemployment claims report will be released. Consensus is for about an increase to 455,000 from 452,000 last week (still elevated).

11:00 AM: Kansas City Fed regional Manufacturing Survey for October. The index was at 14 in September.

8:30 AM: Q3 GDP (second release). This is the advance release from the BEA, and the consensus is for real GDP to increase 2.0% annualized. My initial estimate was for a 1.5% annualized real increase in Q3 GDP, and I'll post another preview during the week. This is probably the last economic report standing between the Fed and QE2 (2nd round of quantitative easing). It would take a huge upside surprise in the GDP report to delay QE2 from arriving on November 3rd at 2:15 PM.

8:30 AM: The Q3 Employment Cost Index from the BLS. This is a measure of total compensation costs and the consensus is for 0.5% increase.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a decline to 57.6 from 60.4 in September.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for October).

After 4:00 PM: The FDIC will probably have another busy Friday afternoon ...

Summary for Week ending Oct 23rd

by Calculated Risk on 10/24/2010 09:00:00 AM

A summary of last week - mostly in graphs.

With all the Fed speeches last week it is clear that the countdown to QE2 continues (QE2: quantitative easing, 2nd round). Also "put-backs" of "soured" mortgages (repurchase demands) is picking up steam, see:

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.2 percent in September after having increased 0.2 percent in August. ... The capacity utilization rate for total industry edged down to 74.7 percent ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 9.5% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 74.7% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production declined slightly in September, and production is still 7.5% below the pre-recession levels at the end of 2007.

This is below consensus expectations of a 0.2% increase in Industrial Production, and an increase to 74.8% (from 74.7% before revision) for Capacity Utilization.

Total housing starts were at 610 thousand (SAAR) in September, up 0.3% from the revised August rate of 608 thousand (revised up from 598 thousand), and up 28% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Total housing starts were at 610 thousand (SAAR) in September, up 0.3% from the revised August rate of 608 thousand (revised up from 598 thousand), and up 28% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). There has been an increase in multi-family starts over the last two months, although single family starts are significantly below the levels of earlier this year.

Single-family starts increased 4.4% to 452 thousand in August. This is 25% above the record low in January 2009 (360 thousand).

This was above expectations of 580 thousand starts, mostly because of the volatile multi-family starts.

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was at 16 in October. This is a 3 point increase from 13 in September, and is the highest level since June. The record low was 8 set in January 2009, and 16 is still very low ...

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was at 16 in October. This is a 3 point increase from 13 in September, and is the highest level since June. The record low was 8 set in January 2009, and 16 is still very low ...Note: any number under 50 indicates that more builders view sales conditions as poor than good.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts (posted before starts were released).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index declined 3.3% in August. This is a repeat sales measure of commercial real estate prices.

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index declined 3.3% in August. This is a repeat sales measure of commercial real estate prices.Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

Reuters reports that the American Institute of Architects’ Architecture Billings Index increased to 50.4 in September from 48.2 in August. Any reading above 50 indicates expansion.

Reuters reports that the American Institute of Architects’ Architecture Billings Index increased to 50.4 in September from 48.2 in August. Any reading above 50 indicates expansion.This graph shows the Architecture Billings Index since 1996. This is the first time the index has been above 50 since Jan 2008.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So, if the index stays at 50 or above, this suggests there will probably be further declines in CRE investment for the next 9 to 12 months.

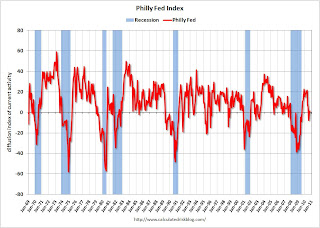

Here is the Philadelphia Fed Index: Business Outlook Survey

Results from the Business Outlook Survey suggest that regional manufacturing activity was steady in October. Although the broad survey measures showed marginal improvement this month, the new orders index continued to suggest weak demand for manufactured goods.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of –0.7 in September to 1.0 in October.

This graph shows the Philly index for the last 40 years.

This graph shows the Philly index for the last 40 years.This index turned down sharply in June and July and was negative in August and September (indicating contraction). The index was barely positive in October, and the internals (new orders, employment) are still weak.

These surveys are timely, but noisy. However this is further evidence of a slowdown in manufacturing. This was slightly worse than the consensus view of a reading of 1.8 (slight expansion).

Best wishes to all.

Saturday, October 23, 2010

Jim the Realtor: Sign Overload

by Calculated Risk on 10/23/2010 09:05:00 PM

The first scene is a classic with all the election signs! Jim says: "Tough time of year for open houses. Aren't you suffering from sign overload right about now?" Yeah, I am!

Jim also update us on some foreclosures and shows us an "estate" in Encinitas (in a mixed neighborhood), and Jim rocks out at the end.

I know the "estate" area very well - that was all flower growers not that many years ago. Some of the land has been sold off to builders, and it looks like some guy bought one plot and built an "estate". Here is the google map of the house (it goes about 70% of the way from Lake to Crest). A little out of character for the immediate neighborhood, and notice all the growers around it.

Number of Bank Failures: 2010 about to surpass 2009

by Calculated Risk on 10/23/2010 05:28:00 PM

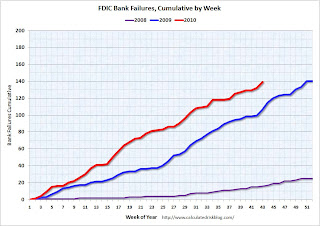

I haven't updated these graphs for some time ...

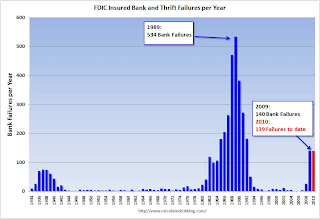

There have been 307 bank failures in this cycle (starting in 2007):

| FDIC Bank Failures by Year | |

|---|---|

| 2007 | 3 |

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 139 |

| Total | 307 |

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows bank failures by week in 2008, 2009 and 2010.

At this time last year, there were 106 bank failures - on the way to 140 total failures in 2009. This year there are 139 failures so far, and, at this pace, it looks like there will be around 175 total failures in 2010.

That would be the highest total since the 181 bank failures in 1992.

That would be the highest total since the 181 bank failures in 1992.Bank failures peaked at 534 in 1989 during the S&L crisis.

And on total assets from the December Congressional Oversight Panel’s Troubled Asset Relief Program report:

[A]lthough the number of failed banks was significantly higher in the late 1980s than it is now, the aggregate assets of failed banks during the current crisis far outweighs those from the 1980s. At the high point in 1988 and 1989, 763 banks failed, with total assets of $309 billion. Compare this to 149 banks failing in 2008 and 2009, with total assets of $473 billion.Note: This is in 2005 dollars and doesn't include the failures in 2010 (only estimates are available so far for 2010). However this does include the failure of WaMu in 2008 with $307 billion in assets that didn't impact the DIF.

Impact of BofA Foreclosure Moratorium on North San Diego County

by Calculated Risk on 10/23/2010 01:52:00 PM

Some interesting data for just one small area ...

Graph from North County Times and shows the impact of the BofA foreclosure moratorium on repossessions in a non-judicial area.

This is just in the North San Diego and Southwest Riverside counties.

From Eric Wolff at the NC Times: Foreclosure moratorium takes hold locally

In the first week of the moratorium, starting Oct. 12, the number of houses foreclosed in the region plummeted 27 percent from the previous week, to 173 foreclosure sales, according to ForeclosureRadar.The "foreclosure-gate" scandal had no impact on existing home sales in September (to be released this coming Monday), but will probably have an impact on closed sales in October.

Much of the drop can be attributed to Bank of America's subsidiary ReconTrust NA, which handled 23.7 percent of the region's foreclosures in 2010.

Unofficial Problem Bank List at 871 Institutions

by Calculated Risk on 10/23/2010 08:39:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 22, 2010.

Changes and comments from surferdude808:

Failures contributed to the Unofficial Problem Bank List changes this week. There were eight removals, with seven because of failure, and four additions, which leaves the list at 871 institutions with assets of $402.2 billion.

Among the removals was the unassisted merger of Citizens National Bank of Springfield ($254 million) into cross-town Empire Bank, Springfield, MO. The failures included Hillcrest Bank ($1.6 billion); First Arizona Savings, a FSB ($272 million); First Suburban National Bank ($149 million); The First National Bank of Barnesville ($136 million); Progress Bank of Florida ($111 million); First Bank of Jacksonville ($81 million); and The Gordon Bank ($29 million).

The First National Bank of Barnesville opened its doors in 1902; thus, it survived the Great Depression but it was not able to weather the Great Recession.

The FDIC could not find a buyer for First Arizona Savings so they will mail insured depositors a check; however, its cost estimate of only 12 percent of assets is the lowest of the night and one-third lower than the next cheapest deposit payoff in this cycle, which was Arcola Homestead Savings Bank at 18.8 percent in June 2010.

The four additions are Gibraltar Private Bank & Trust Co., Coral Gables, FL ($1.6 billion); Wilber National Bank, Oneonta, NY ($929 million Ticker: GIW); Highlands Union Bank, Abingdon, VA ($649 million Ticker: HBKA); and Bank of Maumee, Maumee, OH ($45 million). Gibraltar had purchased about $1.5 billion of assets from Boston Private Bank & Trust Company (Ticker: BPFH) in 2009.

Next week there should be many changes as we expect the FDIC to release its actions for September 2010.