by Calculated Risk on 10/27/2010 12:24:00 PM

Wednesday, October 27, 2010

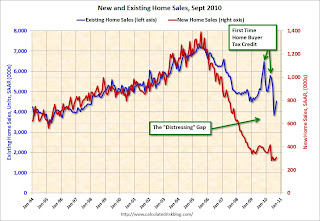

Home Sales: Distressing Gap Sept 2010

By request, here is an update - this graph shows existing home sales (left axis) and new home sales (right axis) through September. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due partially to distressed sales).

Note: it is important to note that existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Initially the gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The two spikes in existing home sales were due primarily to the homebuyer tax credits (the initial credit last year, followed by the 2nd credit this year). There were also two smaller bumps for new home sales related to the tax credits.

Now, once again, the gap is mostly because of the continuing flood of distressed sales (both foreclosures and short sales). I expect that eventually this gap will be closed, however that will only happen after the huge overhang of existing inventory (especially distressed inventory) is significantly reduced.

New Home Sales increased slightly in September, still near record low

by Calculated Risk on 10/27/2010 10:00:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 307 thousand. This is slightly higher than in August (288 thousand SAAR).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted or annualized).

Note the Red columns for 2010. In September 2010, 24 thousand new homes were sold (NSA). This is a new record low for September.

The previous record low for the month of September was 28 thousand in 1981; the record high was 95 thousand in September 2005.

The second graph shows New Home Sales vs. recessions for the last 47 years. The dashed line is the current sales rate.

The second graph shows New Home Sales vs. recessions for the last 47 years. The dashed line is the current sales rate.

Sales of new single-family houses in September 2010 were at a seasonally adjusted annual rate of 307,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 6.6 percent (±16.9%)* above the revised August rate of 288,000, but is 21.5 percent (±13.3%) below the September 2009 estimate of 391,000.And another long term graph - this one for New Home Months of Supply.

Months of supply decreased to 8.0 in September from 8.6 in August. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).

Months of supply decreased to 8.0 in September from 8.6 in August. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of September was 204,000. This represents a supply of 8.0 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. The 307 thousand annual sales rate for September is just above the all time record low in May (282 thousand). This was the weakest September on record.

New home sales are important for the economy and jobs - and this indicates that residential investment will be a sharp drag on GDP in Q3.

MBA: Mortgage Purchase Activity increases slightly

by Calculated Risk on 10/27/2010 07:57:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 3.0 percent from the previous week. The seasonally adjusted Purchase Index increased 3.9 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.25 percent from 4.34 percent, with points increasing to 1.0 from 0.81 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The 30-year contract rate matches the rate from the week ending October 1, 2010, which was the second lowest ever observed in this survey.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is still 30% below the levels of April 2010, and is about at the levels of 1996. This suggests existing home sales will remain weak through the end of the year.

Tuesday, October 26, 2010

Report: Fed will probably use gradual approach for QE2

by Calculated Risk on 10/26/2010 11:21:00 PM

QE2 is coming. The only question is if the Fed will announce a fairly large amount of purchases on November 3rd (like $500 billion), or a somewhat smaller amount and revisit the purchases at each FOMC meeting. It sounds like the Fed might take the 2nd approach ...

From Jon Hilsenrath and Jonathan Cheng at the WSJ: Fed Gears Up for Stimulus

The central bank is likely to unveil a program of U.S. Treasury bond purchases worth a few hundred billion dollars over several months, a measured approach in contrast to purchases of nearly $2 trillion it unveiled during the financial crisis.This is the approach the NY Fed's EVP Brian Sack described earlier this month: Managing the Federal Reserve’s Balance Sheet

It is hard to call "a few hundred billion dollars" a gradual approach, but this is less than current expectations for the Nov 3rd FOMC announcement.

DataQuick: California Mortgage Defaults Rise in Third Quarter

by Calculated Risk on 10/26/2010 07:44:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Notices of Default (NOD) by year through 2009, and for the first three quarters of 2010, in California from DataQuick.

Although the pace of filings has slowed from the previous two years, it is still very high by historical standards.

From DataQuick: California Mortgage Defaults Rise in Third Quarter

The number of foreclosure proceedings initiated by lenders between July and September edged higher on a quarter-to-quarter basis for the first time since early last year. But the number of home owners who went all the way through that process to foreclosure dipped from the previous quarter and a year ago, a real estate information service reported.As prices fall later this year, we might see another increase in NODs. Although NODs will decline in 2010 from 2009, the number will still be very high and 2010 will be the third highest on record (only behind 2009 and 2008).

A total of 83,261 Notices of Default ("NODs") were recorded at county recorder offices during the July-through-September period. That was up 18.9 percent from 70,051 in the prior quarter, and down 25.5 percent from 111,689 in third-quarter 2009, according to San Diego-based MDA DataQuick.

...

"Over the past year, with some minor ups and downs, financial institutions and their servicers have been processing a fairly steady number of defaults each quarter. That probably has more to do with their capacity to process defaults, than with higher or lower levels of incoming distress," said John Walsh, DataQuick president.

...

The number of Trustees Deeds ("TDs") recorded, which reflects the number of houses and condos foreclosed on, totaled 45,377 during the third quarter. That was down 4.8 percent from 47,669 for the prior quarter, and down 9.3 percent from 50,013 for third-quarter 2009. The all-time peak for TDs was 79,511 in third-quarter 2008.

There are many details in the press release - the median origination month was August 2006, Countrywide made the most bad loans (no surprise), and the top beneficiaries were Bank of America (15,992), Wells Fargo (10,069), MERS (5,292), and JP Morgan Chase (5,172).

It will be interesting to see what happens in Q4. Since this is the first stage of the foreclosure process, and almost all foreclosures in California are non-judicial, I'd expect little or no impact from "foreclosure-gate".

Philly Fed September State Coincident Indexes

by Calculated Risk on 10/26/2010 04:00:00 PM

Earlier posts on Case-Shiller house prices:

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. Thirty one states are showing increasing three month activity. The index decreased in 12 states, and was unchanged in 7.

Based on the one month data, this three month activity map be turning even more red next month.

Here is the Philadelphia Fed state coincident index release for September.

In the past month, the indexes increased in 24 states, decreased in 14, and remained unchanged in 12 for a one-month diffusion index of 20. Over the past three months, the indexes increased in 31 states, decreased in 12, and remained unchanged in seven for a three-month diffusion index of 38.

The second graph is of the monthly Philly Fed data for the number of states with one month increasing activity.

The second graph is of the monthly Philly Fed data for the number of states with one month increasing activity. The indexes increased in 24 states, decreased in 14, and remained unchanged in 12. Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

A number of states are showing declining activity - and this "recovery" looks very similar to the sluggish recovery following the 2001 recession. No wonder consumer confidence remains very low.