by Calculated Risk on 10/30/2010 08:37:00 PM

Saturday, October 30, 2010

Unofficial Problem Bank list increases to 894 Institutions

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 29, 2010.

Changes and comments from surferdude808:

As anticipated, the FDIC released its enforcement actions for September this week contributing to many changes to the Unofficial Problem Bank List. This week there were 26 additions and three removals, which results in the list having 894 institutions with $410.7 billion of assets, up from 871 institutions and $402.1 billion of assets last week.

The three removals are for action termination and include First Carolina State Bank, Rocky Mount, NC ($113 million); State Bank of Burnettsville, Burnettsville, IL ($39 million); and The Citizens Bank of Weir, Weir, KS ($6 million).

Among the additions are CNLBank, Orlando, FL ($1.5 billion); Colorado Capital Bank, Castle Rock, CO ($870 million); Malvern Federal Savings Bank, Paoli, PA ($691 million); The Delaware County Bank and Trust Company, Lewis Center, OH ($644 million Ticker: DCBF); County Bank, Rehoboth, DE ($400 million Ticker: CBFD); Bank of Alameda, Alameda, CA ($245 million Ticker: NCLC); Old Harbor Bank, Clearwater, FL ($232 million Ticker: OHBK); and Charter Oak Bank, Napa, CA ($139 million Ticker: CHOB). The FDIC also issued a Prompt Corrective Action order against Charter Oak Bank.

Other changes include Prompt Corrective Actions orders against four institutions already on the list including Firstier Bank, Louisville, KY ($809 million); Nevada Commerce Bank, Las Vegas, NV ($194 million); Valley Community Bank, St. Charles, IL ($142 million); and First Vietnamese American Bank, Westminster, CA ($52 million). Strangely, the FDIC just published the action against Firstier Bank although it is dated April 21, 2010.

Residential Investment declines to new low as Percent of GDP

by Calculated Risk on 10/30/2010 04:45:00 PM

A couple more graphs ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

It is interesting to note that RI as a percent of GDP has declined to a post war low of 2.22%. Some people have asked how could a sector that only accounts for 2.2% of GDP be so important? The answer is that usually RI accounts for a large percentage of the employment and GDP growth in the first year or so of a recovery. Not this time.

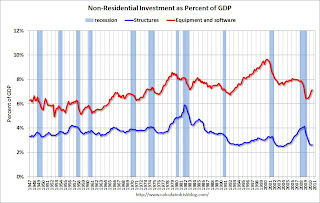

The second graph shows non-residential investment in structures and equipment and software.

The second graph shows non-residential investment in structures and equipment and software.

Equipment and software investment has been booming, and non-residential investment in structures is near a record low.

Investment Contribution to GDP: Leading and Lagging Sectors

by Calculated Risk on 10/30/2010 12:30:00 PM

By request, the following graph is an update to: The Investment Slump in Q2 2009

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential Investment (RI) made a negative contribution to GDP in Q3 2010, and the four quarter rolling average is negative again.

RI was negatively impacted by the slowdown in new home construction, and also because the number of existing home sold fell sharply (real estate commissions are included in RI).

Equipment and software investment has made a significant positive contribution to GDP for five straight quarters (it is coincident).

The contribution from nonresidential investment in structures was slightly positive in Q3. The details will be released next week, but I expect that oil and gas investment made a positive contribution, and hotels, malls and office investment were negative again. As usual nonresidential investment in structures is the last sector to recover.

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far.

Restaurant Index shows expansion in September

by Calculated Risk on 10/30/2010 08:45:00 AM

This is one of several industry specific indexes I track each month.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading above 100 shows expansion for this index.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Improved in September as Restaurant Performance Index Rose Above 100 for First Time in Five Months

Driven by improving same-store sales and customer traffic levels, as well as growing optimism among restaurant operators, the outlook for the restaurant industry improved in September. The National Restaurant Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.3 in September, up a solid 0.8 percent from its August level. In addition, the RPI rose above 100 for the first time in five months, which signifies expansion in the index of key industry indicators.Restraurants are a discretionary expense, and this slight expansion is a little bit of good news.

“The RPI’s solid gain in September was the result of broad-based improvements among both the current situation and forward-looking indicators,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the National Restaurant Association. “Restaurant operators reported positive same-store sales and customer traffic levels for the first time in six months, which propelled the RPI’s Current Situation Index to its highest level in nearly three years.”

...

Restaurant operators reported a net increase in same-store sales for the first time in six months in September. ... Restaurant operators also reported a slight uptick in customer traffic levels in September.emphasis added

Friday, October 29, 2010

Commercial Real Estate: "Normal market conditions years away"

by Calculated Risk on 10/29/2010 10:03:00 PM

From Buck Wargo at the Las Vegas Sun: Commercial real estate’s slide likely at an end

The commercial real estate market led by the office sector appears to have halted its slide ... analysts said.It is possible the office vacancy rate has peaked - or is near the peak as the the Reis vacancy data suggests - but it will take a long time to absorb all the excess office space. And that means non-residential investment in office buildings will be low for some time.

...

With little construction and the demand for space outpacing those who are giving it up, it appears the office market isn’t going to worsen, [Jake Joyce, a project manager with Applied Analysis] said.

“While it’s easy to latch on to even the smallest bright spot, the return to more normal market conditions is years away, but must start somewhere,” Joyce said.

But you do have to start somewhere ...

Real GDP Growth and the Unemployment Rate

by Calculated Risk on 10/29/2010 04:36:00 PM

Here is an excerpt from a previous post earlier this month and his probably worth repeating after the GDP report this morning. This relationship suggests the unemployment will rise with only 2% real GDP growth:

Click on graph for larger image.

Click on graph for larger image.

Here is an update on a version of Okun's Law. This graph shows the annual change in real GDP (x-axis) vs. the annual change in the unemployment rate (y-axis).

Note: For this graph I used a rolling four quarter change - so all the data points are not independent. However - remember - this "law" is really just a guide.

The following table summarizes several scenarios over the next year (starting from the current 9.6% unemployment rate):

| Real GDP Growth | Unemployment Rate in One Year |

|---|---|

| 0.0% | 11.0% |

| 1.0% | 10.5% |

| 2.0% | 10.0% |

| 3.0% | 9.6% |

| 4.0% | 9.1% |

| 5.0% | 8.7% |

I expected a sluggish recovery in 2010, so I thought the unemployment rate would stay elevated throughout 2010 (that was correct).

Going forward, I think the recovery will stay sluggish and choppy for some time and I'd guess the unemployment rate will tick up in the short term and still be above 9% later next year. You can see why those expecting 1% to 2% growth next year (like Goldman Sachs) are expecting the unemployment rate to be close to 10%.

In general, the U.S. economy needs to grow faster than a 3% real rate to reduce the unemployment - and there is no evidence yet of a pickup in growth.