by Calculated Risk on 11/01/2010 10:00:00 AM

Monday, November 01, 2010

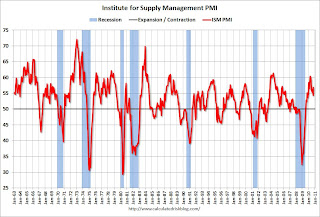

ISM Manufacturing Index increases to 56.9 in October

PMI at 56.9% in October, up from 54.4% in September. The consensus was for an increase to 54.5%.

From the Institute for Supply Management: October 2010 Manufacturing ISM Report On Business®

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The manufacturing sector grew during October, with both new orders and production making significant gains. Since hitting a peak in April, the trend for manufacturing has been toward slower growth. However, this month's report signals a continuation of the recovery that began 15 months ago, and its strength raises expectations for growth in the balance of the quarter. Survey respondents note the recovery in autos, computers and exports as key drivers of this growth. Concerns about inventory growth are lessened by the improvement in new orders during October. With 14 of 18 industries reporting growth in October, manufacturing continues to outperform the other sectors of the economy."

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here is a long term graph of the ISM manufacturing index.

In addition to the increase in the PMI, the ISM's new orders index was up sharply to 58.9 from 51.1 in September.

The employment index increased to 57.7 from 56.5 in September.

And the inventory index declined to 53.9 from 55.6, but this was the 4th month in a row of increasing inventories.

The internals were stronger this month. It was just last month that Ore cautioned that the new orders and inventory indexes were "sending strong negative signals of weakening performance in the [manufacturing] sector".

The increase in the ISM index was in line with the increases in the regional Fed manufacturing surveys.

Personal income declines 0.1%, Spending increases 0.2% in September

by Calculated Risk on 11/01/2010 08:30:00 AM

From the BEA: Personal Income and Outlays, June 2010

Personal income decreased $16.8 billion, or 0.1 percent, and disposable personal income (DPI) decreased $20.3 billion, or 0.2 percent, in September ... Personal consumption expenditures (PCE) increased $17.3 billion, or 0.2 percent.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in September, compared with an increase of 0.3 percent in August.

...

Personal saving as a percentage of disposable personal income was 5.3 percent in September, compared with 5.6 percent in August.

Click on graph for large image.

Click on graph for large image.This graph shows real personal income less transfer payments since 1969.

This measure of economic activity is moving sideways - similar to what happened following the 2001 recession.

This month the saving rate decreased ...

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the Setpember Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the Setpember Personal Income report. In September, income declined 0.1%, and spending increased 0.2% - so the saving rate decreased to 5.3% in September (5.5% using a three month average).

I expect the saving rate to rise some more over the next year, perhaps to 8% or so - keeping the pace of PCE growth below income growth.

Sunday, October 31, 2010

Two Extremes: Paying on Underwater Mortgages, and Living in Default

by Calculated Risk on 10/31/2010 09:22:00 PM

Earlier posts:

The following articles illustrate two extremes we've discussed before. The first is about borrowers with significant negative equity who are still paying their mortgage. They can't refinance. They can't sell. And it is difficult to move for new employment. This is probably a drag on economic growth.

And at the other extreme are borrowers staying in their homes for extended periods without paying their mortgage or property taxes. This might be providing some "stealth stimulus" for the economy. Note: Some people call this the "squatter stimulus", but I think that term is demeaning since many of these people are facing serious financial problems and living with uncertainty.

From Don Lee at the LA Times: Millions of homeowners keep paying on underwater mortgages

Of the estimated 15 million homeowners underwater, about 7.8 million owed at least 25% more than their properties were worth in the first quarter of this year ... More than 4 million borrowers ... were underwater more than 50%.The borrowers with negative equity are still receiving the same housing service, and making the same payment, as a few years ago. In that sense it isn't a drag on the economy. However they can't take advantage of low rates to refinance, they can't sell, it is difficult to move, and they are frequently reluctant to invest in home improvements - and they might even forgo needed repairs. And there is probably a negative wealth effect impacting their overall consumption.

... They still have jobs and can afford to make the payments. ... But they can't refinance because they owe too much.

And from Mark Whitehouse at the WSJ: The Stealth Stimulus of Defaulters Living for Free

Defaulters living in their homes are getting a subsidy worth about $2.6 billion a month, according to a Wall Street Journal analysis based on mortgage data from LPS Applied Analytics and rent data from the Commerce Department.For the borrowers in default, many are probably unemployed or facing other serious financial issues. If they weren’t living “rent free”, they’d probably move in with friends or relatives, or even live in their cars or worse. So the "free" housing service they are currently receiving will probably be replaced with another low cost housing alternative. And if even if they move into an apartment, they will probably still be spending the same amount (just on different items). So for many people in this situation, I don't think there is really much "stealth stimulus".

Music: Quantitative Easin'

by Calculated Risk on 10/31/2010 05:45:00 PM

Earlier posts:

For your enjoyment, from singer Curtis Threadneedle (in the style of Barry White), a song co-written by Curtis Threadneedle and Merle Hazard, and produced by Merle Hazard.

Schedule for Week of Oct 31st

by Calculated Risk on 10/31/2010 01:14:00 PM

The previous post is the Summary for Week ending Oct 30th.

The highly anticipated second round of Federal Reserve quantitative easing (QE2) will be announced on Wednesday at 2:15 PM (when the FOMC statement is released). The key economic release this week is the October employment report on Friday.

8:30 AM: Personal Income and Outlays for September. The consensus is for a 0.3% increase in personal income and a 0.4% increase in personal spending, and for the Core PCE price index to increase 0.1%.

10:00 AM: ISM Manufacturing Index for October. The consensus is for 54.5 or about the same as the 54.4 in September.

10:00 AM: Construction Spending for September. The consensus is for a 0.5% decline in construction spending.

10:00 AM: Q3 Housing Vacancies and Homeownership from the Census Bureau. In Q2 2010, this report indicated that the homeownership rate fell to the lowest level since 1999 (66.9% in Q2 2010). The homeowner and rental vacancy rates provide a hint at the number of excess housing units (Note: this data is based on limited surveys and an estimate of the housing inventory).

Expected: October Personal Bankruptcy Filings

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for +20,000 payroll jobs in October - still weak, but an improvement over the 39,000 jobs reported lost in September.

All day: Light vehicle sales for October. Light vehicle sales are expected to increase in October to around 12.0 million (Seasonally Adjusted Annual Rate), from 11.76 million in September. If correct, this will be highest sales rate in 2 years (excluding Cash-for-clunkers in August 2009).

10:00 AM: Manufacturers' Shipments, Inventories and Orders for September. The consensus is for a 1.8% increase in orders. Also important will be the growth in inventories, and the inventory-to-sales ratio.

10:00 AM: ISM non-Manufacturing Index for October. The consensus is for an increase to 54.0 from 53.2 in September.

2:15 PM: FOMC statement released. The key will be how the FOMC will implement the 2nd round of quantitative easing.

8:30 AM: The initial weekly unemployment claims report will be released. Consensus is for about an increase to 445,000 from 434,000 last week.

8:30 AM: Productivity and Costs for Q3 (Preliminary). The consensus is for a 0.2% increase in unit labor costs.

8:30 AM: Employment Report for October. The consensus is an increase of 60,000 payroll jobs in October, and for the unemployment rate to stay steady at 9.6%.

10:00 AM: Pending Home Sales Index for September. The consensus is for a 3% increase in contracts signed. It usually takes 45 to 60 days to close, so this will provide an early indication of closings in November.

3:00 PM: Consumer Credit for September. The consensus is for another $3 billion decline in consumer credit.

After 4:00 PM: The FDIC will probably have another busy Friday afternoon ...

Note: The Atlanta Fed will host a conference at Jekyll Island, Georgia on November 5th and 6th: The Origins, History, and Future of the Federal Reserve. On Saturday there will be a discussion of "the overvaluation of assets such as land" and the "appropriate policy responses". Also Fed Chairman Ben Bernanke and previous Fed Chairman Alan Greenspan are scheduled to participate on a panel "on the purpose, structure, and functions of the Federal Reserve System".

Summary for Week ending Oct 30th

by Calculated Risk on 10/31/2010 08:30:00 AM

A summary of last week - mostly in graphs. The key reports last week were the Q3 Advance GDP report, and several housing reports (New home sales, existing home sales, and house prices).

The the National Association of Realtors:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September 2010 (4.53 million SAAR) were 10% higher than last month, and were 19.1% lower than September 2009 (5.6 million SAAR).

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Although inventory decreased slightly from August 2010 to September 2010, inventory increased 8.9% YoY in September. This is the largest YoY increase in inventory since early 2008.

Although inventory decreased slightly from August 2010 to September 2010, inventory increased 8.9% YoY in September. This is the largest YoY increase in inventory since early 2008.The year-over-year increase in inventory is very bad news because the reported inventory is already historically very high (around 4 million), and the 10.7 months of supply in September is far above normal.

The bottom line: Sales were weak in September - almost exactly at the levels I expected - and will continue to be weak for some time. Inventory is very high - and the significant year-over-year increase in inventory is very concerning. The high level of inventory and months-of-supply will put downward pressure on house prices.

The Census Bureau reported New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 307 thousand. This is slightly higher than in August (288 thousand SAAR).

The Census Bureau reported New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 307 thousand. This is slightly higher than in August (288 thousand SAAR).This graph shows New Home Sales vs. recessions for the last 47 years. The dashed line is the current sales rate.

And another long term graph - this one for New Home Months of Supply.

Months of supply decreased to 8.0 in September from 8.6 in August. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).

Months of supply decreased to 8.0 in September from 8.6 in August. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).The 307 thousand annual sales rate for September is just above the all time record low in May (282 thousand). This was the weakest September on record.

New home sales are important for the economy and jobs - and this indicated that residential investment would be a sharp drag on GDP in Q3 (subtracted 0.8 percentage points in Q3).

S&P/Case-Shiller released the monthly Home Price Indices for August (actually a 3 month average of June, July and August).

This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).The Composite 10 index is off 29.2% from the peak, and down 0.2% in August(SA).

The Composite 20 index is off 28.8% from the peak, and down 0.3% in August (SA).

The next graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in only 1 of the 20 Case-Shiller cities in August seasonally adjusted. Only New York saw a price increase (SA) in August, and that was very small.

Prices increased (SA) in only 1 of the 20 Case-Shiller cities in August seasonally adjusted. Only New York saw a price increase (SA) in August, and that was very small. Prices in Las Vegas are off 57.5% from the peak, and prices in Dallas only off 6.9% from the peak.

Prices are now falling - and falling just about everywhere. And it appears there are more price declines coming (based on inventory levels and anecdotal reports).

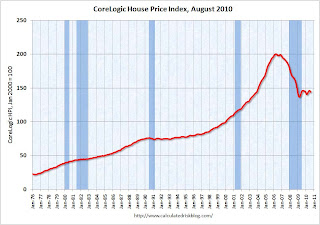

The CoreLogic HPI is a three month weighted average of June, July and August, and is not seasonally adjusted (NSA).

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index is down 1.5% over the last year, and off 28.2% from the peak.

The index is 5.4% above the low set in March 2009, and I expect to see a new post-bubble low for this index later this year or early in 2011. Prices are falling in most areas now (unusually for the summer months).

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.0 percent in the third quarter of 2010, (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the median growth rate of 3.05%. The current recovery is very weak as the 2nd half slowdown continues.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the median growth rate of 3.05%. The current recovery is very weak as the 2nd half slowdown continues.A key number:

Without the boost in inventories, GDP would have been barely positive in Q3.

Overall this was a weak report and will not derail QE2 next wednesday (further easing from the Fed).

The following graph compares the regional Fed surveys with the ISM manufacturing survey, including the Kansas City survey released this morning:

For this graph I averaged the New York and Philly Fed surveys (dashed green, through October), and averaged five Fed surveys (blue) including New York, Philly, Richmond, Dallas and Kansas City.

For this graph I averaged the New York and Philly Fed surveys (dashed green, through October), and averaged five Fed surveys (blue) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

Although the internals were mixed in the regional Fed surveys, this graph suggests the ISM index will still show expansion in October. The ISM Manufacturing index will be released on Monday November 1st.

Best wishes to all.