by Calculated Risk on 11/02/2010 09:14:00 AM

Tuesday, November 02, 2010

Wilmington Trust: A warning of more CRE Construction Losses coming?

Yesterday M&T Bank bought Wilmington Trust. From the WSJ: A Fire Sale in Wilmington

Wilmington announced that M&T Bank would buy it, in an all-stock deal, for about $3.84 a share, compared with Friday's $7.11 close. Wilmington did so while releasing results that showed third-quarter, tangible book value dropped to $3.84 compared with $7.92 in the second quarter. ... Most striking is the speed of the deterioration in the loan book.

Click on graph for larger image in new window.

This table is from the Wilmington Trust press release yesterday. It shows that commercial real estate - construction nonperforming assets jumped from $240.7 million at the end of Q2 to $461.9 million at the end of Q3. Quite a jump ...

Here is the M&T Bank presentation too.

And from the conference call:

CEO: “Credit quality clearly remains the big story. So, let me say a few more things on that subject. The negative effects of the protracted recessionary environment in Delaware, and how these pressures are challenging the financial health of many of our borrowers, simply cannot be over stated. In the third quarter, evidence mounted that had things were getting worse for some of our borrowers. And even some of our strongest clients began to feel the pressure. The financial conditions of more of our borrowers weakened, their cash flows tightened, and appraisals continued to show significant declines in collateral valuations. These issues manifested themselves in our credit metrics, to a significantly greater degree than in the second quarter.So much for extend and hope ... and it sounds like this merger might have been driven by a regulatory review:

By the end of the third quarter, we had evaluated more than 92% of our Commercial Real Estate/Construction and mortgage loans, and the trend line is not encouraging. It appears to us, that there is no significant economic or real estate recovery on the horizon. This gives us little assurance that our loan portfolio will strengthen significantly in the near term, and our capital position will not erode further.”

Analyst: Don, the Company obviously had credit issues, but the decline in TC, book value, etc., the magnitude of increase of non-performers still was pretty surprising. Can you talk at all about whether or not a specific event drove this quarter's results? Was there a regulatory exam, if not, what changed so dramatically in the last 90 days?Sounds like a possible push from the regulators. I wonder how many other regional banks have similar issues?

Wilmington Trust, CEO: Well, what we saw an acceleration in the deterioration of the credit quality of many of our customers over this quarter. We receive a lot in terms of the appraisal information that we gathered. all indicating that both the magnitude and velocity of this credit deterioration was -- was very significant for us.

Analyst: When was your last exam?

Wilmington Trust CEO: We are -- our soundness exam started some time at the end of June, beginning of July. And we are still going through the exit process at this point.

Monday, November 01, 2010

Borrowing costs for Ireland and Portugal increase sharply

by Calculated Risk on 11/01/2010 09:12:00 PM

From the Financial Times: Debt costs jump for Dublin and Lisbon(ht Nemo)

Borrowing costs for Ireland and Portugal shot up as investors took fright at European proposals to force them to take a greater share of losses in future state bail-outs. ... The moves ... follow agreement at last week’s European Union summit on a Franco-German proposal on a mechanism to resolve future Greek-style sovereign debt crises.The yield on the Ireland 10-year bonds jumped to 7.1%, and the spread to the German 10-year bonds is at 462 bps - both are new highs. The yield on the Portugal 10-year bonds increased to 6.1%, and Greece 10-year bonds are now yielding 10.7%.

excerpt with permission

Real Estate Brokers' Commissions Lowest since 1982 as Percent of GDP

by Calculated Risk on 11/01/2010 05:45:00 PM

More from the Q3 2010 GDP underlying detail tables ...

Note: Residential investment (RI), according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $146.6 billion Seasonally Adjusted Annual Rate (SAAR) in Q3 (1.0% of GDP), significantly above the level of investment in single family structures of $110.0 billion SAAR, or 0.75% of GDP.

Brokers' commissions also declined sharply in Q3 as the number of existing homes sold fell off a cliff in Q3. This has pushed brokers' commissions (0.33% of GDP), to the lowest level since 1982, as a percent of GDP.

Brokers' commissions peaked at 0.91% of GDP in Q3 2005. In nominal terms, commissions have declined from an annual peak rate of $116.5 billion in Q3 2005, to an annual rate of $48.2 billion in Q3 2010 - a decline of over 58%.

And investment in multifamily structures - already at a series low as a percent of GDP (since 1959) - declined further in Q3. This might be the low for multifamily structures since multifamily starts increased in recent months.

NMHC Quarterly Apartment Survey: Market Conditions Tighten

by Calculated Risk on 11/01/2010 03:29:00 PM

From the National Multi Housing Council (NMHC): Across-the-Board Improvement in the Apartment Industry, According to NMHC Quarterly Survey of Apartment Market Conditions

The Market Tightness Index, which measures changes in occupancy rates and/or rents, decreased from 83 to 77, but remained well above the “break-even” mark of 50. Sixty percent of respondents said markets were tighter, meaning lower vacancies and/or higher rents.

...

“While demand for apartment residences and apartment properties is still below the peak levels seen in the last decade, the further shift from owning to renting may well add to apartment demand in the near-term, while population growth and a rebound in household formation should strengthen demand over the longer term. But at some point, economic growth will have to shift into a higher gear for the apartment industry to see conditions continue to register improvements of this level.” [said NMHC Chief Economist Mark Obrinsky]

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

The index has indicated tighter market conditions for the last three quarters (from very weak conditions).

A reading above 50 suggests the vacancy rate is falling. Based on limited historical data, I think this index will lead reported apartment rents by about 6 months to 1 year.

This fits with the recent Reis data showing apartment vacancy rates fell in Q3 to 7.2% from 7.8% in Q2.

Also this data is a survey of large apartment owners only. The data released in late July from the Census Bureau showed the rental vacancy rate was steady in Q2 for all rental units in all areas. The Census Bureau will release the Q3 vacancy rates tomorrow, along with the homeownership rate.

A final note: The results of this survey suggest the rental market might have bottomed. I heard from a few sources that effective rents increased slightly over the first half of 2010 at some large apartment complexes. Just something to be aware of ... (I've posted about this before).

Q3: Office, Mall and Lodging Investment

by Calculated Risk on 11/01/2010 01:05:00 PM

First - the advance Q3 GDP report released last Friday showed an annualized real increase of 3.9% for investment in non-residential structures. This broke a streak of eight straight quarterly declines. However the construction spending report released this morning suggests that most (probably all) of this gain will be revised away.

Second - with the release of underlying detail data today - we can see that most of the reported small gains for non-residential structure investment in Q3 were for power and petroleum mining structures.

If we look at just office, mall and lodging investment, non-residential structure investment continued to decline in Q3.

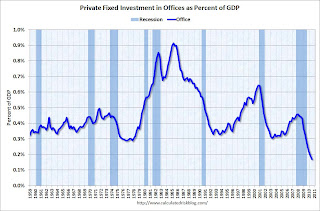

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in offices as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and has declined sharply to a new series low as a percent of GDP (data series starts in 1959).

Reis reported that the office vacancy rate is at a 17 year high at 17.5% in Q3, up from 17.4% in Q2, and 16.6% in Q3 2009. With the office vacancy rate still rising, office investment will probably decline further - although most of the decline in investment has already happened.

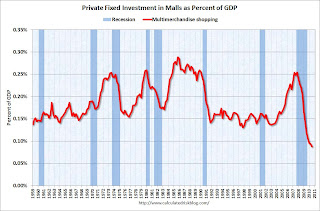

The second graph is for investment in malls.

The second graph is for investment in malls.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen by two-thirds (note that investment includes remodels, so this will not fall to zero). Mall investment is also at a series low (as a percent of GDP).

Reis reported that the mall vacancy rate declined slightly in Q3 2010 from the record high in Q2. However the vacancy rate will have to decline substantially before there is significant new investment.

The third graph is for lodging (hotels).

The third graph is for lodging (hotels).

The bubble boom in lodging investment was stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by over 70% already.

As projects are completed there will be little new investment in these categories for some time.

Also notice that investment for all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly (flat as a percent of GDP for 2 or 3 years). Something similar will probably happen again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

Private Construction Spending Flat in September: July and August Revised Down

by Calculated Risk on 11/01/2010 10:53:00 AM

The Census Bureau reported overall construction spending increased in September compared to August.

[C]onstruction spending during September 2010 was estimated at a seasonally adjusted annual rate of $801.7 billion, 0.5 percent (±1.9%)* above the revised August estimate of $797.5 billion.However private construction spending was about the same as the downwardly revised August rate:

Spending on private construction was at a seasonally adjusted annual rate of $482.0 billion, nearly the same as (±1.1%)* the revised August estimate of $481.9 billion. [revised down from $498.2 billion]

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 65.7% below the peak early 2006, and non-residential spending is 39.5% from the peak in January 2008.

The downward revisions to construction spending in July and August were significant.

These downward revisions will negatively impact Q3 GDP for both residential investment, and non-residential investment in structures.