by Calculated Risk on 11/03/2010 07:32:00 AM

Wednesday, November 03, 2010

MBA: Mortgage Purchase Applications Increase slightly last week

The MBA reports: Mortgage Purchase Applications Increase, while Refinance Applications Decline in Latest MBA Weekly Survey

The Refinance Index decreased 6.4 percent from the previous week. This is the third straight week the Refinance Index has decreased. The seasonally adjusted Purchase Index increased 1.4 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.28 percent from 4.25 percent, with points increasing to 1.07 from 1.00 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index decreased 2.7% last week, and is about 30% below the levels of April 2010. This suggests existing home sales will remain weak through the end of the year.

Tuesday, November 02, 2010

Wednesday: More than just QE2

by Calculated Risk on 11/02/2010 11:59:00 PM

Just a preview - tomorrow will be busy ...

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for +20,000 payroll jobs in October - still weak, but an improvement over the 39,000 jobs reported lost in September.

All day: Light vehicle sales for October. Light vehicle sales are expected to increase in October to around 12.0 million (Seasonally Adjusted Annual Rate), from 11.76 million in September. If correct, this will be highest sales rate in 2 years (excluding Cash-for-clunkers in August 2009).

10:00 AM: Manufacturers' Shipments, Inventories and Orders for September. The consensus is for a 1.8% increase in orders. Also important will be the growth in inventories, and the inventory-to-sales ratio.

10:00 AM: ISM non-Manufacturing Index for October. The consensus is for an increase to 54.0 from 53.2 in September.

2:15 PM: FOMC statement released. The key will be how the FOMC will implement the 2nd round of quantitative easing.

New Feature: CR Graph Galleries

by Calculated Risk on 11/02/2010 06:54:00 PM

To make it easier to review the most recent version of frequently updated graphs, I've created a set of graph galleries (thanks to Ken!).

The Graph Galleries are grouped by Employment, New Home Sales, and much more. There are tabs for each gallery.

Clicking on a tab will load a gallery. Then thumbnails will appear below the main graph for all of the graphs in the selected gallery. Clicking on the thumbnails will display each graph.

The title below each large image is a link to the related blog post on Calculated Risk (I'll put the date in the title to show the most recent update).

To access the galleries, just click on a graph on the blog - or click on "Graph Galleries" in the menu bar above.

As an example, clicking on this graph (based on the most recent employment report), will open the "employment" chart gallery and display this graph - with thumbnails for other employment related graphs.

As an example, clicking on this graph (based on the most recent employment report), will open the "employment" chart gallery and display this graph - with thumbnails for other employment related graphs.

The "print" key displays the full size image of the selected graph for printing from your browser.

Note: The graphs are free to use on websites or for presentations. All I ask is that online sites link to my site http://www.calculatedriskblog.com/ (or to the graphics gallery), and that printed presentations credit www.calculatedriskblog.com.

Enjoy. Best to all.

It's the economy ...

by Calculated Risk on 11/02/2010 04:46:00 PM

Since apparently there is an election today, here is a reminder from Sandhya Somashekhar at the WaPo of the key issue: Economic worries overshadow other issues

[O]ne issue is [in voters'] minds like no other this year: the economy. Nearly 40 percent of voters in a recent Washington Post poll rated the nation's fiscal[CR Note: they meant "economic"] situation as their top concern in the days leading to the election ...Yes - as always - it's the economy.

The good news is the robo-calls and election ads will stop.

LPS: Over 4.3 million loans 90+ days or in foreclosure

by Calculated Risk on 11/02/2010 12:35:00 PM

LPS Applied Analytics released their September Mortgage Performance data today. According to LPS:

• The average number of days delinquent for loans in foreclosure is now 484 days

• In five judicial states (NY, FL, NJ, HI and ME), the average exceeds 500 days

• Over 4.3 million loans are 90 days or more delinquent or in foreclosure

• New problem loans (60+ days delinquent) are back on the rise

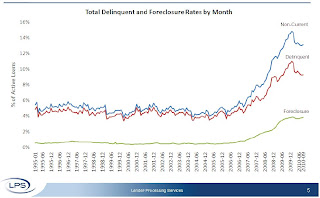

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.

According to LPS, 9.27 percent of mortgages are delinquent, and another 3.84 are in the foreclosure process for a total of 13.11 percent. It breaks down as:

• 2.64 million loans less than 90 days delinquent.

• 2.32 million loans 90+ days delinquent.

• 2.05 million loans in foreclosure process.

For a total of 7.02 million loans delinquent or in foreclosure.

This is similar to the quarterly data from the Mortgage Bankers Association.

Q3 2010: Homeownership Rate at 1999 Levels

by Calculated Risk on 11/02/2010 10:00:00 AM

The Census Bureau reported the homeownership and vacancy rates for Q3 2010 this morning.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate was at 66.9%, the same level as in Q2. This is at about the level of early 1999.

Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. The increase due to demographics (older population) will probably stick, so I've been expecting the rate to decline to around 66%, and probably not all the way back to 64% to 65%. I'll revisit this soon - and the impact on the homebuilders.

The homeowner vacancy rate was at 2.5% in Q3 2010. This is the same level as in Q2, and below the of 2.9% in 2008.

The homeowner vacancy rate was at 2.5% in Q3 2010. This is the same level as in Q2, and below the of 2.9% in 2008.

A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.8% above normal. This data is not perfect, but based on the approximately 75 million homeowner occupied homes, we can estimate that there are close to 600 thousand excess vacant homes.

The rental vacancy rate declined to 10.3% in Q3 2010 from 10.6% in Q2.

This decline fits with the Reis apartment vacancy data and the NMHC apartment survey. This report is nationwide and includes homes for rent.

This decline fits with the Reis apartment vacancy data and the NMHC apartment survey. This report is nationwide and includes homes for rent.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 41 million rental units in the U.S. If the rental vacancy rate declined from 10.3% to 8%, then 2.3% X 41 million units or about 950 thousand excess units would have to be absorbed.

This suggests there are still about 1.55 million excess housing units. These excess units will keep pressure on housing starts, rents and house prices for some time.

NOTE: The graphs in this post link to a new Gallery graphics tool (Thanks Ken!). This CR Gallery is a collection of current graphs from the blog. There are tabs for several categories: Employment, New home Sales, etc.

Click on a tab, and a gallery is loaded. Then thumbnails appear below the main graph for all of the graphs in the selected gallery. Click on the thumbnails to view each graph. The title below each large image is a link to the related blog post on Calculated Risk (or click on the main image to view the blog post).

The "print" key displays the full size image of the selected graph for printing from your browser. Enjoy!