by Calculated Risk on 11/03/2010 05:40:00 PM

Wednesday, November 03, 2010

Comments on FOMC statement

A few comments ...

U.S. Light Vehicle Sales 12.26 million SAAR in October

by Calculated Risk on 11/03/2010 03:29:00 PM

Note: I'll posts some comments on the FOMC statement later today.

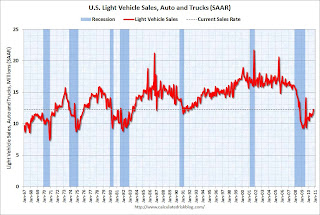

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.26 million SAAR in October. That is up 17.9% from October 2009, and up 4.7% from the September 2010 sales rate.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 12.26 million SAAR from Autodata Corp).

This is the highest sales rate since September 2008, excluding Cash-for-clunkers in August 2009.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate. The current sales rate is still near the bottom of the '90/'91 recession - when there were fewer registered drivers and a smaller population.

This was above most forecasts of around 12.0 million SAAR.

FOMC Statement: QE2 Arrives, $600 Billion by end of Q2 2011

by Calculated Risk on 11/03/2010 02:15:00 PM

I'll have more later ...

Update: from the NY Fed: Statement Regarding Purchases of Treasury Securities. About 86% of the purchases will be in the 2.5 to 10 year Maturity range.

The FOMC also directed the Desk to continue to reinvest principal payments from agency debt and agency mortgage-backed securities into longer-term Treasury securities. Based on current estimates, the Desk expects to reinvest $250 billion to $300 billions over the same period, though the realized amount of reinvestment will depend on the evolution of actual principal payments.From the Federal Reserve's Federal Open Market Committee:

Taken together, the Desk anticipates conducting $850 billion to $900 billion of purchases of longer-term Treasury securities through the end of the second quarter. This would result in an average purchase pace of roughly $110 billion per month, representing about $75 billion per month associated with additional purchases and roughly $35 billion per month associated with reinvestment purchases.

...

To provide operational flexibility and to ensure that it is able to purchase the most attractive securities on a relative-value basis, the Desk is temporarily relaxing the 35 percent per-issue limit on SOMA holdings under which it has been operating. However, SOMA holdings of an individual security will be allowed to rise above the 35 percent threshold only in modest increments.

Information received since the Federal Open Market Committee met in September confirms that the pace of recovery in output and employment continues to be slow. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising, though less rapidly than earlier in the year, while investment in nonresidential structures continues to be weak. Employers remain reluctant to add to payrolls. Housing starts continue to be depressed. Longer-term inflation expectations have remained stable, but measures of underlying inflation have trended lower in recent quarters.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Currently, the unemployment rate is elevated, and measures of underlying inflation are somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate. Although the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, progress toward its objectives has been disappointingly slow.

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to expand its holdings of securities. The Committee will maintain its existing policy of reinvesting principal payments from its securities holdings. In addition, the Committee intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month. The Committee will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to support the economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Sandra Pianalto; Sarah Bloom Raskin; Eric S. Rosengren; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

Voting against the policy was Thomas M. Hoenig. Mr. Hoenig believed the risks of additional securities purchases outweighed the benefits. Mr. Hoenig also was concerned that this continued high level of monetary accommodation increased the risks of future financial imbalances and, over time, would cause an increase in long-term inflation expectations that could destabilize the economy.

General Motors: October U.S. sales increase year-over-year

by Calculated Risk on 11/03/2010 11:12:00 AM

Note: The real key is the seasonally adjusted annual sales rate (SAAR) compared to the last few months, not the year-over-year comparison provided by the automakers.

From MarketWatch: GM reports 3.5% rise in Oct. U.S. car sales

[GM] sold 183,759 cars and trucks, up from 177,603 a year ago.This is not adjusted for selling days, and there was one more selling day in October 2009 than in October 2010.

Once all the reports are released, I'll post a graph of the estimated total October light vehicle sales (SAAR) - usually around 4 PM ET. Most estimates are for an increase to 12.0 million SAAR in October from the 11.71 million SAAR in September.

I'll add reports from the other major auto companies as updates to this post.

Update: from MarketWatch: Ford U.S. October sales rise 19.2% to 157,935

From MarketWatch: Chrysler October U.S. sales jump 37%

Chrysler ... reported a 37% jump in October U.S. auto sales to 90,137 vehicles, up from 65,803 a year ago.From MarketWatch: Toyota U.S. October sales decline 4.4%

ISM non-Manufacturing Index increases in October

by Calculated Risk on 11/03/2010 10:00:00 AM

The October ISM Non-manufacturing index was at 54.3%, up from 53.2% in September - and above expectations of 54.0%. The employment index showed expansion in October at 50.9%, up from 50.2% in September. Note: Above 50 indicates expansion, below 50 contraction.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

From the Institute for Supply Management: October 2010 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in October for the 10th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.Slightly better than expected.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president — supply management for Hilton Worldwide. "The NMI (Non-Manufacturing Index) registered 54.3 percent in October, 1.1 percentage points higher than the 53.2 percent registered in September, and indicating continued growth in the non-manufacturing sector at a slightly faster rate. The Non-Manufacturing Business Activity Index increased 5.6 percentage points to 58.4 percent, reflecting growth for the 11th consecutive month at a substantially faster rate than in September. The New Orders Index increased 1.8 percentage points to 56.7 percent, and the Employment Index increased 0.7 percentage point to 50.9 percent, indicating growth in employment for the second consecutive month and the fourth time in the last six months.

emphasis added

ADP: Private Employment increases by 43,000 in October

by Calculated Risk on 11/03/2010 08:15:00 AM

ADP reports:

Private-sector employment increased by 43,000 from September to October on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from August to September was revised up from the previously reported decline of 39,000 to a smaller decline of 2,000.Note: ADP is private nonfarm employment only (no government jobs).

Since employment began rising in February, the monthly gain has averaged 34,000 with a range of -2,000 to +65,000 during the period. October’s figure is within this recent range and is consistent with the deceleration of economic growth that occurred in the spring. Employment gains of this magnitude are not sufficient to lower the unemployment rate.

The consensus was for ADP to show an increase of about 20,000 private sector jobs in October, so this was above consensus.

The BLS reports on Friday, and the consensus a 60,000 increase in payroll jobs in October, on a seasonally adjusted (SA) basis and for the unemployment rate to stay steady at 9.6%.