by Calculated Risk on 11/07/2010 08:30:00 AM

Sunday, November 07, 2010

Summary for Week ending Nov 6th

A summary of last week - mostly in graphs. NOTE: The graphs in this summary post link to a new Gallery graphics tool (Thanks Ken!). This Gallery is a collection of current graphs from the blog. There are tabs for several categories: Employment, New home Sales, etc. Enjoy!

Statement from the Federal Reserve's Federal Open Market Committee

Details from the NY Fed: Statement Regarding Purchases of Treasury Securities

Fed Chairman Ben Bernanke in the WaPo: What the Fed did and why: supporting the recovery and sustaining price stability

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA increased by 24% at the end of Q3 2010 compared to Q2 2010. The REO inventory increased 92% compared to Q3 2009 (year-over-year comparison).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2010.

The REO inventory for the "Fs" has increased sharply over the last year, from 153,007 at the end of Q3 2009 to a record 293,171 at the end of Q3 2010.

This is just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs. The REO inventory will probably increase sharply in Q4 too.

From the BLS:

Nonfarm payroll employment increased by 151,000 in October, and the unemployment rate was unchanged at 9.6 percent, the U.S. Bureau of Labor Statistics reported today.Both August and September payroll employment were revised up.

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at the bottom of the recession (Both the 1991 and 2001 recessions were flat at the bottom, so the choice was a little arbitrary).

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at the bottom of the recession (Both the 1991 and 2001 recessions were flat at the bottom, so the choice was a little arbitrary).The dotted line shows payroll employment excluding temporary Census workers.

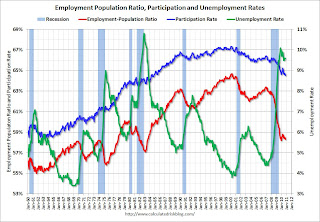

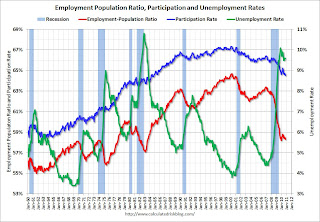

This graph shows the employment-population ratio, and the partcipation and unemployment rates. The unemployment rate has been stuck at 9.6% for three straight months.

This graph shows the employment-population ratio, and the partcipation and unemployment rates. The unemployment rate has been stuck at 9.6% for three straight months.The Employment-Population ratio declined to 58.3% in October from 58.5% in September. This is disappointing news.

Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate also declined to 64.5% in October from 64.7% in September. This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined to 9.154 million in October, from the record 9.472 million in September. This is still very high.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined to 9.154 million in October, from the record 9.472 million in September. This is still very high.These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 17.0% in October from 17.1% in September. The high for U-6 was 17.4% in October 2009. Still grim.

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.206 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 6.123 million in September. It appears the number of long term unemployed has peaked ... although this may be because people are giving up.

The underlying details of the employment report were mixed. The positive included the 151,000 payroll jobs added, the upward revisions to August and September, a slight uptick in hours worked and average hourly earnings, and a slight decline in part time workers (and slight decline in U-6 unemployment).

The negatives include the declines in the employment-population ratio and the participation rate, the increase in workers unemployed for over 26 weeks, and the unemployment rate still flat at a very high level. This report was a clear improvement from the previous four months, but this was still a fairly soft report.

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.26 million SAAR in October. That is up 17.9% from October 2009, and up 4.7% from the September 2010 sales rate.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 12.26 million SAAR from Autodata Corp).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 12.26 million SAAR from Autodata Corp).This is the highest sales rate since September 2008, excluding Cash-for-clunkers in August 2009.

This was above most forecasts of around 12.0 million SAAR.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.The October ISM Non-manufacturing index was at 54.3%, up from 53.2% in September - and above expectations of 54.0%. The employment index showed expansion in October at 50.9%, up from 50.2% in September. Note: Above 50 indicates expansion, below 50 contraction.

The Census Bureau reported the homeownership and vacancy rates for Q3 2010 this week.

The Census Bureau reported the homeownership and vacancy rates for Q3 2010 this week. The homeownership rate was at 66.9%, the same level as in Q2. This is at about the level of early 1999.

Note: graph starts at 60% to better show the change.

The homeowner vacancy rate was at 2.5% in Q3 2010. This is the same level as in Q2, and below the of 2.9% in 2008. The rental vacancy rate declined to 10.3% in Q3 2010 from 10.6% in Q2.

Best wishes to all.

Saturday, November 06, 2010

Ireland Update

by Calculated Risk on 11/06/2010 09:19:00 PM

Just an update from the Irish Times: Interest rate on bonds falls slightly

IRELAND MANAGED to break an eight-day losing streak on international bond markets yesterday ... Sovereign bond yields ... remained near record highs for much of the day but finished a little lower at 7.623 per cent.The Greece 10 year yield was up to 11.46%, and the Portugal 10 year yield fell slightly to 6.51%.

...

However, the spread ... on 10-year money reached 5.34 per cent yesterday, the most since Bloomberg began collecting the data in 1991, before narrowing to 5.2 per cent.

Just something to watch ... best wishes to all

Employment: Participation Rate

by Calculated Risk on 11/06/2010 02:15:00 PM

The following graph shows the employment population ratio, the participation rate, and the unemployment rate (ht Dirk).

Click on graph for larger image.

Click on graph for larger image.

Most of the increase in the participation rate in the '60 and '70s was from women joining the labor force. However one of the key features of the current employment recession is the decline in the participation rate.

The sharplest declines in the participation rate are for the "16 to 19" and the "20 to 24" age groups.

The partcipation rate for the "16 to 19" group has fallen from 41.4% in Dec 2007 to 35.2% in Oct 2010.

The participation rate for the "20 to 24" group has fallen from 74.0% to 71.4% in the same period.

The participation rate for the "55 and over" group has increased from 38.9% to 40.0% since December 2007. Of course the size of the "55 and over" group is increasing, and that might be pushing down the overall participation rate. I'll have more on this later this week.

And a repeat of a popular graph ...

And a repeat of a popular graph ...

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The dotted line is ex-Census hiring. The two lines have joined since the decennial Census is over.

Best to all

Live Webcast 10:45 AM ET: Bernanke at Jekyll Island

by Calculated Risk on 11/06/2010 10:30:00 AM

From the Atlanta Fed, here is a live webcast from Jekyll Island (Saturday 10:45AM ET).

Panelists will share personal insights and perspectives on the purpose, structure, and functions of the Federal Reserve System.

Panelist: Ben Bernanke, Chairman, Board of Governors of the Federal Reserve System

Panelist: Alan Greenspan, Former Chairman, Board of Governors of the Federal Reserve System

Panelist: Gerald Corrigan, Managing Director, Goldman Sachs, and Former President, Federal Reserve Bank of New York

Moderator: Raghuram Rajan, Professor of Finance, University of Chicago

Posts yesterday (Graphics Gallery, Employment report, Record Fannie, Freddie, FHA REO):

Unofficial Problem Bank list at 894 Institutions

by Calculated Risk on 11/06/2010 09:08:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 5, 2010.

Changes and comments from surferdude808:

The number of institutions on the Unofficial Problem Bank List remained unchanged this week at 894 as there were four additions and four removals. However, aggregate assets increased to $416.5 billion from $410.7 billion.As always, thanks to surferdude808 for compiling this list!

Removals this week are the failures that include K Bank, Randallstown, MD ($592 million); Pierce Commercial Bank, Tacoma, WA ($242 million); Western Commercial Bank, Woodland, CA ($111 million); and First Vietnamese American Bank, Westminster, CA ($52 million).

Additions this week are Superior Bank, Tampa, FL ($3.4 billion Ticker: SUPR); The Suffolk County National Bank of Riverhead, Riverhead, NY ($1.7 billion Ticker: SUBK); Essex Bank, Tappahannock, VA ($1.2 billion Ticker: BTC); and Community Central Bank, Mount Clemens, MI ($543 million Ticker: CCBD).

Friday, November 05, 2010

Bank Failure #143: First Vietnamese American Bank, Westminster, California

by Calculated Risk on 11/05/2010 09:22:00 PM

There were 140 failures in 2009. This makes 143 and counting in 2010 ...

someday this war's gonna end

today is that day

by Soylent Green is People

From the FDIC: Grandpoint Bank, Los Angeles, California, Assumes All of the Deposits of First Vietnamese American Bank, Westminster, California

As of September 30, 2010, First Vietnamese American Bank had approximately $48.0 million in total assets and $47.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $9.6 million. ... First Vietnamese American Bank is the 143rd FDIC-insured institution to fail in the nation this year, and the twelfth in California.