by Calculated Risk on 11/13/2010 09:59:00 PM

Saturday, November 13, 2010

Labor Force Participation Trends, Over 55 Age Groups

On Thursday I asked: What will happen to the Labor Force Participation Rate?

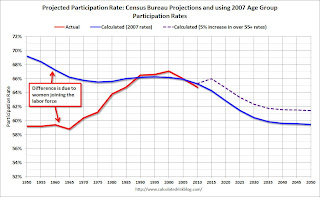

I posted a series of graphs trying to show the trends in participation - and one of the graphs I posted showed two projections for the labor force participation rate through 2050 (using population projections from the Census Bureau). Here is that graph again:

Click on graph for larger image.

Click on graph for larger image.

This graph shows the calculated participation rate (blue) through 2050, and the actual participation rate since 1950 (red). The calculated participation rate, using 2007 data, is far too high for the earlier periods. This is mostly because of women joining the labor force (see the previous post for more on women joining the labor force).

The blue line would indicate the participation rate over the next 40 years if the participation rate per age group stayed static at 2007 levels. The participation rate would be expected to decline as the population ages. This simple analysis suggests the participation rate would be at about the same level in 2015 as today.

I added the dashed purple line to show the impact of a 5 percentage point increase in the 'over 55' labor force participation rate. I pointed out that the participation rate for the 'over 55' age group has been trending up. If the trend continues for the 'over 55' group - perhaps because of necessity, perhaps because of fewer "back breaking" jobs - then the overall participation rate will not fall as quickly as the blue line indicates. With just a 5 percentage point increase in participation for the 'over 55', the participation rate will be back to 66% in 2015.

A couple of readers asked if this was possible? The answer is yes.

The second graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The second graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The participation rate is trending up for all age groups. And another five percentage point increase is very possible over the next 5 to 10 years. After that the 'over 55' participation rate might start to decline as the oldest baby boomers move into the 'over 75' age group.

All of this suggests to me that the participation rate will probably move back towards 66% over the next few years, even with an aging population.

Reports: Ireland bailout talks continue

by Calculated Risk on 11/13/2010 05:30:00 PM

The Financial Times "Eurozone in talks on Ireland bail out" reports that European ministers are currently deliberating whether Ireland needs a bailout before the markets open on Monday. The FT notes that the "the discussions ... are expected to intensify on Sunday".

And from Bloomberg: Ireland Urged to Take Aid by Officials Amid Debt Crisis

Irish Prime Minister Brian Cowen said he is working with fellow European leaders as his nation’s sovereign debt crisis threatens the stability of European markets.Leaders in Ireland want to avoid asking for aid from the IMF or using the EFSF, however other European leaders are apparently pushing Ireland to accept aid to contain the financial turbulence.

While reiterating that his debt-strapped country has not sought to tap an EU rescue fund, Cowen told reporters today that “there are issues affecting the wider euro area of which we are a member” and that he and his counterparts were working to “ensure that the bond markets respond positively to the euro.”

My guess is if Ireland accepts aid, then Ireland's bonds will rally (and the yield will fall sharply) - however this will probably lead to a "buyers strike" for Portugal's bonds. And then Portugal will have to ask for aid. Then Spain and / or Italy would be next in line ... and I think that is the real concern.

Apartment Rents increasing in San Francisco

by Calculated Risk on 11/13/2010 01:43:00 PM

From Robert Selna at the San Francisco Chronicle: San Francisco apartment rents expected to rise

Data from real estate research firm RealFacts show that San Francisco County's average asking rent for buildings of 50 or more units was $2,282 in the third quarter of 2010, only about $120 lower than the same quarter in 2008.This fits with other reports of falling vacancy rates and rents at least stabilizing.

...

Marcus & Millichap, which tracks rents citywide in buildings of 15 units or more, reported that since the start of the year, the average asking rent had increased 1.4 percent to $1,782.

It appears apartment rents have at least stabilized and are probably increasing in many areas - and the vacancy rates are falling. This means we will probably see a slight pickup in multi-family construction in 2011 (from record lows).

Before the housing market can recovery, a large portion of the excess vacant housing supply has to be absorbed. The excess supply includes both rental and owner occupied homes, and the falling apartment vacancy rate is an indicator the excess supply is starting to decline.

Report: Ireland in "technical" discussions on asking for aid

by Calculated Risk on 11/13/2010 09:15:00 AM

The monthly euro finance minister meeting is Tuesday in Brussels. That is probably the next key date ...

A few excerpts from the Irish Times: Government campaigns to avoid EU financial bailout

THE GOVERNMENT is campaigning to avert the threat of being forced to seek emergency fiscal aid from the EU authorities as it battles a drastic loss in investor confidence.

...

Two well-placed sources told The Irish Times, however, that Irish officials have been involved in ‘‘technical’’ discussions about the procedures to be followed in the event of any aid application being made to the European Financial Stability Facility (EFSF).

Friday, November 12, 2010

Unofficial Problem Bank list increases to 898 Institutions

by Calculated Risk on 11/12/2010 11:59:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 12, 2010.

Changes and comments from surferdude808:

Despite failures, the Unofficial Problem Bank List continued its rise to the 900 level. This week the list count finished at 898 after six additions and two removals. Assets total $418.5 billion, up from $416.5 billion last week.

After three down trending weeks in October, some readers wondered if the list had peaked. After this pause, the Unofficial Problem Bank List has added a net 27 institutions and $16.4 billion of assets since October 22nd.

Removals are two of this week’s failures -- Darby Bank & Trust Co., Vidalia, GA ($690 million) and Copper Star Bank, Scottsdale, AZ ($204 million).

Additions include Atlantic Coast Bank, Waycross, GA ($901 million Ticker: ACFC); The Leaders Bank, Oak Brook, IL ($659 million); NewDominion Bank, Charlotte, NC ($535 million); Middlesex Federal Savings, F.A., Somerville, MA ($389 million); Community Bank of Oak Park River Forest, Oak Park, IL ($364 million); and First Federal Savings and Loan Association of Pekin, Pekin, IL ($28 million).

We applaud the Illinois State Banking Department for the timely disclosure of its enforcement actions. Next week, we anticipate the OCC will release its actions for October, which will likely push the list count over 900.

Bank Failure #146: Copper Star Bank, Scottsdale, AZ

by Calculated Risk on 11/12/2010 07:29:00 PM

Fed burnishing to return

Like a bad penny.

by Soylent Green is People

From the FDIC: Stearns Bank National Association, St. Cloud, Minnesota, Assumes All of the Deposits of Copper Star Bank, Scottsdale, Arizona

As of September 30, 2010, Copper Star Bank had approximately $204.0 million in total assets and $190.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $43.6 million. ... Copper Star Bank is the 146th FDIC-insured institution to fail in the nation this year, and the fourth in Arizona.Three down today so far ...