by Calculated Risk on 11/16/2010 11:59:00 PM

Tuesday, November 16, 2010

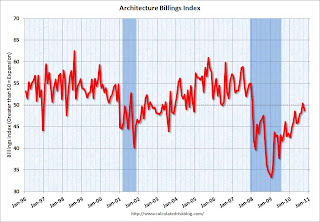

AIA: Architecture Billings Index shows contraction in October

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

Reuters reports that the American Institute of Architects’ Architecture Billings Index decreased to 48.7 in October from 50.4 in September. Any reading below 50 indicates contraction.

The ABI press release is not online yet.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Architecture Billings Index since 1996. The index showed expansion in September (above 50) for the first time since Jan 2008, however the index is indicating contraction again in October.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So there will probably be further declines in CRE investment for the next 9 to 12 months.

Report: European Crisis team heads to Ireland

by Calculated Risk on 11/16/2010 07:45:00 PM

The Financial Times is reporting that a Debt crisis team heads for Dublin. This team includes IMF, European Central Bank, and European Commission officials - personnel from the same agencies who visited Greece right before that bailout. Although this is just a "discussion", the Financial Times suggests this is sign "a bailout for the country’s ailing banks is imminent".

And from the WSJ: Banks' Exposure Stirs EU Contagion Worries

All told, European banks were sitting on more than $650 billion of exposure to Ireland as of March 31, according to the Bank for International Settlements.A bailout of the Irish banks is a bailout of European banks (especially UK and German banks).

By request, here are links to the sovereign debt series from "Some investor guy" posted earlier this year:

DataQuick: SoCal Home Sales off 24.3% from October 2009

by Calculated Risk on 11/16/2010 04:11:00 PM

From DataQuick: Southland Home Sales Fall, Prices Flat

Southern California home sales dropped in October to their lowest level in three years amid doubts about the drawn-out market recovery, tight mortgage lending policies and expired government incentives.In October 2009, existing home sales were boosted by the home buyer tax credit, and the NAR reported sales of 5.98 million on a Seasonally adjusted annual rate (SAAR) basis.

...

A total of 16,744 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 7.4 percent from 18,091 in September, and down 24.3 percent from 22,132 for October 2009, according to MDA DataQuick of San Diego.

...

Foreclosure resales accounted for 34.7 percent of the resale market last month, up from a revised 33.6 percent in September and down from 40.4 percent a year ago.

Sales are down close to 25% year-over-year just about everywhere, and the initial estimate for national sales in October is about 4.5 million SAAR with about 10.4 months-of-supply.

Update on Ireland Bailout Talks

by Calculated Risk on 11/16/2010 12:51:00 PM

Update: The Guardian is providing updates: Ireland's debt crisis - live coverage (ht Tommy)

From the Financial Times: Dublin in talks to resolve crisis

“We are discussing with both the ECB and the IMF and of course the Irish,” Mr [Rehn, the EU’s economic and monetary affairs commissioner] told reporters in Brussels on Tuesday. “The real problems are in the banking sector,” not with the government, “but these are connected”.The WSJ has details of the proposed bailout: U.K. Support Sought for Ireland Bailout

excerpt with permission

A package of aid for Irish banks could be worth €45 billion to €50 billion, while a broader package designed to restore confidence in Ireland's public finances as well could range from €80 billion to €100 billion ... In any deal, the IMF would likely contribute half as much aid as the EU and U.K. combined.And Irish leaders are still saying they have not asked for help, but they are now acknowledging the talks:

“Given the current market conditions, there have been on-going contacts at official level with our international partners,” [Taoiseach Brian Cowen] said.Some reports suggest a tentative deal could be reached very soon (perhaps as early as tomorrow).

...

“This is not an insurmountable challenge and, through working together with our partners in a calm and rational manner, we can resolve these issues and underpin financial stability in the medium and longer term," he said. “It is in all of our interests that we find a credible, efficient and above all workable solution that will provide assurance to the markets and thereby restore confidence and stability."

NAHB Builder Confidence up slightly in November

by Calculated Risk on 11/16/2010 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was at 16 in November. This is a 1 point increase from the revised 15 in October (revised down from 16). This is the highest level since June. The record low was 8 set in January 2009, and 16 is still very low ...

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the September data for starts (October housing starts will be released tomorrow).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

Press release from the NAHB: Builder Confidence Improves Slightly in November

Builder confidence in the market for newly built, single-family homes improved slightly in November, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI rose one notch to 16 from a downwardly revised level of 15 in the previous month.This was slightly below expectations of an increase to 17.

...

Two out of three of the HMI's component indexes registered improvement in November, while the third component held steady. The component gauging sales expectations in the next six months rose two points to 25, the component gauging traffic of prospective buyers rose one point to 12, and the component gauging current sales conditions held unchanged at 16.

Industrial Production, Capacity Utilization Flat in October

by Calculated Risk on 11/16/2010 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production was unchanged in October after having fallen 0.2 percent in September. ... The capacity utilization rate for total industry was flat at 74.8 percent, a rate 6.6 percentage points above the low in June 2009 and 5.8 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 9.7% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 74.8% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production was unchanged in October, and production is still 7.3% below the pre-recession levels at the end of 2007.

This was below consensus expectations of a 0.3% increase in Industrial Production, and an increase to 74.9% for Capacity Utilization.