by Calculated Risk on 11/17/2010 08:30:00 AM

Wednesday, November 17, 2010

Housing Starts decline in October

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 519 thousand (SAAR) in October, down 11.7% from the revised September rate of 588 thousand, and just up 9% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Most of the decline this month was due to multi-family starts (after two strong months).

Single-family starts decreased 1.1% to 436 thousand in October. This is 21% above the record low in January 2009 (360 thousand).

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for almost two years - with a slight up and down over the last six months due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for almost two years - with a slight up and down over the last six months due to the home buyer tax credit.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was below expectations of 590 thousand starts, mostly because of the volatile multi-family starts. Starts will stay low until the excess inventory of existing homes is absorbed.

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 519,000. This is 11.7 percent (±8.6%) below the revised September estimate of 588,000 and is 1.9 percent (±9.6%)* below the October 2009 rate of 529,000.

Single-family housing starts in October were at a rate of 436,000; this is 1.1 percent (±8.6%)* below the revised September figure of 441,000.

Building Permits:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 550,000. This is 0.5 percent (±3.0%)* above the revised September rate of 547,000, but is 4.5 percent (±3.1%) below the October 2009 estimate of 576,000.

Single-family authorizations in October were at a rate of 406,000; this is 1.0 percent (±1.3%)* above the revised September figure of 402,000.

MBA: Mortgage Purchase Activity decreases as mortgage rates increase

by Calculated Risk on 11/17/2010 07:30:00 AM

The MBA reports: Mortgage Applications Decline as Mortgage Rates Jump in Latest MBA Weekly Survey

The Refinance Index decreased 16.5 percent from the previous week and is at the lowest level observed since July of this year. The seasonally adjusted Purchase Index decreased 5.0 percent from one week earlier, the first decrease after three consecutive weekly increases.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.46 percent from 4.28 percent, with points increasing to 1.13 from 1.04 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the highest 30-year fixed-rate observed in the survey since the week ending September 10, 2010.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is about 30% below the levels of April 2010. This suggests existing home sales will remain weak through at least the end of the year.

Tuesday, November 16, 2010

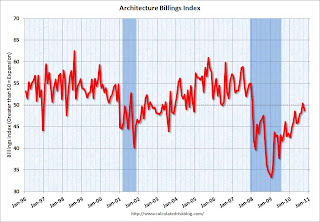

AIA: Architecture Billings Index shows contraction in October

by Calculated Risk on 11/16/2010 11:59:00 PM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

Reuters reports that the American Institute of Architects’ Architecture Billings Index decreased to 48.7 in October from 50.4 in September. Any reading below 50 indicates contraction.

The ABI press release is not online yet.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Architecture Billings Index since 1996. The index showed expansion in September (above 50) for the first time since Jan 2008, however the index is indicating contraction again in October.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So there will probably be further declines in CRE investment for the next 9 to 12 months.

Report: European Crisis team heads to Ireland

by Calculated Risk on 11/16/2010 07:45:00 PM

The Financial Times is reporting that a Debt crisis team heads for Dublin. This team includes IMF, European Central Bank, and European Commission officials - personnel from the same agencies who visited Greece right before that bailout. Although this is just a "discussion", the Financial Times suggests this is sign "a bailout for the country’s ailing banks is imminent".

And from the WSJ: Banks' Exposure Stirs EU Contagion Worries

All told, European banks were sitting on more than $650 billion of exposure to Ireland as of March 31, according to the Bank for International Settlements.A bailout of the Irish banks is a bailout of European banks (especially UK and German banks).

By request, here are links to the sovereign debt series from "Some investor guy" posted earlier this year:

DataQuick: SoCal Home Sales off 24.3% from October 2009

by Calculated Risk on 11/16/2010 04:11:00 PM

From DataQuick: Southland Home Sales Fall, Prices Flat

Southern California home sales dropped in October to their lowest level in three years amid doubts about the drawn-out market recovery, tight mortgage lending policies and expired government incentives.In October 2009, existing home sales were boosted by the home buyer tax credit, and the NAR reported sales of 5.98 million on a Seasonally adjusted annual rate (SAAR) basis.

...

A total of 16,744 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 7.4 percent from 18,091 in September, and down 24.3 percent from 22,132 for October 2009, according to MDA DataQuick of San Diego.

...

Foreclosure resales accounted for 34.7 percent of the resale market last month, up from a revised 33.6 percent in September and down from 40.4 percent a year ago.

Sales are down close to 25% year-over-year just about everywhere, and the initial estimate for national sales in October is about 4.5 million SAAR with about 10.4 months-of-supply.

Update on Ireland Bailout Talks

by Calculated Risk on 11/16/2010 12:51:00 PM

Update: The Guardian is providing updates: Ireland's debt crisis - live coverage (ht Tommy)

From the Financial Times: Dublin in talks to resolve crisis

“We are discussing with both the ECB and the IMF and of course the Irish,” Mr [Rehn, the EU’s economic and monetary affairs commissioner] told reporters in Brussels on Tuesday. “The real problems are in the banking sector,” not with the government, “but these are connected”.The WSJ has details of the proposed bailout: U.K. Support Sought for Ireland Bailout

excerpt with permission

A package of aid for Irish banks could be worth €45 billion to €50 billion, while a broader package designed to restore confidence in Ireland's public finances as well could range from €80 billion to €100 billion ... In any deal, the IMF would likely contribute half as much aid as the EU and U.K. combined.And Irish leaders are still saying they have not asked for help, but they are now acknowledging the talks:

“Given the current market conditions, there have been on-going contacts at official level with our international partners,” [Taoiseach Brian Cowen] said.Some reports suggest a tentative deal could be reached very soon (perhaps as early as tomorrow).

...

“This is not an insurmountable challenge and, through working together with our partners in a calm and rational manner, we can resolve these issues and underpin financial stability in the medium and longer term," he said. “It is in all of our interests that we find a credible, efficient and above all workable solution that will provide assurance to the markets and thereby restore confidence and stability."