by Calculated Risk on 11/19/2010 07:10:00 PM

Friday, November 19, 2010

Bank Failure #149: First Banking Center, Burlington, Wisconsin

Escape velocity near

Warp trajectory

by Soylent Green is People

From the FDIC: First Michigan Bank, Troy, Michigan, Assumes All of the Deposits of First Banking Center, Burlington, Wisconsin

As of September 30, 2010, First Banking Center had approximately $750.7 million in total assets and $664.8 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $142.6 million. Compared to other alternatives, First Michigan Bank's acquisition was the least costly resolution for the FDIC's DIF. First Banking Center is the 149th FDIC-insured institution to fail in the nation this year, and the second in Wisconsin.Three down today with close to $1 billion in assets. A billion here, a billion there ...

Bank Failure #148: Allegiance Bank of North America, Bala Cynwyd, Pennsylvania

by Calculated Risk on 11/19/2010 06:12:00 PM

To perpetual bailout

And justice for none

by Soylent Green is People

From the FDIC: VIST Bank, Wyomissing, Pennsylvania, Assumes All of the Deposits of Allegiance Bank of North America, Bala Cynwyd, Pennsylvania

As of September 30, 2010, Allegiance Bank of North America had approximately $106.6 million in total assets and $92.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $14.2 million. .... Allegiance bank of North America is the 148th FDIC-insured institution to fail in the nation this year, and the first in Pennsylvania.Two down today ...

Bank Failure #147: Gulf State Community Bank, Carrabelle, Florida

by Calculated Risk on 11/19/2010 05:14:00 PM

Note: I started posting bank failures a few years when I was predicting 100s of banks would fail. Since then it has become sort of a Friday afternoon ritual.

Rare Florida solvent bank

So few may exist

by Soylent Green is People

From the FDIC: Centennial Bank, Conway, Arkansas, Assumes All of the Deposits of Gulf State Community Bank, Carrabelle, Florida

As of September 30, 2010, Gulf State Community Bank had approximately $112.1 million in total assets and $112.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $42.7 million. ... Gulf State Community Bank is the 147th FDIC-insured institution to fail in the nation this year, and the 28th in Florida.Another 40% or so loss on assets. Ouch.

Disposition of Canceled HAMP Trial Modifications

by Calculated Risk on 11/19/2010 03:47:00 PM

Treasury released the October HAMP statistics last night.

There is some interesting data on the disposition of canceled HAMP trial modifications. The general view was that a majority of these borrowers would lose their homes in foreclosure or through a short sale. That hasn't happened yet.

The statistics, from the 8 largest servicers (about 80% of HAMP), show that most of these borrowers are in alternative modification programs or have cured the default (current of loan paid off).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the disposition of canceled HAMP trial modifications (in percentages). This represents 552 thousand canceled trial modifications as of September.

Only 3.9% of borrowers have lost their homes in foreclosure, and another 8.5% have lost their homes through a short sale or deed-in-lieu of foreclosure.

About 13% of borrowers are in the foreclosure process, and another 1.9% in bankruptcy.

So what has happened to the borrowers in all of those canceled trials? The largest percentage of borrowers are in alternative modification programs (lender programs). The next largest group is in "action pending". Some have paid off their loans (probably sold their homes), and another 7.7% have managed to become current.

So the number of foreclosures was lower than many expected, although many of the borrowers in the alternative modification programs will probably redefault (and the action pending group might also results in a number of foreclosures). Hopefully HAMP will keep updating this table.

Fed Manufacturing Surveys and ISM Manufacturing Index

by Calculated Risk on 11/19/2010 12:04:00 PM

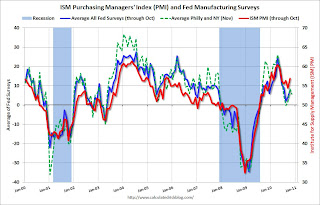

Earlier this week, the NY Fed and the Philly Fed manufacturing surveys were released. The readings couldn't have been more different, with the NY Fed survey showing "conditions deteriorated", and the Philly Fed showing activity improved sharply:

The Empire State Manufacturing Survey indicates that conditions deteriorated in November for New York State manufacturers. For the first time since mid-2009, the general business conditions index fell below zero, declining 27 points to -11.1. The new orders index plummeted 37 points to -24.4, and the shipments index also fell below zero.And the Philly Fed:

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of 1.0 in October to 22.5 in November. This is the highest reading in the index since last December. Indexes for new orders and shipments also improved this month, and each index increased 15 points.Usually these two surveys are fairly consistent, and this is reminder not to make too much of any one data point! Is manufacturing slowing or is activity picking up again? These two surveys provide opposite answers.

The other regional Fed surveys and the ISM manufacturing index will be released over the next two weeks, and hopefully they will provide some clarity.

The following graph compares the regional Fed surveys with the ISM manufacturing index, including the NY Fed and Philly Fed surveys for November. Averaging the NY Fed and Philly Fed survey suggests manufacturing is still expanding, but at a sluggish pace:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The New York and Philly Fed surveys are averaged together (dashed green, through November), and averaged five Fed surveys (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City.

The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM manufacturing index will released on Dec 1st. The Richmond Fed survey will be released on Tuesday Nov 23rd, the Kansas City Fed survey on Wednesday Nov 24th, and the Dallas Fed survey on Monday Nov 29th.

A slowdown in manufacturing has been one of the reasons I thought GDP growth would slow in the 2nd half of 2010 and into 2011 (this is part of the general sluggish and choppy recovery). My view was based on the end of the inventory adjustment, a slowdown in export growth, and sluggish growth for consumer spending. So the Philly Fed reading was surprising to me.

"Some thoughts on the muni market"

by Calculated Risk on 11/19/2010 09:30:00 AM

From Bond Girl: Some thoughts on the muni market

I have been somewhat hesitant to write about the recent sharp correction in the muni market, mainly because I do not like wasting my time.I think it is important to understand that these supply issues are what is driving the muni market - not an imminent default.

...

My opinion, for whatever it is worth to you, is that there are a handful of factors – mostly unrelated to the relative creditworthiness of muni issuers – that have provoked this correction. These factors are related, and they will likely contribute to volatility going into next year. The first, obviously, is a supply glut. The pending expiration of the Build America Bond (BAB) program has pulled supply forward, and this is going to seesaw over the next several weeks. Since the BAB program was initiated, most issuers have structured their new issues with the sense that they will go to either the tax-exempt or taxable market, whichever is more advantageous at the time. It has been almost completely a supply management game since the market for these bonds was established and munis became truly bifurcated.

...

By allowing muni issuers to sell taxable bonds, the BAB program opened the market up to investors like pensions and foreign investors, who otherwise would not benefit from a tax exemption on the interest income on the bonds and would find tax-exempt yields unappetizing. This program has relieved the supply pressure on the market for essentially two years now, keeping interest rates low.

What is going on now is that muni issuers are scrambling to get deals done to take advantage of the program before it expires, and this is pulling the number of new issues that would ordinarily be coming to market forward. So the looming expiration of the BAB program is creating the very conditions it was created to alleviate. Issuers are very conscious of this fact, and that is why a large number of deals are getting pulled. As more issues get pulled and supply is reduced, there will be some relief on rates, which I think is what happened today. But you can expect that muni issuers will be dancing around this until the program expires at the end of the year, so there will likely be significant volatility. There is also considerable uncertainty as to how supply issues will play out in the first quarter of 2011.