by Calculated Risk on 11/21/2010 04:09:00 PM

Sunday, November 21, 2010

Irish Bailout approved by EU and IMF

From the Irish Times: Irish application for IMF/EU rescue package approved

Taoiseach Brian Cowen tonight confirmed the European Union has agreed to Government request for financial aid package from the European Union and the International Monetary Fund.The amount of the aid still hasn't been determined. Apparently the loans will be from the IMF, the European Financial Stability Facility (EFSF), and possibly from the UK and Sweden directly.

European finance ministers held an emergency conference call tonight to consider a Cabinet request for aid, during which the application was approved.

More from the Financial Times: Eurozone agrees €80bn-€90bn Irish aid

Earlier: Here is the economic schedule for the coming holiday week. There will be plenty of data released early in the week, including existing home sales on Tuesday, new home sales on Wednesday, the 2nd estimate of Q3 GDP on Tuesday, and Personal income and spending for October on Wednesday - and much more.

And a summary of last week.

A Summary for the Week ending November 20th

by Calculated Risk on 11/21/2010 11:30:00 AM

Below is a summary of last week mostly in graphs. Note: A key story again last week was the imminent bailout of Ireland. There will probably be more on the bailout details later today.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Total housing starts were at 519 thousand (SAAR) in October, down 11.7% from the revised September rate of 588 thousand, and just up 9% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

This was below expectations of 590 thousand starts, mostly because of the volatile multi-family starts. Single-family starts decreased 1.1% to 436 thousand in October. This is 21% above the record low in January 2009 (360 thousand).

The graph shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for almost two years - with a slight up and down over the last six months due to the home buyer tax credit. Starts will stay low until the excess inventory of existing homes is absorbed.

The MBA reported that 13.52 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2010 (seasonally adjusted). This is down from 14.42 percent in Q2 2010.

Note: the MBA's National Delinquency Survey (NDS) covered "about 44 million first-lien mortgages on one- to four-unit residential properties" and the "NDS is estimated to cover approximately 88 percent of the outstanding first lien mortgages in the market." This gives about 50 million total first lien mortgages or about 6.75 million delinquent or in foreclosure.

This graph shows the percent of loans delinquent by days past due.

This graph shows the percent of loans delinquent by days past due.Most of the decline in the overall delinquency rate was in the seriously delinquent categories (90+ days or in foreclosure process). Part of the reason is lenders were being more aggressive in foreclosing in Q3 (before the foreclosure pause), and there was a surge in REO inventory (real estate owned). Some of the decline was probably related to modifications too.

Loans 30 days delinquent decreased to 3.36%. This is slightly below the average levels of the last 2 years, but still high.

Delinquent loans in the 60 day bucket decreased to 1.44% - the lowest since Q2 2008.

With the foreclosure pause, the 90+ day and in foreclosure rates will probably increase in Q4.

The CoreLogic HPI is a three month weighted average of July, August, and September and is not seasonally adjusted (NSA).

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.The index is down 2.8% over the last year, and off 29.2% from the peak.

The index is 3.9% above the low set in March 2009, and I expect to see a new post-bubble low for this index later this year or early in 2011.

“We’re continuing to see price declines across the board with all but seven states seeing a decrease in home prices,” said Mark Fleming, chief economist for CoreLogic. “This continued and widespread decline will put further pressure on negative equity and stall the housing recovery.”

On a monthly basis, retail sales increased 1.2% from September to October (seasonally adjusted, after revisions), and sales were up 7.3% from October 2009.

On a monthly basis, retail sales increased 1.2% from September to October (seasonally adjusted, after revisions), and sales were up 7.3% from October 2009. Retail sales increased 0.4% ex-autos - about at expectations.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 11.2% from the bottom, and only off 1.8% from the pre-recession peak.

From the Fed: Industrial production and Capacity Utilization

Industrial production was unchanged in October after having fallen 0.2 percent in September. ... The capacity utilization rate for total industry was flat at 74.8 percent, a rate 6.6 percentage points above the low in June 2009 and 5.8 percentage points below its average from 1972 to 2009.

This graph shows Capacity Utilization. This series is up 9.7% from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. This series is up 9.7% from the record low set in June 2009 (the series starts in 1967).Capacity utilization at 74.8% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The next graph shows industrial production since 1967.

The next graph shows industrial production since 1967.Industrial production was unchanged in October, and production is still 7.3% below the pre-recession levels at the end of 2007.

This was below consensus expectations of a 0.3% increase in Industrial Production, and an increase to 74.9% for Capacity Utilization.

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

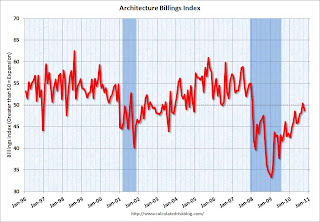

Reuters reported that the American Institute of Architects’ Architecture Billings Index decreased to 48.7 in October from 50.4 in September. Any reading below 50 indicates contraction.

Reuters reported that the American Institute of Architects’ Architecture Billings Index decreased to 48.7 in October from 50.4 in September. Any reading below 50 indicates contraction. This graph shows the Architecture Billings Index since 1996. The index showed expansion in September (above 50) for the first time since Jan 2008, however the index is indicating contraction again in October.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So there will probably be further declines in CRE investment for the next 9 to 12 months.

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 16 in November. This is a 1 point increase from the revised 15 in October (revised down from 16). This is the highest level since June, but slightly below expectations of an increase to 17. The record low was 8 set in January 2009, and 16 is still very low ...

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 16 in November. This is a 1 point increase from the revised 15 in October (revised down from 16). This is the highest level since June, but slightly below expectations of an increase to 17. The record low was 8 set in January 2009, and 16 is still very low ...Note: any number under 50 indicates that more builders view sales conditions as poor than good.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the November release for the HMI and the September data for starts.

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

Over the last 12 months, the median CPI rose 0.5%, the trimmed-mean CPI rose 0.8%, and the CPI less food and energy rose 0.6%. The indexes for rent and owners' equivalent rent both increased in October (some analysts blamed the disinflation trend on these measures of rent, but that wasn't true in October).

This graph shows these three measure of inflation on a year-over-year basis.

This graph shows these three measure of inflation on a year-over-year basis. They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year.

As far as disinflation, the U.S. is still tracking Japan in the '90s ...

Best wishes and Happy Thanksgiving to all!

Irish finance minister will recommend IMF and EU Bailout

by Calculated Risk on 11/21/2010 08:54:00 AM

Some breaking news from the Irish Times: Lenihan to seek Cabinet approval for financial bailout

Minister for Finance Brian Lenihan said he would seek Cabinet approval later today for a financial bailout from the International Monetary Fund (IMF) and the European Union.In addition to Ireland, the bond yields to watch are for Portugal and Spain to see if the problem spreads.

...

"I will be recommending to the Government that we should apply for a program and start formal applications," he said.

Saturday, November 20, 2010

Ireland’s children "brought up for export" again

by Calculated Risk on 11/20/2010 09:31:00 PM

The previous post is the Schedule for Week of November 21st

From Suzanne Daley at the NY Times: The Hunt for Jobs Sends the Irish Abroad, Again

Ireland seems set to watch yet another generation scatter across the globe to escape desperate times. ... Experts say about 65,000 people left Ireland last year, and some estimate that the number may be more like 120,000 this year. At first, most of those leaving were immigrants returning home to Central Europe. But increasingly, the experts say, it is the Irish themselves who are heading out ...Ireland already has a huge excess of housing units - and losing another generation will not help. The younger generation is leaving Greece too. A shrinking population - especially losing the young and well educated - doesn't help the economy recover.

Schedule for Week of November 21st

by Calculated Risk on 11/20/2010 06:16:00 PM

This is a holiday week (Happy Thanksgiving!), but there will be plenty of data released early in the week. The key releases are existing home sales (on Tuesday) and New home sales (on Wednesday).

8:30 AM ET: Chicago Fed National Activity Index (October). This is a composite index of other data.

9:00 AM: CoreLogic Shadow Inventory Data for August 2010. This report provides an estimate of the number of properties not currently listed for sale that are either seriously delinquent (90 days or more), in foreclosure, or real estate owned (REO) by lenders.

Morning: Moody's/REAL Commercial Property Price Index (CPPI) for September.

1:30 PM: Minneapolis Fed President Kocherlakota speaks on "Monetary Policy, Labor Markets, and Uncertainty" before the Sioux Falls Rotary Club.

8:30 AM: Q3 GDP (second estimate). This is the second estimate for Q3 from the BEA, and the consensus is for real GDP growth to be revised to an increase of 2.4% annualized from the advance estimate of 2.0%.

8:30 AM: Corporate Profits, 3rd quarter 2010 (preliminary estimate)

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for sales of 4.5 million at a Seasonally Adjusted Annual Rate (SAAR) in October, about the same as the 4.53 million SAAR in September. Housing economist Tom Lawler is projecting a slight decline from last month (SAAR). In addition to sales, the level of inventory and months-of-supply will be very important (since months-of-supply impacts prices). Months-of-supply was probably still in double digits in October.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October. The consensus is for a reading of 5 (slight expansion), the same as last month.

10:00 AM: the BLS will release the Regional and State Employment and Unemployment report for October.

2:00 PM: FOMC Minutes, Meeting of November 2-3, 2010. There might be some interesting points on QE2.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly over the last few months - suggesting home sales will be very weak through the end of the year.

8:30 AM: Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income and a 0.5% increase in personal spending, and for the Core PCE price index to increase 0.1%.

8:30 AM: The initial weekly unemployment claims report will be released a day early because of the Thanksgiving holiday. Initial claims increased slightly to 439,000 last week, and initial claims are expected to decline to 435,000 this week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.1% increase in durable goods orders after increasing 3.3% in September.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for November).

10:00 AM: New Home Sales for October from the Census Bureau. The consensus is for a slight increase in sales to 314K (SAAR) in October from 307K in September. New home sales collapsed in May and have averaged only 294K (SAAR) over the last five months. Prior to the last five months, the previous record low was 338K in Sept 1981.

10:00 AM: FHFA House Price Index for September. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic).

11:00 AM: Kansas City Fed regional Manufacturing Survey for November. The index was at 10 in October.

Thanksgiving Holiday. Markets Closed.

Markets will close at 1:00 p.m. on the day after Thanksgiving.

After 4:00 PM: The FDIC will probably take Friday afternoon off ...

New Fannie Mae Lending Guidelines

by Calculated Risk on 11/20/2010 02:14:00 PM

UPDATE: Good news. These are not seller-funded Down payment Assistance Programs (DAPs). From Fannie Mae:

Interested Party Contributions (IPCs) [include] ... funds that flow from an interested party through a third-party organization, including nonprofit entities, to the borrower ... Fannie Mae does not permit IPCs to be used to make the borrower’s down payment, meet financial reserve requirements, or meet minimum borrower contribution requirements.Lynnley Browning at the NY Times mentions some of the changes: New Lending Guidelines From Fannie Mae

The rules, effective on Dec. 13, will allow buyers to use gifts and grants from nonprofit groups for their minimum 5 percent down payment, which is the threshold set by Fannie Mae, the government-owned company that sets lending standards and buys mortgages from lenders.The lower back end debt-to-income (DTI) ratio makes sense. I'd prefer 31% for the front end DTI1 (the HAMP goal), and 40% for the back end DTI.

...

Fannie Mae is getting tougher on debt-to-income ratios, or the amount of a borrower’s gross monthly income that goes toward paying off all debts. The maximum ratio for those seeking a conventional mortgage will drop to 45 percent from 55 percent under the new guidelines.

...

But perhaps the toughest news from Fannie Mae concerns borrowers who have gone through foreclosure. They will be excluded from obtaining a Fannie-backed loan for seven years, up from four.

1 Front end DTI includes Principal, Interest, Taxes and Insurance (PITI) plus any homeowners association fees. The back end DTI includes PITI and HOA, plus installment debt, alimony, 2nd liens, and other fixed payments.