by Calculated Risk on 11/22/2010 04:00:00 PM

Monday, November 22, 2010

Existing Home Sales Forecast, and Ireland Update

From housing economist Tom Lawler (existing home sales will be released tomorrow):

Based on the data I have seen so far, I estimate that existing home sales ran at a seasonally adjusted annual rate of around 4.46 million homes, down 1.5% from September’s pace, and down 25.4% from last October’s “tax-credit-goosed” pace. The YOY decline in unadjusted sales will be larger than that for seasonally adjusted sales for “calendar” reasons (including the fact that this October had one fewer business day than last October).A 3.7% decline in inventory (from September) would put inventory at 3.89 million. Based on this estimate, the months-of-supply in October was around 10.4 months.

The local realtor/MLS inventory numbers I’ve seen have on aggregate been broadly consistent with the 3.2% national drop in active listings from September to October on realtor.com, though the local realtor numbers suggest that the NAR’s estimate may show a somewhat greater decline – perhaps closer to -3.7%(The NAR does not use national listings, but instead uses listings from its sample of local MLS/associations/boards).

And on Ireland:

Irish borrowing costs, which fell under 8 per cent earlier today on news that EU had approved a Government request for a multi-billion euro package, rose shortly after the Greens’ announcement and closed at 8.1 per cent.An excellent European source told me today that his attention is now on Spain - and that there are some early troubling signs of rising credit costs (not just the ten year yield). Something to keep an eye on ...

Discussions resumed today between delegations from the IMF, the EU and the Commission and a team of Irish officials to discuss the terms of the bailout.

Monetary Policy Confusion

by Calculated Risk on 11/22/2010 03:17:00 PM

An editorial in the WaPo yesterday - and some recent emails I've received - indicate there is some confusion on the difference between monetary and fiscal policy.

From the WaPo yesterday: Kicking the Fed

[B]uying hundreds of billions of dollars worth of federal debt in a deliberate effort to lower long-term interest rates and boost employment looks to many economists, market participants and politicians like fiscal policy by another name.Well, these "economists, market participants and politicians" are confused.

The NY Fed's Terrence Checki provided a succinct description of monetary policy in a speech last Friday: Challenges Facing the U.S. Economy and Financial System

Monetary policy works by influencing the level and shape of the domestic yield curve. In normal times, the Fed does this by buying and selling Treasury securities at the short end of the curve, thereby influencing short-term rates. The Fed's purchase of Treasury bonds (under quantitative easing "QE" or LSAP) simply extends classic open market operations to longer duration securities, to produce similar results: a shift in the yield curve consistent with desired financial conditions.That is monetary policy, not fiscal policy which is related to government revenue collection and expenditures.

While I have some sympathy for those who question the degree to which this will ultimately be successful in producing the desired real economy effects, I am not sure what to make of the fact that a change in operating procedure per se could have generated such an uproar ..

Regarding the external implications of the policy, several points are worth keeping in mind. One is that the goal of policy is to stimulate demand in the United States by encouraging lower real yields. To be sure, the dollar has weakened of late, but as a side effect of policy, not as a goal, and not by more than might be expected in light of our recent slowing and recent changes in interest rates and inflation expectations. And as growth strengthens, the value of the dollar should adjust accordingly.

It seems valid to question the effectiveness of QE2 (aka LSAP), but confusing monetary and fiscal policy is not helpful.

The Milwuakee Journal Sentinel provides an example of a confused politician: Ryan leads opposition to Fed's economic efforts

"There is nothing more insidious that a government can do to its people than to debase its currency," [U.S. Rep. Paul] Ryan said.Ryan is correct about the dangers of inflation, but that isn't a concern right now. And if Ryan means what he says about the debasing the currency, he should be opposing the proposed extension of the tax cut for higher income earners. That is fiscal policy. What will debase the currency is long term government spending far in excess of revenue.

Just as harmful, Ryan warns, is that the proliferation of newly printed dollars inevitably unleashes inflation and throws the economy out of kilter in other ways.

"Inflation is a killer of wealth. It wipes out the middle class. It eviscerates the standard of living for people who have retired or are living on fixed incomes," he said.

Ryan then argues for eliminating the Fed's dual mandate of price stability and maximum sustainable employment. There are times when the two mandates are in conflict - like during periods of stagflation - but not right now.

Currently inflation is below the Fed's target of around 2%, and the unemployment rate is unacceptably high at 9.6%. So both "mandates" argue for further FOMC action.

I would support further fiscal policy aimed directly at the unemployed (an extension of benefits - or even directly hiring some of the unemployed). I think that would be more effective than monetary policy right now.

Moody's: Commercial Real Estate Prices increase in September

by Calculated Risk on 11/22/2010 11:52:00 AM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index increased 4.3% in September. This reverses the sharp decline in August. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices and make the index very volatile.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.

From Bloomberg: Commercial Property Prices in U.S. Increase the Most on Record, Moody Says

U.S. commercial property prices rose 4.3 percent in September from the previous month ... “Each of the summer months this year recorded declines in the 3 percent to 4 percent range, followed by this month’s sizeable uptick,” Nick Levidy, a Moody’s managing director in New York, said in the statement. “The relatively large swings seen in the index recently are due in part to the uncertain macroeconomic environment and the effects of a thin market with low transaction volumes.”The headline for the Bloomberg article is a little misleading - there was a large reported increase in September, but that was pretty minor compared to the price declines over the summer.

CoreLogic: Shadow Housing Inventory pushes total unsold inventory to 6.3 million units

by Calculated Risk on 11/22/2010 09:21:00 AM

From CoreLogic: Shadow Inventory Jumps More Than 10 Percent in One Year, Pushing Total Unsold Inventory to 6.3 Million Units

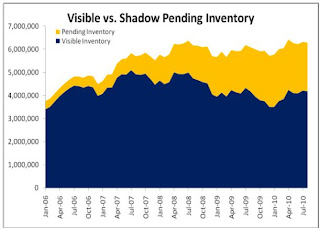

This graph from CoreLogic shows the breakdown of "shadow inventory" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

CoreLogic estimates the "shadown inventory" (by this method) at about 2.1 million units.

CoreLogic estimates shadow inventory, sometimes called pending supply, by calculating the number of properties that are seriously delinquent (90 days or more), in foreclosure and real estate owned (REO) by lenders and that are not currently listed on multiple listing services (MLSs). Shadow inventory is typically not included in the official metrics of unsold inventory.

According to CoreLogic, the visible supply of unsold inventory was 4.2 million units in August 2010, the same as the previous year. The visible inventory measures the unsold inventory of new and existing homes that were on the market. The visible months’ supply increased to 15 months in August, up from 11 months a year earlier due to the decline in sales during the last few months.

The total visible and shadow inventory was 6.3 million units in August, up from 6.1 million a year ago. The total months’ supply of unsold homes was 23 months in August, up from 17 months a year ago. Although it can vary and it depends on the market and real estate cycle, typically a reading of six to seven months is considered normal so the current total months’ supply is roughly three times the normal rate.

...

Mark Fleming, chief economist for CoreLogic commented, “The weak demand for housing is significantly increasing the risk of further price declines in the housing market. This is being exacerbated by a significant and growing shadow inventory that is likely to persist for some time due to the highly extended time-to-liquidation that servicers are currently experiencing.”

The second graph from CoreLogic shows the total visible and pending inventory. Even though the visible inventory has declined slightly from the peak in 2007, the total inventory is at close to an all time high of 6.3 million units.

The second graph from CoreLogic shows the total visible and pending inventory. Even though the visible inventory has declined slightly from the peak in 2007, the total inventory is at close to an all time high of 6.3 million units.Note: The term "shadow inventory" is used in many different ways. My definition is: housing units that are not currently listed on the market, but will probably be listed soon. This includes:

Although the CoreLogic report is useful in estimating future supply, I think it is the visible supply that impacts prices.

Chicago Fed: Economic Activity picked up slightly in October

by Calculated Risk on 11/22/2010 08:30:00 AM

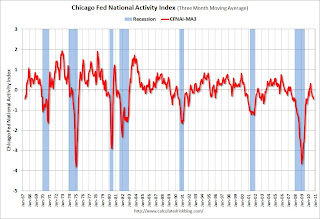

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Index shows economic activity picked up in October

Led by improvements in production- and employment-related indicators, the Chicago Fed National Activity Index increased to –0.28 in October from –0.52 in September.

...

The index’s three-month moving average, CFNAI-MA3, decreased to –0.46 in October from –0.33 in September, reaching its lowest level since November 2009. October’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend for the fifth consecutive month. With regard to inflation, the amount of economic slack reflected in the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was sluggish in October.

Sunday, November 21, 2010

Shadow Inventory

by Calculated Risk on 11/21/2010 10:10:00 PM

Tomorrow morning CoreLogic will release their Shadow Inventory report as of August 2010. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

CoreLogic then adds this shadow or "pending inventory" to the "visible supply" for August as reported by the NAR: 4.1 million units and 12.0 months-of-supply.

The term "shadow inventory" is used in many different ways. My definition is: housing units that are not currently listed on the market, but will probably be listed soon. This includes:

I expect CoreLogic to report 1.5 to 2.0 million units of pending supply, and that will put their combined months-of-supply metric in the stratosphere. Although the CoreLogic report is useful in estimating future supply, I think it is the visible supply that impacts prices.

Earlier: Here is the economic schedule for the coming holiday week. There will be plenty of data released early in the week, including existing home sales on Tuesday, new home sales on Wednesday, the 2nd estimate of Q3 GDP on Tuesday, and Personal income and spending for October on Wednesday - and much more.

And a summary of last week.