by Calculated Risk on 11/25/2010 03:15:00 PM

Thursday, November 25, 2010

The Pain would come from Spain

First, a great overview from Raphael Minder at the NY Times: A Spanish Bailout Would Test Europe’s Strained Finances

[A]ny bailout of Spain — with an economy twice the size of [Greece, Ireland and Portugal] combined — could severely stress the ability of Europe’s stronger countries to help the financially weaker ones, and spell deep trouble for the euro, Europe’s common currency.There is much more in the article.

...

The looming question is whether Spanish banks are really as healthy as the government and the banks say they are. ... Last July, Spanish banks emerged relatively unscathed from stress tests carried out across Europe ... But the credibility of the stress tests has since been undermined by the collapse of Irish banks.

And from the WSJ: EU Hopes to Double Bailout Fund. Concerns about Spain is the reason for doubling the fund.

Galleries, Europe and more ...

by Calculated Risk on 11/25/2010 09:15:00 AM

A few housekeeping notes for a holiday ...

• Every weekend I post a weekly schedule of economic data for the coming week. The current schedule can be accessed in the menu bar above: "Weekly Schedule".

• Receive blog posts via email. Sign up here for free (No subscription information will be sold or otherwise provided to third parties).

• Follow on Twitter.

• Graph Galleries are now active. You can access the galleries by clicking on a graph, or use "Graph Galleries" in the menu bar above.

The galleries are graphs grouped by category:

1) Employment,

2) New Home sales,

3) Existing home sales,

4) Home prices,

5) Housing (like starts and homeownership rate)

6) Mortgage Delinquency

7) Transportation

8) Manufacturing

9) GDP

10) Commercial Real Estate (CRE)

11) Retail

12) Trade

13) Employment Participation Rate (an analysis)

14) Inflation (CPI)

Two examples:

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph is based on data from MBA's National Delinquency Survey (NDS)and shows the percent of loans delinquent by days past due.

If you click on the graph, the link will take you to the same graph in the "delinquency" gallery.

The title for the graph "MBA Q3 Delinquency Data, Nov 18, 2010" is a link to the related blog post - and the date is when the graph was posted.

Note the "print" link at the bottom. That will display the full size image (The graphs are free to use on websites or for presentations. All I ask is that online sites link to my site, http://www.calculatedriskblog.com/, and printed presentations credit www.calculatedriskblog.com.)

And another example from the existing home sales report this week.

And another example from the existing home sales report this week.

Clicking on the graph will take you to the "existing home" gallery. There are seven related graphs in the gallery (Existing home sales, inventory, months-of-supply, etc). You can click on the thumbnails at the bottom to view each graph.

Enjoy!

And on Europe:

• Ireland 10-year yield is over 9%

• Spanish 10-year bond yields have hit a record 5.2%.

• Portugal 10-year yield is at 7%.

Thanks to all for reading. Have a great Thanksgiving!

Wednesday, November 24, 2010

Music: "The Dollar and Its Diving"

by Calculated Risk on 11/24/2010 10:24:00 PM

A little holiday music ...

ATA: Truck Tonnage Index increases in October

by Calculated Risk on 11/24/2010 07:15:00 PM

Earlier post: New Home Sales decline in October

From the American Trucking Association: ATA Truck Tonnage Index Rose 0.8 Percent in October

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index rose 0.8 percent in October after increasing a revised 1.8 percent in September. The latest gain put the SA index at 109.7 (2000=100) in October from 108.9 in September.

...

ATA Chief Economist Bob Costello said that truck tonnage changes over the last couple months shows there are some bright spots in the U.S. economy. “October tonnage levels were at the highest level in three months, even after accounting for typical seasonal shipping patterns. These gains fit with reports out of both the manufacturing and retail sectors and show there is a little bit of life in this economic recovery."

Click on map for larger image.

Click on map for larger image.This graph from the ATA shows the Truck Tonnage Index since Jan 2006.

The line is added to show the index has been mostly moving sideways this year.

Comments on October Personal Income and Outlays Report

by Calculated Risk on 11/24/2010 03:28:00 PM

The BEA released the Personal Income and Outlays report for October this morning.

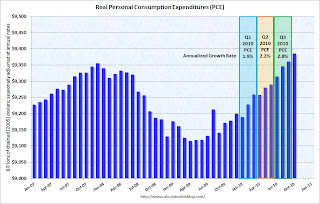

Personal income increased $57.6 billion, or 0.5 percent ... Personal consumption expenditures (PCE) increased $44.0 billion, or 0.4 percent.The following graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in October, compared with an increaseof 0.2 percent in September.

Click on graph for large image.

Click on graph for large image.The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

Even with no growth in November and December, PCE growth will be close to 2% in Q4, and it will probably be closer to 3% (annualized growth rate).

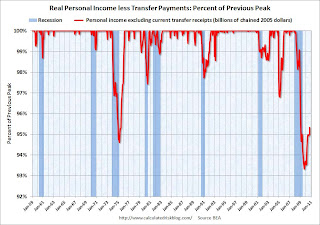

Also personal income less transfer payments increased sharply in October. This increased to $9,285.7 billion (SAAR, 2005 dollars) from $9,252.2 billion in September. This measure had stalled out over the summer.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and is still 4.7% below the previous peak - but is recovering again.

This graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and is still 4.7% below the previous peak - but is recovering again. Overall this was a fairly positive report, in line with consensus expectations, and suggests decent (but not robust) growth in October.

Europe Update: Irish Austerity, New Resolution Mechanism, Rising Yields

by Calculated Risk on 11/24/2010 12:43:00 PM

From the Irish Times: 'No group sheltered' as €15 billion savings plan unveiled

[S]pending on social welfare cut by €2.8 billion primarily through cuts in unemployment benefits and child income supports ... new levies on property and a hike in the basic rate of income tax ...And the WSJ reports obtaining a copy of Germany's proposal for a permanent resolution mechanism that would take effect after the EFSF expires in 2013. According to the WSJ, the proposal would create a

"permanent, intergovernmental crisis-management mechanism" in which euro-zone members, private investors and the International Monetary Fund would all play a role.This is the widely discussed "haircut" for bondholders.

Spanish 10-year bond yields have pushed above 5%, the Portugal 10-year yield is at 7%, and Ireland is up to 8.89%.

Note: Right now this is a European problem and I see little impact on the U.S. in the short term.