by Calculated Risk on 11/27/2010 08:37:00 AM

Saturday, November 27, 2010

Unofficial Problem Bank list increases to 919 Institutions

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 26, 2010.

Changes and comments from surferdude808:

The FDIC released its actions for October, which contributed to a notable increase in the Unofficial Problem Bank List. This week there were 17 additions and one removal leaving the list at 919 institutions with assets of $410.2 billion. Assets declined $9.4 billion during the week, but $11.6 billion, or more than 100 percent of the drop in assets, came from the release of 2010q3 financials. Thus, the net 16 additions this week added $2.2 billion of assets. For the month, a net 25 institutions were added and the list has 376 more institutions than it did a year ago.The Q3 FDIC Quarterly banking profile was released last week and showed 860 problem institutions at the end of Q3 with $379 billion in assets.

The sole removal this week is the termination of an action by the FDIC against Torrey Pines Bank, San Diego, CA ($1.2 billion Ticker: WAL).

Among the 17 additions this week are the Bank of the Orient, San Francisco, CA ($675 million); Town & Country Bank and Trust Company, Bardstown, KY ($454 million Ticker: FHDG); Border State Bank, Greenbush, MN ($347 million); McHenry Savings Bank, McHenry, IL ($271 million); and SouthBank, a Federal Savings Bank, Huntsville, AL ($265 million).

Friday, November 26, 2010

Fannie and Freddie on Foreclosed Homes: Resume all normal sales activity

by Calculated Risk on 11/26/2010 07:34:00 PM

From Kimberly Miller at the Palm Beach Post: Fannie Mae, Freddie Mac give the 'go-ahead' to resume sales of foreclosed homes

Fannie Mae and Freddie Mac gave the go-ahead this week to restart sales of their foreclosed properties ... Brokers received memos Wednesday from the government-sponsored enterprises saying that the homes could once again be marketed and sales finalized on properties already under contract.Fannie and Freddie halted some sales of already foreclosed properties (REO: Real Estate Owned), and they also halted some foreclosures in process. The above story was on sales of REOs.

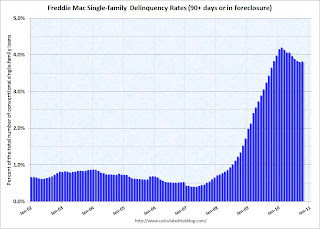

On a related point, Freddie Mac reported that the serious delinquency rate increased to 3.82% in October from 3.80% in September. The following graph shows the Freddie Mac serious delinquency rate (loans that are "three monthly payments or more past due or in foreclosure"):

Click on graph for larger image in new window.

Click on graph for larger image in new window.Some of the rapid increase last year was probably because of foreclosure moratoriums, and distortions from modification programs because loans in trial mods were considered delinquent until the modifications were made permanent. As modifications have become permanent, they are no longer counted as delinquent.

The increase in October - the first increase since February - is probably related to the new foreclosure moratoriums.

Note: Fannie and Freddie report REO inventory quarterly, but the FHA reported that REO increased sharply in October to 54,609 from 51,487 at the end of September. So even though Fannie and Freddie halted many foreclosures in process, they also halted REO sales - so my guess is their REO inventory probably increased in October and November too (like for the FHA).

Accelerated Timetable for Ireland Bailout Details

by Calculated Risk on 11/26/2010 05:38:00 PM

From the NY Times: Europeans Striving to Calm Nerves in Markets

[T]he team of European Union and International Monetary Fund specialists in Ireland was racing to complete terms of its financing package before markets reopen on Monday.Looks like Sunday will be busy again.

And from the Irish Times: Reports that bailout will attract 6.7% rate rejected

The interest rate for a nine-year EU/IMF loan would be lower than the 6.7 per cent being quoted in some reports today, a source involved in the talks has indicated.University College Dublin professor Karl Whelan earlier estimated an EFSF borrowing rate close to 6%: Borrowing Rates from The EFSF

And more stress tests are coming in Spain (from NY Times article):

In Spain, the central bank ... said it would carry out further stress tests to show ... financial institutions ... could absorb a “problematic exposure” of 180 billion euros, or $238 billion, to the country’s collapsed construction and real estate sectors.

Housing Supply: What do all the numbers mean?

by Calculated Risk on 11/26/2010 01:42:00 PM

We are constantly bombarded with housing supply numbers: 3.86 million existing homes for sale, 10.5 month-of-supply, 2.1 million "pending sales", 7 million mortgages delinquent.

Recently NY Fed president William Dudley said "We estimate that there are roughly 3 million vacant housing units more than usual", and other sources have mentioned there are close to 19 million vacant housing units in the U.S.!

What does it all mean?

The number to start with is the "visible supply" reported monthly from the National Association of Realtors (NAR). At the end of October, the NAR reported there were 3.86 million homes for sale.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows nationwide inventory for existing homes.

Notice that inventory started to increase in the 2nd half of 2005. That was one of the indicators I used to call the top of the housing bubble.

Also notice the seasonal pattern for inventory - inventory increases in the spring, and usually peaks during the summer months, and then falls off sharply in December as homeowners take their homes off the market for the holidays. I expect NAR reported inventory to fall to around 3.5 million of so in December (down from 3.86 million in October, but up from 3.283 in December 2009).

This brings up an interesting point about how the NAR calculates "months-of-supply". The simple formula is months-of-supply = inventory divided by sales. The NAR uses the Seasonally Adjusted Annual Rate (SAAR) of sales, but the Not Seasonally Adjusted (NSA) inventory - even though there is a clear seasonal pattern for inventory.

The NAR formula is: months-of-supply = (inventory (NSA) /sales (SAAR)) * 12 months. (edit: oops, inverted initially, correct above) For October, the NAR reported 4.43 million sales (SAAR), and 3.86 million units of inventory, so that equals 10.5 months of supply.

If inventory drops to 3.5 million in December (normal seasonal decline), but the sales rate stay at 4.43 million, the months-of-supply metric will decline to 9.5 months. Some analysts might report that decline as "good news" even though it is just because of the normal seasonal change in inventory.

A couple more points:

• Historically year end inventory is around 3% to 3.5% of the total number of owner occupied units. Currently there are about 75 million owner occupied units, so a normal level of year end inventory would be around 2.3 to 2.6 million units. So the visible inventory at around 3.5 million would be significantly above the normal level.

• It is the visible inventory that impacts prices. Also important is the level of distressed sales (short sales and foreclosures).

This graph (posted with permission) shows the percentage of short sales and REO (lender Real Estate Ownder) sales since January 2006. From CoreLogic:

Distressed sales fell 10 percent in August to 68,700, the lowest level since May 2008. Although the level of distressed sales declined, it simply reflects the weak demand in the market overall because total sales also declined and the distressed sale share remained stable at 28 percent.So both the level of visible inventory and the percentage of distressed sales is elevated - and that puts downward pressure on house prices.

The next number is the "pending sales" of 2.1 million units. This was reported by CoreLogic this week:

This graph from CoreLogic shows the breakdown of "pending sales" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as a pending sale.

This graph from CoreLogic shows the breakdown of "pending sales" by category. For this report, CoreLogic estimates the number of 90+ day delinquencies, foreclosures and REOs not currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as a pending sale.CoreLogic estimates the "pending sale" (by this method) at about 2.1 million units. This number is useful - especially the trend - because it suggests that the visible inventory will stay elevated for some time. And also that the number of distressed sales will stay elevated.

Some analyst have called the number of REOs and total delinquent loans as the "shadow inventory". This is incorrect for two reasons: 1) some homes are listed for sale and are visible (CoreLogic removed these homes from their pending sales metric), and 2) some loans will cure from the borrower catching up, the sale of the home, or with a loan modification.

This graph from Lender Processing Services shows the number of cures by the previous month status. Notice that a very large number of 30 and 60 day loans cure every month (right hand scale). This is common even in good times.

This graph from Lender Processing Services shows the number of cures by the previous month status. Notice that a very large number of 30 and 60 day loans cure every month (right hand scale). This is common even in good times.A fairly large number of 90+ day and in-foreclosure loans are curing too. This is probably because of modifications - and there will probably be a high percentage of redefaults - but this shows why you can't include all delinquent loans as part of the "shadow inventory".

And that brings us to the 7 million delinquent loans. There are two sources for the number of delinquent loans: the Mortgage Bankers Association (MBA) quarterly National Delinquency Survey, and a monthly report from Lender Processing Services (LPS).

This graph shows the percent of loans delinquent by days past due through Q3 according to the MBA.

This graph shows the percent of loans delinquent by days past due through Q3 according to the MBA.The MBA reported that 13.52 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2010 (seasonally adjusted). This is down from 14.42 percent in Q2 2010.

Note: the MBA's National Delinquency Survey (NDS) covered "about 44 million first-lien mortgages on one- to four-unit residential properties" and the "NDS is estimated to cover approximately 88 percent of the outstanding first lien mortgages in the market." This gives about 50 million total first lien mortgages or about 6.75 million delinquent or in foreclosure.

And from LPS Applied Analytics October Mortgage Performance data:

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.The percent in the foreclosure process is trending up because of the foreclosure moratoriums.

According to LPS, 9.29 percent of mortgages are delinquent, and another 3.92 are in the foreclosure process for a total of 13.20 percent. It breaks down as:

• 2.72 million loans less than 90 days delinquent.

• 2.24 million loans 90+ days delinquent.

• 2.09 million loans in foreclosure process.

For a total of 7.04 million loans delinquent or in foreclosure.

And finally, what about those "3 million excess vacant housing units"?

This number comes from the Census Bureau's quarterly Housing Vacancies and Homeownership. This report shows almost 19 million total vacant housing units, but that number is pretty meaningless and includes 2nd homes, partially constructed new homes, and much more.

The 3 million number is calculated using the homeowner and rental vacancy rates, and estimating the number of excess units above the normal frictional level. There is always some number of vacant homeowner and rental units as people move and for other reasons. So the excess is the number above this frictional level. The NY Fed also added in a part of the increase in "Vacant, held off market, other" to obtain the 3 million estimate.

I think this last portion of the "excess vacant inventory" is less reliable, and I just use the homeowner and rental vacancy rates. My current estimate is about 1.55 million excess vacant units. This is a key number because once the excess is absorbed in an area as new households are formed, then new construction will begin - and that will mean a pickup in economic activity and employment.

The key numbers to follow for the housing market are 1) existing home inventory, 2) number of delinquent loans, and 3) the excess vacant inventory.

Portugal and Spain: More Denials

by Calculated Risk on 11/26/2010 08:23:00 AM

From the previous post excerpting from Michael Pettis:

Its official – Spain and Portugal will need to be bailed out soon. How do I know? In one of my favorite TV shows, Yes Minister, the all-knowing civil servant Sir Humphrey explains to cabinet minister Jim Hacker that you can never be certain that something will happen until the government denies it.From the Financial Times: Portugal denies facing bail-out pressure

Portugal has denied as “totally false” reports that it is under pressure ... to request an international financial bail-out.And from the Financial Times: Spain issues defiant warning to markets

“There is no truth to these reports,” a government spokesman told the Financial Times.

excerpt with permission

José Luis Rodríguez Zapatero, Spanish prime minister, on Friday ruled out any rescue package for the country ... “I should warn those investors who are short selling Spain that they are going to be wrong and will go against their own interests,” Mr Zapatero said

Thursday, November 25, 2010

Pettis: Will Europe face defaults?

by Calculated Risk on 11/25/2010 09:01:00 PM

From Michael Pettis on Europe: Chinese inflation and European defaults

Its official – Spain and Portugal will need to be bailed out soon. How do I know? In one of my favorite TV shows, Yes Minister, the all-knowing civil servant Sir Humphrey explains to cabinet minister Jim Hacker that you can never be certain that something will happen until the government denies it.And Portugal and Spain have just rejected the possibility of a bailout (a joke with a lot of truth).

Pettis offers a few pessimistic predictions including:

Greece will be forced to default and restructure its debt, and the restructuring will come with a significant amount of debt forgiveness. The idea that it can grow its way out of the current debt burden is a fantasy.And ...

Greece will not be the only defaulter. Spain, Portugal, Ireland, Italy, Belgium and much of Eastern Europe will also face severe financial distress and possible default.Best wishes to all.