by Calculated Risk on 11/29/2010 10:45:00 PM

Monday, November 29, 2010

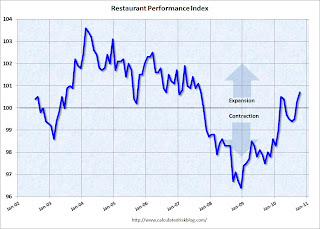

Restaurant Performance Index highest in three years

This is one of several industry specific indexes I track each month.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading above 100 shows expansion for this index.

From the National Restaurant Association (NRA): Restaurant Performance Index highest in three years

"The National Restaurant Association’s Restaurant Performance Index in October reached 100.7. This is the highest level for the index in over three years, since September 2007, and reflects a strengthening environment of consumer spending at restaurants." said Hudson Riehle, senior vice president of the Research and Knowledge Group for the National Restaurant Association.

Restraurants are a discretionary expense, and this expansion suggests consumers are becoming more confident.

DOT: Vehicle miles driven increased in September

by Calculated Risk on 11/29/2010 05:49:00 PM

The Department of Transportation (DOT) reported that vehicle miles driven in September were up 1.5% compared to September 2009:

Travel on all roads and streets changed by +1.5% (3.7 billion vehicle miles) for September 2010 as compared with September 2009.

Cumulative Travel for 2010 changed by +0.5% (11.1 billion vehicle miles).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the rolling 12 month total vehicle miles driven.

On a rolling 12 month basis, vehicle miles driven have only increased slightly from the bottom of the recession.

Miles driven are still 1.6% below the peak in 2007. This is another indicator of a sluggish recovery. And this report was for September when oil prices were in the mid $70s per barrel. Oil prices moved up to the mid $80s today, and that might impact miles driven in December.

Home Sales: Distressing Gap

by Calculated Risk on 11/29/2010 02:12:00 PM

Here is an update to a graph I've been posting for several years. This graph shows existing home sales (left axis) and new home sales (right axis) through October. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

Note: it is important to note that existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Initially the gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The two spikes in existing home sales were due primarily to the homebuyer tax credits (the initial credit in 2009, followed by the 2nd credit in 2010). There were also two smaller bumps for new home sales related to the tax credits.

Now the gap is mostly because of the continuing flood of distressed sales (both foreclosures and short sales).

In a few years - when the excess housing inventory is absorbed and the number of distressed sales has declined significantly - I expect existing home-to-new home sales to return to this historical relationship.

We can guess at the levels: The median turnover for existing homes is just over 6% of all owner occupied homes per year, and with about 75 million owner occupied homes that would suggest close to 5 million sales per year (no one should expect existing home sales to be over 7 million units per year any time soon!). And that would suggest new home sales at just over 800 thousand per year when the market eventually recovers (not 1.2 or 1.3 million per year). This fits with this analysis: The Impact of the Declining Homeownership Rate.

Dallas Fed manufacturing survey shows activity increased in November

by Calculated Risk on 11/29/2010 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Strengthens Further

Texas factory activity increased in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, was positive for the third consecutive month and came in at a reading of 13, up from 7 in October.The following graph compares the regional Fed surveys through November with the ISM manufacturing index through October. The ISM manufacturing index for November will be released on Wednesday, Dec 1st.

All other manufacturing activity indicators also rose, posting their best month since May. The new orders and shipments indexes turned positive after five months of negative readings.

...

Labor market indicators picked up this month. The employment index rose from –4 to 6, reaching its highest level since May, and hours worked increased for the first time in four months.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The New York and Philly Fed surveys are averaged together (dashed green, through November), and averaged five Fed surveys (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City.

The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

With the exception of the NY Fed survey (Empire state), all the regional surveys showed a pickup in manufacturing activity in November.

Europe Update

by Calculated Risk on 11/29/2010 08:58:00 AM

Weekly Posts:

• Schedule for Week of Nov 28th

• A Summary for Week ending November 27th

The European markets are off about 1% this morning.

The yield on the Ireland 10-year bond is up to 9.25%.

The yield on the Portugal 10-year bond is up to 7.02%.

The yield on the Spain 10-year bond is up to 5.36%.

Roubini suggests Portugal should seek a bailout: "Go now to the IMF to borrow money now" (in Portugese)

And from Reuters: Greece Gets Loan Repayment Extension to 2021

Greece will have until 2021 to repay its 110 billion euro ($145.7 billion) EU/IMF bailout loan, the country's finance minister said on Monday.Update: from Paul Krugman: Not Waving But Drowning

In return, Greece will have to pay a higher fixed interest rate of about 5.8 percent from 5.5 percent...

It’s as if we’re having the following dialogue:

“Ireland really can’t afford to pay these debts.”

“Here’s a credit line!”

“No, really, we just can’t afford to pay.”

“Here’s a credit line!”

It really is like watching a car wreck.

Sunday Night Futures

by Calculated Risk on 11/29/2010 12:09:00 AM

Earlier the rescue package for Ireland was announced and preliminary agreement on a permanent resolution mechanism was reached (starting in 2013 - if the markets can wait that long).

Not much market reaction. The Asian markets are mixed tonight. And CNBC's Pre-Market Data shows the S&P 500 off about 8 points or less than 1%. Dow futures are off about 80 points.

The Euro is down slightly to 1.32 dollars

It will be interesting to see the reaction in the bond markets for Ireland, Spain and Portugal .

Best to all.