by Calculated Risk on 12/02/2010 03:15:00 PM

Thursday, December 02, 2010

Unemployed: Longer out of work, tougher to find a job

An important article from Catherine Rampell at the NY Times: Persistence of Long-Term Unemployment Tests U.S.. A short excerpt:

New data from the Labor Department, provided to The New York Times, shows that people out of work fewer than five weeks are more than three times as likely to find a job in the coming month than people who have been out of work for over a year, with a re-employment rate of 30.7 percent versus 8.7 percent, respectively.This is why it is critical to help the unemployed. Rampell writes:

Likewise, previous economic studies, many based on Europe’s job market struggles, have shown that people who become disconnected from the work force have more trouble getting hired, probably because of some combination of stigma, discouragement and deterioration of their skills.

Direct employment programs — like the public works projects of the New Deal era and World War II — might be the fastest way to put people back to work, economists say. But those raise concerns of crowding out businesses and displacing other workers. Besides, such proposals, which smack of socialism to some, seem politically unfeasible at the moment.If structured correctly - in an environment with a 9.6% unemployment rate - the "crowding out" would be minimal. As far as the politics - well, I support a direct hiring program - and I have no expectation of it happening.

Employment Report Preview

by Calculated Risk on 12/02/2010 01:02:00 PM

The BLS will release the November Employment Report at 8:30 AM tomorrow. The consensus is for an increase of 145,000 payroll jobs in November, and for the unemployment rate to stay steady at 9.6%. Note: Bloomberg is listing the consensus as 168,000 payroll jobs, and an increase in the unemployment rate to 9.7%.

Most of the recent employment related reports have been slightly above expectations:

• ADP reported Private Employment increased by 93,000 in November, the largest gain in three years. This was well above expectations of 68,000 private sector jobs.

• The ISM manufacturing employment index decreased slightly to 57.5 from 57.7 in October. This still suggests some hiring in manufacturing (the ADP report showed manufacturing employment increased by 16,000 in November). Most of the regional Fed manufacturing surveys also showed an increase in employment in November.

• Weekly initial unemployment claims were down significantly from October.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The average over the last 4 weeks was 431,000 initial claims per week.

For October the average was 456,500. Although still elevated, this suggests some pickup in hiring compared to October.

• The Reuters/University of Michigan consumer sentiment index increased to 71.6 from 67.7 in October.

• The Reuters/University of Michigan consumer sentiment index increased to 71.6 from 67.7 in October.

This graph shows the consumer sentiment index.

There is some correlation between consumer sentiment and employment, and although this increase in sentiment was minor (and sentiment is still low), this does suggest some improvement.

• As I mentioned last month, the decennial Census hiring and layoffs can be ignored. As of October, there were only 1 thousand temporary census workers remaining on the payroll.

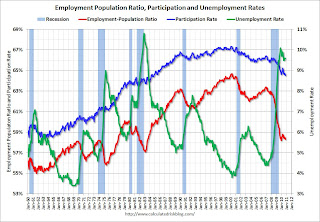

• The unemployment rate is dependent on both job creation and the participation rate.

Usually the participation rate - the percent of the civilian population in the labor force - falls when the job market is weak. And a decline in the participation rate puts downward pressure on the unemployment rate (and the opposite is true when the participation rate increases).

Right now the participation rate is very low at 64.5%, and a further decline would be considered very bad employment news (even if the unemployment rate declined slightly). An increase in the participation rate (due to more confidence), could lead to an increase in the unemployment rate even as hiring improves.

This graph shows the recent sharp decline in the participation rate (blue), and also the unemployment rate and the employment-population ratio. The participation rate had mostly been above 66% since the late '80s, and had been over 67% in the late '90s.

This graph shows the recent sharp decline in the participation rate (blue), and also the unemployment rate and the employment-population ratio. The participation rate had mostly been above 66% since the late '80s, and had been over 67% in the late '90s.

The participation rate probably increased in November, and this might have pushed the unemployment rate up to 9.7%.

For much more on the participation rate, see:

• Labor Force Participation Rate: What will happen?

• Labor Force Participation Trends, Over 55 Age Groups

Note: I think the participation rate will move back towards 66% over the next few years, even with an aging population.

• In October the seasonally adjusted unemployment rate was 9.644% unrounded (reported as 9.6%), so it won't take much of an increase to reach 9.7% for November.

• Bottom line: I think hiring improved in November (I'll take the over again on jobs), but the unemployment rate might have increased too (depending on the participation rate).

Pending Home Sales index increases in October

by Calculated Risk on 12/02/2010 10:00:00 AM

From the NAR:

Strong Rebound in Pending Home Sales

The Pending Home Sales Index,* a forward-looking indicator, rose 10.4 percent to 89.3 based on contracts signed in October from 80.9 in September. The index remains 20.5 percent below a surge to a cyclical peak of 112.4 in October 2009 ... The data reflects contracts and not closings, which normally occur with a lag time of one or two months.This suggests existing home sales in November and December will be somewhat higher than in October.

This also suggests months-of-supply will fall below double digits in November and December, but will remain elevated putting downward pressure on house prices.

Note: in the calculation of months-of-supply, the NAR uses the seasonally adjusted sales rate, but they do not seasonally adjust inventory. Since inventory declines every November and December, the months-of-supply would decline even if the sales rate stayed steady. Since it appears sales will increase slightly (based on pending home sales), and inventory will seasonally decline, the months-of-supply will fall. For more, see: Housing Supply: What do all the numbers mean?

Weekly Initial Unemployment Claims increase to 436,000

by Calculated Risk on 12/02/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 27, the advance figure for seasonally adjusted initial claims was 436,000, an increase of 26,000 from the previous week's revised figure of 410,000. The 4-week moving average was 431,000, a decrease of 5,750 from the previous week's revised average of 436,750.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 5,750 to 431,000.

This is the lowest level for the 4-week moving average since August 2008. The level is still high, but the decline in the 4-week average is good news.

Wednesday, December 01, 2010

Summary of a busy day

by Calculated Risk on 12/01/2010 11:26:00 PM

• The Federal Reserve released details of borrowing by financial firms, and others during the financial crisis. Here are some articles:

From the NY Times: Fed Papers Show Breadth of Emergency Measures

From Bloomberg: Fed Names Recipients of $3.3 Trillion of Aid During U.S. Financial Crisis

From Bloomberg: European Banks Dominated Use of Fed’s Commercial Paper Program

• ADP reported Private Employment increased by 93,000 in November, the largest gain in three years and well above expectations of 68,000 private sector jobs.

• U.S. Light Vehicle Sales were at 12.26 million SAAR in November

• The ISM Manufacturing Index decreased slightly to 56.6 in November.

• European bond yields declined. The Ireland 10-year bond yield fell to 8.94% from 9.36% yesterday. The yield on Portugal 10-year bonds fell to 6.65% from just over 7%, and the yield of Spain's 10-year bonds declined to 5.29% from 5.5%.

• The Asian markets are up all green tonight (up about 1% to 2%)

• Here are the graph galleries for auto sales, ISM index, and construction spending.

Best to all.

Pettis on Europe

by Calculated Risk on 12/01/2010 08:13:00 PM

Usually Michael Pettis writes about China and economics. Today he wrote about Europe and politics: The rough politics of European adjustment. This is a lengthy piece, and here are a few excerpts:

I am now going to veer off into a very different realm, that of politics. I don’t in any sense pretend to be an expert on the subject, but one of the things that surprises me is that as far as I know (perhaps because I am looking in the wrong places) and in spite of very clear historical precedent, very few analysts, even the greatest euro-skeptics, are wondering about of the changes in electoral politics that are likely to take place in Europe over the next few years as a consequence of the euro adjustment.P.S. I appreciate the mention, but he meant Naked Capitalism.

...

Political radicalism in these countries will rise inexorably as a consequence of rising class conflict. As Keynes pointed out as far back as 1922, the process of adjusting the currency and debt will primarily be one of assigning the costs to different economic groups, and this is never an easy or conflict-free exercise. Of course the less stable a government becomes as a consequence of this adjustment, the more likely it is to prefer very short-term solutions.

...

[T]he distribution of these costs is not determined by economic theory but rather by political interests. That is why I said last week that political radicalism in Europe will almost certainly rise and the process of governing will become increasingly unstable. It is through the political process that the costs of adjustment will be assigned to the different groups, and when the costs are likely to be so high, the squabbling over the assignment of those costs is likely to be quite brutal.

...

I am not suggesting that politics will get nearly as crazy or as radicalized as they did in the 1930s. There are much more robust mechanisms today for transferring and sharing adjustment costs, and I assume (hope) we learned enough from the 1930s to recognize that asking one side or the other to pay the full cost is not likely to be good for anyone. But it is hard to imagine that the kinds of disruptive political sectarianism that we saw in some European countries as recently as 20 or 30 years ago cannot revive.