by Calculated Risk on 12/03/2010 03:53:00 PM

Friday, December 03, 2010

Catching Up: ISM Non-Manufacturing index showed expansion in November

Earlier employment posts:

• November Employment Report: 39,000 Jobs, 9.8% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Seasonal Retail Hiring: Retailers remain cautious

• Graphics Gallery for Employment

The November ISM Non-manufacturing index was at 55.0%, up from 54.3% in October - and slightly above expectations of 54.7%. The employment index showed expansion in November at 52.7%, up from 50.9% in October. Note: Above 50 indicates expansion, below 50 contraction.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

From the Institute for Supply Management: October 2010 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 11th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.A little bit of positive economic news as opposed to the weak employment report.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI (Non-Manufacturing Index) registered 55 percent in November, 0.7 percentage point higher than the 54.3 percent registered in October, and indicating continued growth in the non-manufacturing sector at a slightly faster rate. The Non-Manufacturing Business Activity Index decreased 1.4 percentage points to 57 percent, reflecting growth for the 12th consecutive month but at a slower rate than in October. The New Orders Index increased 1 percentage point to 57.7 percent, and the Employment Index increased 1.8 percentage points to 52.7 percent, indicating growth in employment for the third consecutive month and the fifth time in the last seven months. The Prices Index decreased 5.1 percentage points to 63.2 percent, indicating that prices increased slower in November. According to the NMI, 10 non-manufacturing industries reported growth in November. Respondents' comments mostly reflect cautious optimism. There is a degree of uncertainty that still remains for some industries and companies."

emphasis added

.

Seasonal Retail Hiring: Retailers remain cautious

by Calculated Risk on 12/03/2010 01:01:00 PM

According to the BLS employment report - and combining October and November - retailers hired seasonal workers at above the pace of last year, but well below the pre-crisis levels.

Click on graph for larger image.

Click on graph for larger image.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year (not seasonally adjusted).

This really shows the collapse in retail hiring in 2008 and modest rebound in 2009.

Retailers hired 433 thousand workers (NSA) net in October and November. This is above the 367 hired last year in October and November, but well below the pre-crisis average of close to 550 thousand for the same two months.

Note: this is NSA (Not Seasonally Adjusted), retailers employed 28 thousand fewer workers in November than October seasonally adjusted.

This suggests retailers are still cautious about the holiday season.

Earlier employment posts:

• November Employment Report: 39,000 Jobs, 9.8% Unemployment Rate

• Employment Summary and Part Time Workers, Unemployed over 26 Weeks

• Graphics Gallery for Employment

Employment Summary and Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 12/03/2010 10:04:00 AM

Here are a few more graphs based on the weak employment report ...

Percent Job Losses During Recessions

Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time from the start of the recession.

In the previous post, the graph showed the job losses aligned at the bottom.

The dotted line shows payroll employment excluding temporary Census workers.

This is by far the worst post WWII employment recession.

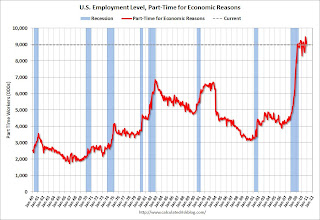

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed over the month at 9.0 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) declined slightly to 8.972 million in November. This has been around 9 million since August 2009 - a very high level.

These workers are included in the alternate measure of labor underutilization (U-6) that was steady at 17.0% in November. The high for U-6 was 17.4% in October 2009. Still very grim.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 6.313 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 6.206 million in October. It appears the number of long term unemployed has peaked, however the level is extremely high - and the increases over the last two months is very concerning.

Summary

Perhaps the worst news was the jump in the unemployment rate to 9.8% without an increase in the participation rate. If the participation rate had increased, at least that would mean people were becoming more confident and rejoining the labor force. Instead the Labor Force Participation Rate was flat at 64.5% and this is a very low level. Note: This is the percentage of the working age population in the labor force (here is the graph in the galleries of the participation rate).

Most of the underlying details of the employment report were weak. The positives included small upward revisions to the September and October payroll reports, a slight increase in average hourly earnings, and a slight decline in part time workers.

The negatives include the unemployment rate increasing to 9.8%, few payroll jobs added (only 39,000 jobs), the decline in the employment-population ratio, the steady participation rate at a very low level, and the increase in workers unemployed for over 26 weeks.

• Earlier Employment post: November Employment Report: 39,000 Jobs, 9.8% Unemployment Rate

November Employment Report: 39,000 Jobs, 9.8% Unemployment Rate

by Calculated Risk on 12/03/2010 08:30:00 AM

From the BLS:

The unemployment rate edged up to 9.8 percent in November, and nonfarm payroll employment was little changed (+39,000), the U.S. Bureau of Labor Statistics reported today.The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image.

Click on graph for larger image.The unemployment rate increased to 9.8% (red line).

The Employment-Population ratio declined to 58.2% in November matching the cycle low set in 2009 (black line).

The Labor Force Participation Rate was steady at 64.5% in November (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

The second graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.The dotted line is ex-Census hiring. The two lines have joined since the decennial Census is over.

For the current employment recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only the early '80s recession with a peak of 10.8 percent was worse).

This is a very disappointing employment report and far below expectations. I'll have much more soon ...

Thursday, December 02, 2010

Hotels: RevPAR up 10.1% compared to same week in 2009

by Calculated Risk on 12/02/2010 11:50:00 PM

From HotelNewsNow.com: STR: Upscale segment reports strong weekly gains

Overall, the industry’s occupancy increased 7.0% to 43.6%, ADR was up 2.9% to US$87.53, and RevPAR ended the week up 10.1% to US$38.16.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 8.2% compared to last year and 4.2% below the median for 2000 through 2007.

Note: For the first time this year, RevPAR (revenue per available room) was up compared to the same week two years ago (in 2008).

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

European Bond Spreads, Dec 1, 2010

by Calculated Risk on 12/02/2010 06:33:00 PM

Here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of Dec 1st):

Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

Led by Ireland, peripheral European bond spreads (over German bonds) have risen considerably in the past few weeks.Maybe the Atlanta Fed should add Belgium.

Since the November FOMC meeting, the 10-year Irish-to-German bond spread has risen by 142 basis points (bps) (from 6.32% to 4.90%), through November 29; spreads on Spanish debt are up 83 bps and 62 bps on Greek debt.

The spreads narrowed sharply today after ECB President Jean-Claude Trichet announced the ECB will extend special liquidity measures until at least April 12th - and continue the Securities Market Program (bond buying of euro-zone debt).