by Calculated Risk on 12/06/2010 05:15:00 PM

Monday, December 06, 2010

AAR: November Rail Traffic shows "mixed progress"

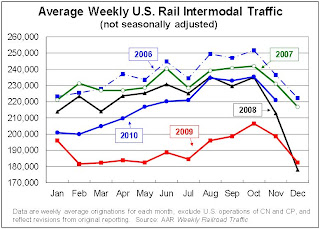

From the Association of American Railroads: AAR Reports November 2010 Rail Traffic Continues Mixed Progress. The AAR reports carload traffic in November 2010 was up 4.5% compared to November 2009, however carload traffic was still lower than in November 2008. Intermodal traffic (using intermodal or shipping containers) is up 11.3% over November 2009 and up slightly over November 2008.

"Even though U.S. rail volumes were down in November from October levels — due largely to Thanksgiving — November marks the 11th straight month in which rail volumes were higher than year-earlier levels. That hasn’t happened since January 2006," said AAR Senior Vice President John Gray. "Granted, 2009 was a bad year for rail traffic, but like the economy in general, rail traffic has been slowly improving. We’re hopeful that recent gains in consumer confidence and some recent encouraging signs regarding consumer spending will mean a continuation of economic growth and further growth in rail traffic."

While railroads continue to bring employees back to work and cars out of storage, data show the pace slowed slightly in recent months. During the month of October, the most recent period for industry employment data, railroads added 191 people to the employee rolls. Railroads brought 465 rail cars out of storage in November, with 317,810 cars, or roughly 20.8 percent of the North American railcar fleet, still in storage.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows U.S. average weekly rail carloads (NSA). Traffic increased in 14 of 19 major commodity categories year-over-year.

From AAR:

• U.S. freight railroads originated an average of 284,407 carloads per week in November 2010 (see chart below left), for a total of 1,137,626 carloads for the month. That’s up 4.5% over November 2009. November was the ninth straight month with higher year-over-year average weekly rail carloads, something that hasn’t happened since 2004.As the first graph shows, rail carload traffic collapsed in November 2008, and now, over a year into the recovery, carload traffic has only recovered part way.

• On a seasonally adjusted basis, U.S. rail carloads were down 1.1% in November 2010 from October 2010. Seasonally-adjusted carloads on U.S. carriers have fallen (though by relatively small amounts) three of the past four months.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):• On a non-seasonally adjusted basis, there is always a big decline in intermodal traffic in November from October, partly because many of the goods retailers stock for holiday sales are shipped in September and October and partly because of Thanksgiving. The week including Thanksgiving this year was the lowest-volume intermodal week of the year for U.S. railroads.The small seasonally adjusted declines suggest the recovery is very sluggish, or has even stalled, over the last few months.

• Seasonally adjusted U.S. rail intermodal traffic was down 0.4% in November 2010 from October 2010, its third straight monthly decline. As with carloads, recent declines have been small.

excerpts with permission

Note: The Ceridian-UCLA diesel fuel index for November will be released tomorrow.

Residential Investment and Unemployment

by Calculated Risk on 12/06/2010 01:10:00 PM

One of the key reasons for the sluggish recovery has been the ongoing problems in housing. Usually residential investment (RI) is a major contributor to GDP growth in the early stages of a recovery, but not this time because of the huge overhang of existing vacant homes.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Click on graph for larger image in graphics gallery.

Click on graph for larger image in graphics gallery.

This graph shows RI and investment in single family structures as a percent of GDP. Usually RI rebounds strongly at the beginning of a recovery, but this time RI has continued to decline.

RI as a percent of GDP is at a post WWII low of 2.22%, and investment in single family structures is near the all time low.

Some people have asked how a sector that only accounts for 2.2% of GDP be so important? The answer is that usually RI accounts for a large percentage of the employment and GDP growth in the first year or so of a recovery. We can see this by looking at housing starts and the unemployment rate.

This graph shows single family housing starts (through October) and the unemployment rate (inverted) through November. Note: Of course there are many other factors too, but housing is a key sector.

This graph shows single family housing starts (through October) and the unemployment rate (inverted) through November. Note: Of course there are many other factors too, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) rebounded a little last year,and then moved sideways for some time, before declining again in May.

This is what I expected when I first posted the above graph in August 2009. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.I'm now looking at a 2011 forecast for housing, and the good news is RI should increase modestly next year. It will not be a vigorous recovery, but I do expect RI to make a positive contribution to GDP - and that is an improvement, and is one of the reasons I think real GDP growth in 2011 will be 3%+. Not great, but an improvement over 2010.

Germany rejects calls for larger rescue fund and "E-Bonds"

by Calculated Risk on 12/06/2010 09:17:00 AM

The European finance ministers are meeting today in Brussels. As we discussed over the weekend, some ministers are pushing to increase the bailout fund and others are arguing for "E-bonds" - joint European government bonds. As expected, Germany reject both suggestions ...

From the Irish Times: Germany rejects calls over debt fund

German Chancellor Angela Merkel said she saw no need to increase the size of the bailout mechanism.The German view is the higher spreads are the penalty for bad behaviour.

Mrs Merkel also said the European Union treaty did not allow for issuing common bonds, which would anyway reduce the element of competition and the interest rate incentive for fiscal good behaviour.

The key 10-year bond yields fell sharply last week (Ireland, Portugal, Spain), but are up slightly today.

Sunday, December 05, 2010

Bernanke: Without Fed's actions, unemployment rate might have hit 25%

by Calculated Risk on 12/05/2010 09:06:00 PM

From the CBS 60 Minutes interview: Fed Chairman Bernanke On The Economy

CBS: In the panic of 2008, the Fed put up $3.3 trillion. And just this past week, the Fed revealed who got emergency help. ... it was a historic transfusion of cash in a global system that was bleeding to death. We asked Bernanke what would have happened if the Fed hadn't acted.Although we don't how bad it would have been, I've repeatedly praised the Fed's creative and aggressive liquidity efforts - once they finally understood what was happening. This was the Federal Reserve at its best (and they are constantly criticized for this effort).

Scott Pelley: What would unemployment be today?

Fed Chairman Bernanke: Unemployment would be much, much higher. It might be something like it was in the Depression. Twenty-five percent. We saw what happened when one or two large financial firms came close to failure or to failure. Imagine if ten or 12 or 15 firms had failed, which is where we almost were in the fall of 2008. It would have brought down the entire global financial system and it would have had enormous implications, very long-lasting implications for the global economy, not just the U.S. economy.

And on the Fed at its worst:

Pelley: Is there anything that you wish you'd done differently over these last two and a half years or so?Bernanke was flat out blind. Missing the housing bubble and inevitable financial impact was inexcusable. I criticized Bernanke repeatedly in 2005, 2006 and 2007 for not recognizing the serious problems with the economy. I ridiculed Bernanke's 2005 piece in the WSJ: The Goldilocks Economy and wrote then that Bernanke was "channeling Coolidge's [Dec 1928] monument to economic shortsightedness".

Bernanke: Well, I wish I'd been omniscient and seen the crisis coming, the way you asked me about, I didn't.

There is much more in the interview including comments on income inequality ... "Well, it’s a very bad development. It’s creating two societies." ... and on unemployment ... "At the rate we're going, it could be four, five years before we are back to a more normal unemployment rate."

As always, I suggest ignoring Bernanke's comments on the deficit.

Earlier:

• Summary for Week ending December 4th

• Schedule for Week of December 5th

Europe Update: The launch of "E-Bonds"?

by Calculated Risk on 12/05/2010 07:02:00 PM

The European finance ministers meet this week in Brussels. Some ministers are pushing to increase the bailout fund and others are arguing for "E-bonds" - joint European government bonds. Although the key 10-year bond yields fell sharply last week (Ireland, Portugal, Spain), the crisis is far from over. A couple of articles:

From Stephen Castle at the NY Times: Pressure Rises to Bolster European Bailout Fund

European finance ministers are under mounting pressure to significantly increase the €750 billion rescue fund for the currency union when they meet Monday. ... Didier Reynders, the Belgian finance minister, suggested over the weekend that the fund ... will have to be increased when it is made permanent after 2013, and that it may make little sense to wait until then to do it.From the Financial Times: Europe’s leaders at odds over bond plan

Jean-Claude Juncker, Luxembourg’s prime minister who also chairs meetings of eurozone finance ministers, and Giulio Tremonti, Italy’s finance minister, argue in Monday’s Financial Times that the launch of “E-bonds” would send a clear message to financial markets and European citizens about the “the irreversibility of the euro”.Good luck getting Germany on board.

excerpt with permission

Bank Failures per Week in 2010

by Calculated Risk on 12/05/2010 02:29:00 PM

I haven't updated this graph for some time ...

There have been 314 bank failures in this cycle (starting in 2007):

| FDIC Bank Failures by Year | |

|---|---|

| 2007 | 3 |

| 2008 | 25 |

| 2009 | 140 |

| 2010 | 149 |

| Total | 314 |

The FDIC has slowed down recently, and there are probably only two weeks left for bank closures this year. The 149 bank failures this year is the highest total since 1992 (181 bank failures).

Unfortunately banks are still being added to the unofficial problem bank list much faster than they are being removed ... so there are probably many more banks failures to come.

Earlier:

• Summary for Week ending December 4th

• Schedule for Week of December 5th