by Calculated Risk on 12/07/2010 08:27:00 PM

Tuesday, December 07, 2010

Mortgage Rates rise sharply

From "Soylent Green is People":

[I]t's been a complete bloodbath in the market for us. ... Three rate sheets for the worse, an average 4.75% 1.0 point loan today, well up from the October lows of 3.750%. Crushing to say the least.From economist Tom Lawler:

Benchmark US interest rates are up sharply today in at times frantic trading in response to the tax package “deal” reached between the administration and Congressional Republican leaders. (While yesterday’s silly “60 Minutes” bond market rally lasted longer than an hour, it wasn’t by much!!!) The MBS market also got crushed today, and indicative 30-year conventional conforming fixed-rate quotes, which had moved lower following Friday’s employment report, jumped up sharply today, with most lenders showing something in the range of 4 ¾% and 1 point (for a 60-day lock).This will impact refinance activity immediately, but might accelerate some purchase activity because of a fear of further rate hikes.

Tax Negotiations: No help for 99ers

by Calculated Risk on 12/07/2010 04:03:00 PM

Just to be clear, the "extension of the unemployment benefits" is an extension of the qualifying dates for the various tiers of benefits, and not additional weeks of benefits. There is no additional help for the so-called "99ers".

Emergency Unemployment Compensation (EUC) comes in four tiers:

Tier I is for 20 additional weeks;

Tier II is for up to 14 weeks;

Tier III is for up to 13 weeks;

Tier IV is for up to 6 weeks.

As an example, if a worker was receiving Tier I benefits, they will be able to move to Tier II benefits with this proposed extension. Without the extension of the qualifying dates, workers would not be able to move to the next tier.

These two tables are from the Center for Budget and Policy Priorities. The total number of weeks depends on the state unemployment rate.

In 25 states, workers can qualify for 99 weeks of unemployment:

To repeat: this extension doesn't add additional weeks of benefits; it keeps the above structure in place for an additional 13 months.

Europe Update: More Stress Tests, Iceland out of recession

by Calculated Risk on 12/07/2010 01:06:00 PM

From the Financial Times: EU banks face new stress-tests

A new round of co-ordinated stress-tests on European banks would begin in February ... The “scope and methodology” of the new round of tests was still under discussion, [Olli Rehn, EU commissioner for economic and monetary affairs ]said, but should be disclosed fairly shortly.The last round of stress tests were heavily criticized - and all of the Irish banks passed the tests only to fail a few months later.

And from the NY Times: Iceland Breaks Out of Recession

Iceland broke out of recession in the third quarter of this year, official data showed Tuesday ... Unlike Ireland and Greece ... Iceland allowed private banks to fail, and its currency, the krona, has declined by about 46 percent against the dollar since the start of 2008.That isn't currently an option for Ireland, Greece, Portugal or Spain ...

BLS: Job Openings increase sharply in October, Labor Turnover still Low

by Calculated Risk on 12/07/2010 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in October was 3.4 million, which was up

from 3.0 million in September. Since the most recent series trough in

July 2009, the number of job openings has risen by 1.0 million or 44

percent.

The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image in graphics gallery.

Click on graph for larger image in graphics gallery.Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Note: The temporary decennial Census hiring and layoffs distorted this series over the summer months.

In October, about 4.047 million people lost (or left) their jobs, and 4.196 million were hired (this is the labor turnover in the economy) adding 149 thousand total jobs.

The good news is job openings is increasing, however overall labor turnover is still low.

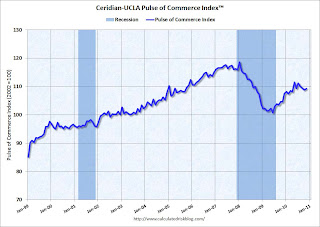

Ceridian-UCLA: Diesel Fuel index increases slightly in November

by Calculated Risk on 12/07/2010 09:00:00 AM

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the index since January 1999.

This is a new index, and doesn't have much of a track record in real time, although the data suggests the recovery has "stalled" since May.

Press Release: Inventory Movement Up Slightly in November in Still Fragile Market, Reports Latest Ceridian-UCLA Pulse of Commerce Index™

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers, and consumers, grew 0.4 percent in November following three consecutive months of decline. The growth, while positive, is not enough to offset the 0.6 percent decline that the PCI saw the previous month, nor the 2.1 percent decline experienced in the PCI since July. Though on a year-over-year basis the PCI is up, the three month moving average has been declining for four months, suggesting relative weakness within the goods producing segments of the economy.Note:

“While the PCI’s most recent data shows growth, it is not substantial enough to offset the loss from the third quarter,” explained Ed Leamer, chief PCI economist and director of the UCLA Anderson Forecast. “In short, November’s “up” is relative to a low-bar so the growth is only mildly encouraging. The flatness we’re seeing with the latest PCI data reflects inventories in motion which seem to be signaling a weak fourth quarter.”

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

I'm not confident in using this index to forecast GDP growth, although it does appear to track Industrial Production over time (with plenty of noise).

Monday, December 06, 2010

Report: General Agreement on Taxes for next two years

by Calculated Risk on 12/06/2010 08:29:00 PM

The NY Times has the details: Pact on Bush Tax Cuts Trims Payroll Levy

A few points:

• Extend Bush income tax cuts for two years, including for high income earners.

• 13-month extension of jobless aid for the long-term unemployed. This isn't additional weeks of benefits for the '99ers - this is an extension of the qualification dates for existing tiers of extended unemployment benefits.

• Reducing the Social Security payroll tax by two percentage points for a year:

For a family earning $50,000, the two percentage point cut would mean a savings of $1,000.• Estate tax exemption of $5 million per person and a maximum rate of 35 percent.

For workers paying the maximum, the two percentage point cut would mean a savings of $2,136.

This is expected to increase the budget deficit by $900 billion over two years.