by Calculated Risk on 12/09/2010 04:20:00 PM

Thursday, December 09, 2010

Hotels: RevPAR up 5.3% compared to same week in 2009

A weekly update on hotels from HotelNewsNow.com: STR: Orlando leads weekly performance

Overall, the U.S. hotel industry’s occupancy increased 4.7% to 49.9%, ADR was up 0.5% to US$96.87, and RevPAR ended the week up 5.3% to US$48.31.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 7.8% compared to last year and 4.6% below the median for 2000 through 2007.

Note: Last week RevPAR (revenue per available room) was up compared to the same week two years ago (in 2008) for the first time this year. This week RevPAR is down 5.9% compared to 2008.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Q3 Flow of Funds: Household Real Estate assets declined $650 Billion in Q3 2010

by Calculated Risk on 12/09/2010 01:14:00 PM

The Federal Reserve released the Q3 2010 Flow of Funds report this morning: Flow of Funds.

According to the Fed, household net worth is now off $11 Trillion from the peak in 2007, but up $5.8 trillion from the trough in Q1 2009.

The Fed estimated that the value of household real estate fell $684 billion to $16.55 trillion in Q3 2010, from $17.2 trillion in Q2 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

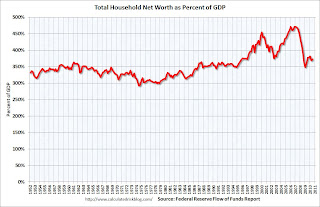

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952.

Household percent equity (as measured by the Fed) collapsed when house prices collapsed in 2007 and 2008.

In Q3 2010, household percent equity (of household real estate) declined to 38.8% as the value of real estate assets fell by almost $650 billion.

Note: something less than one-third of households have no mortgage debt. So the approximately 50+ million households with mortgages have far less than 38.8% equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

Mortgage debt declined by $65 billion in Q3. Mortgage debt has now declined by $488 billion from the peak. Studies suggest most of the decline in debt has been because of defaults.

Assets prices, as a percent of GDP, have fallen significantly and are not far above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

Freddie Mac: Mortgage Rates rise to Five-Month High

by Calculated Risk on 12/09/2010 11:29:00 AM

From Bloomberg: Mortgage Rates for U.S. Loans Jump to Five-Month High

U.S. mortgage rates surged to a five- month high ... The average rate for a 30-year fixed loan increased to 4.61 percent in the week ended today from 4.46 percent, Freddie Mac said in a statement.These rates are still low, but this increase will significantly impact refinance activity.

The average rate for a 30-year loan climbed for a fourth straight week after falling to 4.17 percent last month, the lowest in records dating to 1971.

Weekly Initial Unemployment Claims decline to 421,000

by Calculated Risk on 12/09/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Dec. 4, the advance figure for seasonally adjusted initial claims was 421,000, a decrease of 17,000 from the previous week's revised figure of 438,000. The 4-week moving average was 427,500, a decrease of 4,000 from the previous week's revised average of 431,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 4,000 to 427,500.

This is the lowest level for the 4-week moving average since August 2008. The level is still high, but the decline in the 4-week average is good news.

Wednesday, December 08, 2010

CB Richard Ellis: Office Vacancy rate to peak in Q2 2011

by Calculated Risk on 12/08/2010 08:54:00 PM

According to Reis, the office vacancy rate hit a 17 year high in Q3, but the rate of increase has slowed.

Today CB Richard Ellis released a forecast for the office market: U.S. Office Real Estate Vacancy Rate expected to decline modestly in 2011

CBRE-EA forecasts that the office vacancy rate will peak in 2Q2011 at 16.8%, up from the 16.6% level at 3Q2010. ... The U.S. office market vacancy rate is expected to slowly decline over the next two years, falling to 16.4% by the end of 2011 and to 15.3% by the end of 2012 ...This forecast sounds about right. It appears leasing has started to increase a little, and investment in office structures is at a record low as percent of GDP - so the office vacancy rate will probably peak soon.

“The recent increase in leasing is a step in the right direction but activity is uneven across markets and generally tenant footprints are not increasing,” said Arthur Jones, Senior Economist, CBRE-EA. “Since office space is the "economy in a box", continued job growth is key to the market‟s ongoing recovery.”

... the recovery will take longer to gain traction in depressed housing markets such as California and Arizona ...

“While vacancy is starting to improve, the high levels indicate that the rent recovery will be measured in terms of years,” said Mr. Jones. “The process will take time and the outlook over the next year will remain subdued with little upward movement in rent.”

However, with the vacancy rate near 17%, it will be some time before there is an increase in new office investment (and the associated construction jobs).

Accounting for the Payroll Tax Cut

by Calculated Risk on 12/08/2010 04:50:00 PM

Update: apparently this is settled and the trust fund will receive credits from the general fund - so there will no impact to Social Security.

There is no text for the plan available yet, and I've been trying to understand the accounting for the payroll tax cut and maybe this has already been settled ...

There are two obvious alternatives: 1) Social Security will receive something close to $120 billion less than currently estimated in 2011, and this will negatively impact the long term Social Security projections, and 2) the full amount of the payroll tax will still be credited to Social Security (as if there was no cut), and the 2% cut will come directly from the General Fund in 2011 - so this tax cut will have zero impact on long run Social Security projections.

Some people will say it doesn't matter - debt is debt - fine, if it doesn't matter, do it the 2nd way (debit the General Fund). I think it will matter for future debates.