by Calculated Risk on 12/10/2010 03:52:00 PM

Friday, December 10, 2010

Under 35: Living with Parents vs. Homeownership rate

This interesting graph is from economist Tom Lawler comparing the percent of 24-34 year olds living at home vs. the under 35 year old homeownership rate ...

There is a clear inverse relationship, and this suggests some pent up demand for housing units when the employment picture improves (although the demand could be for rental units).

The Pain in Spain

by Calculated Risk on 12/10/2010 01:13:00 PM

Just an update ... the yield on Spain's 10-year bond is rising again.

This graph from Bloomberg shows the yield for Spain's 10-year bond over the last year. The yield was up to 5.4% today, just below the peak of 5.5% in late November.

This graph from Bloomberg shows the yield for Spain's 10-year bond over the last year. The yield was up to 5.4% today, just below the peak of 5.5% in late November.

The bond yields declined in July following the European bank stress tests, but most investors have lost confidence in those tests - and another round will be conducted early next year. But will the bond markets wait?

The yield on Portugal's 10-year bond is up to 6.27%.

Consumer Sentiment increases in December

by Calculated Risk on 12/10/2010 09:55:00 AM

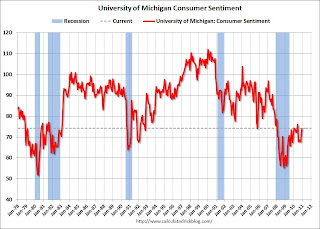

The preliminary Reuters / University of Michigan consumer sentiment index increased to 74.2 in December from 71.6 in November.

Click on graph for larger image in graphics gallery.

Click on graph for larger image in graphics gallery.

This was above the consensus forecast of 72.5.

This is the highest level since June 2010, but sentiment is still at levels usually associated with a recession - and sentiment is well below the pre-recession levels.

In general consumer sentiment is a coincident indicator.

Trade Deficit decreases in October

by Calculated Risk on 12/10/2010 08:30:00 AM

The Census Bureau reports:

[T]otal October exports of $158.7 billion and imports of $197.4 billion resulted in a goods and services deficit of $38.7 billion, down from $44.6 billion in September, revised. October exports were $4.9 billion more than

September exports of $153.8 billion. October imports were $0.9 billion less than September imports of $198.4 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through October 2010.

After trade bottomed in the first half of 2009, imports increased much faster than exports. October exports were $4.9 billion more than in September and are at the highest level since August 2008.

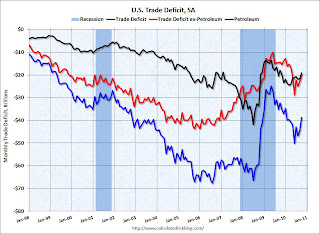

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit decreased slightly in September - even with higher prices - and the trade deficit with China decreased (NSA).

After stalling over the summer, it appears exports are growing again. I expect the dollar volume of oil imports to rise over the next couple of months since oil prices have increased sharply since October.

Thursday, December 09, 2010

Tax Bill to add $857 Billion to Debt

by Calculated Risk on 12/09/2010 11:10:00 PM

From Bloomberg: Senate Tax-Cut Extension Plan Would Add $857 Billion to Debt

The congressional Joint Committee on Taxation, which estimates the revenue effects of tax legislation, said the provisions would cost the government $801.3 billion in forgone revenue over 10 years. Extending unemployment benefits for 13 months, another feature of the package, would cost $56 billion, the Obama administration has said.It is important to remember the Joint Committee on Taxation assumed all the provisions will end as scheduled; the payroll tax cut after one year, and the other tax cuts after two years. That seems very unlikely, so the actual cost will be much much higher. As an example, if the tax cut for high income earners stays in place for the next decade that will add $700 billion alone to the debt!

Also, the vast majority of the impact is from extending the Bush tax cuts.

Building Costs after the Bust

by Calculated Risk on 12/09/2010 06:54:00 PM

Jeff Collins at the OC Register has some numbers: Builders benefit from cost savings

Builders say construction costs are down 15 to 25 percent.This is definitely low end construction at $50 to $70 per sq ft excluding land and entitlements.

That translates into an average cost of $100,000 to $140,000 for just the "sticks and bricks" (without land) for a modest, 2,000-square-foot house.

That same house cost $140,000 to $190,000 to build during the peak of the housing boom just four years ago.

Collins notes that most of the savings has come from labor costs:

"A typical laborer used to make between $150 and $180 a day," observed [Scott McKernan, president of Joseph Holt Plastering in Corona]. "Now (he or she is) making $60."

...

Price drops for materials like lumber and drywall have helped some, but not much, industry officials say. ... Ganahl Lumber's purchasing Vice President Pete Meichtry says that overall material costs are down – at best – 5 to 10 percent.