by Calculated Risk on 12/12/2010 08:54:00 AM

Sunday, December 12, 2010

Summary for Week ending December 11th

Note: here is the busy economic schedule for the coming week.

Below is a summary of the previous week, mostly in graphs. Also the proposed tax legislation and the rise in mortgage rates (impacting refinance activity) were important stories last week.

• Trade Deficit decreased in October

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.

The first graph shows the monthly U.S. exports and imports in dollars through October 2010.

After trade bottomed in the first half of 2009, imports increased much faster than exports. However imports have slowed over the last few months. October exports were $4.9 billion more than in September and are at the highest level since August 2008.

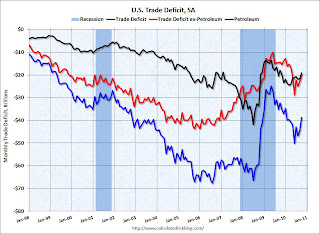

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The trade deficit decreased in October to $38.7 billion, down from $44.6 billion in September.

• BLS: Job Openings increased sharply in October, low Labor Turnover

The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In October, about 4.047 million people lost (or left) their jobs, and 4.196 million were hired (this is the labor turnover in the economy) adding 149 thousand total jobs.

The good news was job openings increased from 3.0 million in September to 3.4 million in October, however overall labor turnover was still low.

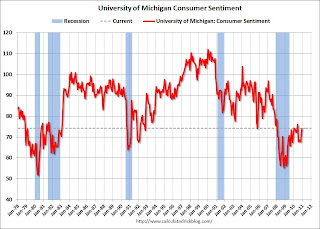

• Consumer Sentiment increased in December

The preliminary Reuters / University of Michigan consumer sentiment index increased to 74.2 in December from 71.6 in November. This was above the consensus forecast of 72.5.

The preliminary Reuters / University of Michigan consumer sentiment index increased to 74.2 in December from 71.6 in November. This was above the consensus forecast of 72.5.

This is the highest level since June 2010, but sentiment is still at levels usually associated with a recession - and sentiment is well below the pre-recession levels.

In general consumer sentiment is a coincident indicator.

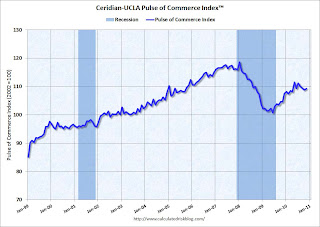

• Ceridian-UCLA: Diesel Fuel index increases slightly in November

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM. The data suggests the recovery has "stalled" since May.

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM. The data suggests the recovery has "stalled" since May.

"The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers, and consumers, grew 0.4 percent in November following three consecutive months of decline. The growth, while positive, is not enough to offset the 0.6 percent decline that the PCI saw the previous month, nor the 2.1 percent decline experienced in the PCI since July. Though on a year-over-year basis the PCI is up, the three month moving average has been declining for four months, suggesting relative weakness within the goods producing segments of the economy."

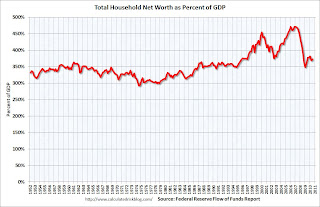

• Q3 Flow of Funds Report

The Federal Reserve released the Q3 2010 Flow of Funds report this week: Flow of Funds.

This is the Households and Nonprofit net worth as a percent of GDP.

This is the Households and Nonprofit net worth as a percent of GDP.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

Note that this ratio was relatively stable for almost 50 years, and then we saw the stock market and housing bubbles.

This graph shows household real estate assets and mortgage debt as a percent of GDP.

This graph shows household real estate assets and mortgage debt as a percent of GDP.

The Fed estimated that the value of household real estate fell $684 billion to $16.55 trillion in Q3 2010, from $17.2 trillion in Q2 2010. Mortgage debt declined by $65 billion in Q3. Mortgage debt has now declined by $488 billion from the peak.

Assets prices, as a percent of GDP, have fallen significantly and are not far above historical levels. However household mortgage debt, as a percent of GDP, is still historically very high, suggesting more deleveraging ahead for households.

• Other Economic Stories ...

• From the Association of American Railroads: AAR Reports November 2010 Rail Traffic Continues Mixed Progress

• From David Leonhardt at the NY Times: For Obama, Tax Deal Is a Back-Door Stimulus Plan

• From CoStar: Commercial Real Estate prices declined in October

• From Bloomberg: Mortgage Rates for U.S. Loans Jump to Five-Month High

• Unofficial Problem Bank list at 919 Institutions

Best wishes to all!

Saturday, December 11, 2010

Recovery and Recession at the same time

by Calculated Risk on 12/11/2010 10:13:00 PM

Note: here is the economic Schedule for Week of December 12th

Ylan Mui at the WaPo captures the economic bifurcation of America: Economic recovery leaving some behind this Christmas

At Tiffany's, executives report that sales of their most expensive merchandise have grown by double digits. At Wal-Mart, executives point to shoppers flooding the stores at midnight every two weeks to buy baby formula the minute their unemployment checks hit their accounts. Neiman Marcus brought back $1.5 million fantasy gifts in its annual Christmas Wish Book. Family Dollar is making more room on its shelves for staples like groceries, the one category its customers reliably shop.Some people are doing fine. Others are barely getting by and still trapped in a deep recession. A 9.8% unemployment rate is unacceptable ... something to remember this time of year. Best to all.

"When you start to line up all the pieces, you see a story that starts to emerge," said James Russo, vice president of global consumer insights for The Nielsen Co. "You kind of see this polarized Christmas."

Schedule for Week of December 12th

by Calculated Risk on 12/11/2010 05:07:00 PM

This will be a very busy week. The current plan is for the Senate to vote on the tax legislation on Monday at 3:00 pm. The House of Representatives is expected to vote later in the week, and then Congress plans to adjourn for the year on Friday.

Two key housing reports will be released this week: November housing starts (Thursday) and homebuilder confidence in December (Wednesday). Also November retail sales will be released on Tuesday, and the Fed will release the November industrial production and capacity utilization report on Wednesday. Also there is a Fed FOMC meeting on Tuesday, although no changes are expected.

9:00 AM ET: CoreLogic Q3 Negative Equity report. For Q2, CoreLogic reported that 11 million residential properties with mortgages were in negative equity (about 23 percent of properties with mortgages).

7:30 AM: NFIB Small Business Optimism Index for November. This index has been showing that small businesses remain pessimistic, and the survey also shows that the major concern is the lack of customers.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the small business optimism index through October. Although the index increased to 91.7 in October (highest since May), it is still at a recessionary level according to NFIB Chief Economist Bill Dunkelberg.

8:30 AM: Retail Sales for November. The consensus is for a 0.6% increase from October. (0.6% increases ex-auto).

8:30 AM: Producer Price Index for November. The consensus is for a 0.6% increase in producer prices.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.9% increase in inventories.

2:15 PM: FOMC Meeting Announcement. No changes are expected to either interest rates or QE2.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly since then.

8:30 AM: Consumer Price Index for November. The consensus is for a 0.2% increase in prices. The consensus for core CPI is an increase of 0.1%.

8:30 AM: NY Fed Empire Manufacturing Survey for December. The consensus is for a reading of 4.0, a turnaround from the surprise decline in November of -11.1. These regional surveys have shown a slight pickup following the slowdown in Q3 with the exception of this NY Fed survey.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for November.

This graph shows industrial production since 1967. Industrial production was unchanged in October, and production is still 7.3% below the pre-recession levels at the end of 2007.

This graph shows industrial production since 1967. Industrial production was unchanged in October, and production is still 7.3% below the pre-recession levels at the end of 2007.The consensus is for a 0.3% increase in Industrial Production in November, and an increase to 75.0% (from 74.8%) for Capacity Utilization.

10 AM: The December NAHB homebuilder survey. This index collapsed following the expiration of the home buyer tax credit. The consensus is for a reading of 16, the same is in November (still very depressed).

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims has been trending down over the last couple of months. The consensus is for a slight increase to 425,000 from 421,000 last week.

8:30 AM: Housing Starts for November. Housing starts also collapsed following the expiration of the home buyer tax credit.

This graph shows total and single unit starts since 1968.

This graph shows total and single unit starts since 1968. Total housing starts were at 519 thousand (SAAR) in October, down 11.7% from the revised September rate. Single-family starts decreased 1.1% to 436 thousand in October.

The consensus is for an increase to 550,000 (SAAR) in November from 519,000 in October.

10:00 AM: Philly Fed Survey for December. This survey showed expansion last month after showing contraction in the early fall. The consensus is for a reading of 14.1, down from 22.5 in November.

10:00 AM: Conference Board Leading Indicators for November. The consensus is for a 1.1% increase in the index.

After 4:00 PM: The FDIC might have a busy Friday afternoon ...

Several Stories: Apartment vacancy rates falling

by Calculated Risk on 12/11/2010 11:51:00 AM

The trend of falling vacancy rates continues ...

From Eric Wolff at the North County Times: Rental vacancy rates fall as people lose homes

Vacancy rates for North San Diego County apartments fell 1.2 percentage points to 4.3 percent in the fall, the fourth straight drop, according to the biannual survey conducted by the San Diego County Apartment Association.From Josh Brown at the Virginian-Pilot: Rents rise, vacancies drop for apartments in Hampton Roads

... and landlords took the opportunity to raise rents 0.8 percent ... The report attributed the drop in vacancy to the ongoing foreclosure crisis, as people evicted from homes need somewhere to live, and to a modest increase in employment.

Rough times in the housing market may be boosting demand for apartments in Hampton Roads, according to local experts and a new report.From the Aurora Sentinel: Denver metro vacancies for homes, condos to rent at lowest since 2001

... In the past year, the number of renters in the region has climbed by nearly 2,000, the largest uptick since 2005.

It’s slim pickings for those seeking a single-family home to rent.This fits with the Reis vacancy survey (showing apartment vacancy rates fell in Q3 to 7.2% from 7.8% in Q2), the NMHC apartment survey, and the Census Bureau's quarterly rental vacancy rate.

Vacancies in for-rent condos, single-family homes and other small properties across metro Denver fell to 2.9 percent during third quarter of this year - the lowest third-quarter rate since 2001.

Unofficial Problem Bank list at 919 Institutions

by Calculated Risk on 12/11/2010 08:30:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 10, 2010.

Changes and comments from surferdude808:

The Unofficial Problem Bank List declined by one to 919 this week after three additions and four removals. However, total assets increased by $1.1 billion to $411.4 billion.

The three additions include Intervest National Bank, New York, NY ($2.1 billion) and the two thrift subsidiaries of Great River Holding Company -- RiverWood Bank, Baxter, MN ($174 million) and RiverWood Bank, Bemidji, MN ($177 million).

The removals include the two failures this week -- Paramount Bank, Farmington, MI ($253 million) and Earthstar Bank, Southhampton, PA ($113 million). The other two removals are Millennium BCP Bank, National Association, Newark, NJ, which completed a voluntary liquidation on October 15, 2010; and Oceanside Bank, Jacksonville, FL, which was acquired by The Jacksonville Bank in an unassisted merger.

Next week, we anticipate the OCC will release its actions for November 2010.

Friday, December 10, 2010

An Economists' Hanukkah Song

by Calculated Risk on 12/10/2010 11:36:00 PM

Enjoy - a rearranged version of Adam Sandler's hit for the econ nerds out there. Jodi Beggs is an economist and Ph.D. candidate at Harvard University ... she has a website with a series of microeconomics lectures at Economists Do It With Models and she gave a talk at the AEA humor sesssion earlier this year.