by Calculated Risk on 12/20/2010 08:30:00 AM

Monday, December 20, 2010

Chicago Fed: Economic Activity Slowed in November

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Index shows economic activity slowed in November

Led by declines in employment-related indicators, the Chicago Fed National Activity Index decreased to –0.46 in November from –0.25 in October. Three of the four broad categories of indicators that make up the index deteriorated from October to November, with only the production and income category improving.

The index’s three-month moving average, CFNAI-MA3, ticked up to –0.41 in November from –0.42 in October. November’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. With regard to inflation, the amount of economic slack reflected in the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This index suggests the economy was sluggish in November.

Weekend:

• Ten Economic Questions for 2011

• The economic schedule for the coming week.

• Summary for Week ending December 18th

Sunday, December 19, 2010

Las Vegas: A tour of the Preposterous

by Calculated Risk on 12/19/2010 09:47:00 PM

Patrick Coolican at the Las Vegas Sun takes a drive around Las Vegas: Boom-bust era leaves architectural scars across valley

A couple of excerpts:

Now we’re on Gibson Road in Henderson, up the hill from Interstate 215, and there sits Vantage, a boxy, glassy modernist condo development; a historical artifact of the era of the credit boom, and, perhaps, delusional exuberance. It was a $160 million project, but no one lives there. It sits on the hill, surrounded by suburbia, like a hipster who’s stumbled into a church that he thought was a nightclub.This quote from the article captures the bubble insanity: "It seemed any project, no matter how preposterous, could make money." They were wrong.

...

We drive east on 215 to ManhattanWest on Russell Road, another half-finished mixed-use development. Dense, high-rise urbanism plopped down in the suburbs, its name a great irony. Some windows are covered with plywood, like an abandoned property in a city that suffered a natural disaster.

It’s like a Hollywood set. But of what? It imagines that it’s supposed to look this way because somewhere, there’s something that’s cool and authentic and looks like this, perhaps? But there is no such place.

Ten Economic Questions for 2011

by Calculated Risk on 12/19/2010 03:56:00 PM

Just some questions looking forward to next year:

1) House Prices: How much further will house prices fall on the national repeat sales indexes (Case-Shiller, CoreLogic)? Will house prices bottom in 2011?

2) Residential Investment: It appears residential investment (RI) bottomed in 2010, and will probably make a positive contribution to GDP growth in 2011 for the first time since 2005. RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. Historically RI has been the best leading indicator for the economy, but the growth in RI will probably be modest because of the large overhang of excess housing units. How much will RI grow in 2011?

3) Distressed house sales: Foreclosure activity is very high, although activity has slowed recently - probably because of "foreclosure gate" issues. The number of REOs (Real Estate Owned by lenders) is increasing again, although still below the levels of late 2008. How much will foreclosure activity pick up in 2011? Will the number of REOs peak in 2011 and start to decline?

4) Economic growth: After I took the "over" for 2011 back in November, a number of analysts have upgraded their forecasts. As an example, Goldman Sachs noted Friday:

The US economic outlook for 2011 has improved further with enactment of the fiscal compromise, as well as a stronger trend in recent data. As we forewarned, we are revising up our forecasts to incorporate this news and now expect real GDP to rise 3.4% in 2011 and 3.8% in 2012 (up from 2.7% and 3.6%) ...It does appear GDP growth will increase in 2011, although GDP growth will probably still be sluggish relative to the slack in the system. How much will the economy grow in 2011?

5) Employment: The U.S. economy added about 87 thousands payroll jobs per month in 2010 through November. This was extremely weak payroll growth for a recovery. How many payroll jobs will be added in 2011?

6) Unemployment Rate: The post-Depression record for consecutive months with the unemployment rate above 9% was 19 months in the early '80s. That record will be broken this month, and it is very possible that the unemployment rate will still be above 9% in December 2011. This high level of unemployment - and the number of long term unemployed - is an economic tragedy. The economy probably needs to add around 125 thousand payroll jobs per month just to keep the unemployment rate from rising (payroll jobs and unemployment rate come from two different surveys, so there is no perfect relationship, and the rate also depends on the participation rate). What will the unemployment rate be in December 2011?

7) State and Local Governments: How much of a drag will state and local budget problems have on economic growth and employment? Will there be any significant muni defaults?

8) Europe and the Euro: What will happen in Europe? When will the next blowup happen? How much of a drag will the problems in Europe have on U.S. growth?

9) Inflation: With all the slack in the system, will the U.S. inflation rate stay below target? Will there be any spillover from rising inflation rates in China and elsewhere?

10) Monetary Policy: Will the Fed expand QE2 (probably not)? Will the Fed reverse any of the Large Scale Asset Purchases? Probably not. Will the Fed raise the Fed Funds rate? Very unlikely.

OK, some of the questions were really multiple questions - and I ventured a guess on the last one.

Earlier:

• The economic schedule for the coming week.

• Summary for Week ending December 18th

Summary for Week ending December 18th

by Calculated Risk on 12/19/2010 09:20:00 AM

Note: here is the economic schedule for the coming week.

Below is a summary of the previous week, mostly in graphs. A key story was that the proposed tax legislation was passed by the Senate and House, and was signed into law on Friday.

• Housing Starts increased slightly in November

Click on graphs for larger image in graph gallery.

Click on graphs for larger image in graph gallery.

Total housing starts were at 555 thousand (SAAR) in November, up 3.9% from the revised October rate of 534 thousand, and up 16% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

This graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight up and down over the last six months due to the home buyer tax credit.

This was close to expectations of 550 thousand starts. The low level of starts is good news for housing, and I expect Starts to stay low until more of the excess inventory of existing homes is absorbed.

• Industrial Production, Capacity Utilization increased in November

This graph shows Capacity Utilization. "The capacity utilization rate for total industry rose to 75.2 percent, a rate 5.4 percentage points below its average from 1972 to 2009." This series is up 10.3% from the record low set in June 2009 (the series starts in 1967).

This graph shows Capacity Utilization. "The capacity utilization rate for total industry rose to 75.2 percent, a rate 5.4 percentage points below its average from 1972 to 2009." This series is up 10.3% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.2% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production increased in November, but production is still 6.8% below the pre-recession levels at the end of 2007.

This was slightly above consensus expectations of a 0.3% increase in Industrial Production, and an increase to 75.0% for Capacity Utilization.

• Retail Sales increased 0.8% in November

On a monthly basis, retail sales increased 0.8% from October to November(seasonally adjusted, after revisions), and sales were up 7.7% from November 2009. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

On a monthly basis, retail sales increased 0.8% from October to November(seasonally adjusted, after revisions), and sales were up 7.7% from November 2009. This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 12.8% from the bottom, and only off 0.3% from the pre-recession peak.

This was above expectations for a 0.6% increase (and October was revised up). Retail sales ex-autos were up 1.2%, above expectations of a 0.6% increase.

• CoreLogic: House Prices declined 1.9% in October

CoreLogic reported house prices declined 1.9% in October. The CoreLogic HPI is a three month weighted average of August, September and October, and is not seasonally adjusted (NSA).

CoreLogic reported house prices declined 1.9% in October. The CoreLogic HPI is a three month weighted average of August, September and October, and is not seasonally adjusted (NSA).

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 3.93% over the last year, and off 30.2% from the peak.

The index is 2.2% above the low set in March 2009, and I expect to see a new post-bubble low for this index - possibly as early as next month or maybe in early 2011.

• NFIB: Small Business optimism improved in November

This graph shows the small business optimism index since 1986. Although the index increased to 93.2 in October (highest since December 2007), it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg.

This graph shows the small business optimism index since 1986. Although the index increased to 93.2 in October (highest since December 2007), it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

• CoreLogic: 10.8 Million U.S. Properties with Negative Equity in Q3

Note that the slight decline in homeowners with negative equity was mostly due to foreclosures.

First American CoreLogic released the Q3 2010 negative equity report this week.

CoreLogic reports that 10.8 million, or 22.5 percent, of all residential properties with mortgages were in negative equity at the end of the third quarter of 2010, down from 11.0 million and 23 percent in the second quarter. This is due primarily to foreclosures of severely negative equity properties rather than an increase in home values.Here are a couple of graphs from the report:

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home.

This graph shows the distribution of negative equity (and near negative equity). The more negative equity, the more at risk the homeowner is to losing their home. About 10% of homeowners with mortgages have more than 25% negative equity - although the percent of homeowners with severe negative equity has been declining over the last few quarters mostly because of homes lost to foreclosure.

The second graph shows the break down of equity by state.

The second graph shows the break down of equity by state.In Nevada very few homeowners with mortgages have any equity, whereas in New York almost half have over 50%.

As CoreLogic's Mark Fleming noted, the number of homeowners with negative might increase over the next few quarters with declining home prices.

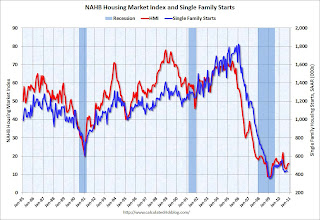

• NAHB Builder Confidence Flat in December

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was unchanged at 16 in December. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was unchanged at 16 in December. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the December release for the HMI and the October data for starts (graph before November housing starts were released).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

• Other Economic Stories ...

• From the NY Times: Moody’s Slashes Ireland’s Credit Rating

• Here come the '99ers

• Unofficial Problem Bank list increases to 920 Institutions

Best wishes to all!

Saturday, December 18, 2010

Apartments: Inflection Point

by Calculated Risk on 12/18/2010 08:35:00 PM

I try to pass on what I'm hearing. It was back in June that I noted

I spoke with a large apartment owner in Texas who told me they are seeing effective rents rising over the last few months.I'll be attending the NMHC meeting in January 2011 (Palm Springs), and I'll report on what I hear. I think we are past the inflection point for apartments (vacancy rate has peaked, rents and construction have bottomed).

I've also heard that the mood really changed at the NMHC meeting in May compared to the January meeting. There is a growing consensus among large apartment owners that rents have bottomed and the industry will rebound in 2011.

There was an interesting interview by Jeff Collins at the OC Register today with a Los Angeles area architect Thomas Cox: Apartments reviving architect’s business

Us: When did things start picking up? How busy are you now?It appears 2010 was the low point for multifamily construction, and activity will pick up in 2011. As Tom Cox noted, these new projects won't be delivered until 2012 or 2013.

Tom: For us at TCA, we really felt the housing industry slide in mid-2008 and it was significant. 2009 was the worst. ... Jan. 5, I received a call that we won [a] design competition. This was a major turning point for us.

Several months later, we landed another large multifamily project with a local developer for a 1,000-unit apartment project. ... Then, in April, we started getting calls from clients we had previously done work for on “dead” projects that they wanted to bring back to life, so to speak. They thought they could secure funding and many of these were permit-ready, so it made sense.

Other clients started coming out of the woodwork, wanting to get something going, so we’ve been very busy. We have doubled our staff in the past six months.

...

Us: To what do you attribute this turnaround? Does this mean that housing construction is rebounding?

Tom: Construction is rebounding in certain segments, especially multifamily. Single-family is lagging, but multifamily is definitely showing signs of recovery, especially as more financing for developers becomes available.

I think the turnaround boils down to a few factors: Number 1, there is a huge demand for multifamily projects because of the lack of inventory. The Gen Y demographic is just now starting to infiltrate the workplace and as they pick up jobs, they are looking for apartments to rent. Additionally, as the economy starts to recover and people start getting back on their feet, they will be looking to “uncouple” or move out of their temporary living arrangement and back into their own place.

Number 2, construction costs are at an all time low, so now is a good time to build. Number 3, the money that is available is reasonably priced because interest rates are at an all-time low. And number 4, the loans are better structured and becoming more and more available. Also, a lot of development companies are finding new sources of funding in addition to banks, such as private money, pension money, and insurance money.

...

Our clients know that they need to start now if they’re going to deliver projects in 2012 and 2013.

I expect residential investment to make a positive contribution to GDP growth in 2011 for the first time since 2005.

Earlier:

• Schedule for Week of December 19th: Happy Holidays

Spanish Ghost Towns

by Calculated Risk on 12/18/2010 05:06:00 PM

From Suzanne Daley and Raphael Minder at the NY Times: Newly Built Ghost Towns Haunt Banks in Spain

A better known real estate debacle is a sprawling development in Seseña, south of Madrid, one of Spain’s “ghost towns.” It sits in a desert surrounded by empty lots. Twelve whole blocks of brick apartment buildings, about 2,000 apartments, are empty; the rest, only partly occupied. Most of the ground floor commercial space is bricked up.This article really captures the craziness of the housing bubble in Spain. Building homes primarily to sell to people who work in construction isn't sustainable - as some areas of the United States discovered too. What were they thinking?

The boom and bust of Spain’s property sector is astonishing. Over a decade, land prices rose about 500 percent and developers built hundreds of thousands of units — about 800,000 in 2007 alone. Developments sprang up on the outskirts of cities ready to welcome many of the four million immigrants who had settled in Spain, many employed in construction.