by Calculated Risk on 12/21/2010 08:50:00 AM

Tuesday, December 21, 2010

Moody's Warns it may downgrade Portugal's Credit Rating

From the Reuters: A Warning to Portugal as Spain Sells Bonds

Moody’s ... put Portugal on review for a possible downgrade, almost a week after doing the same to Spain, and having cut Ireland by five notches last week.Europe was one of the Ten Economic Questions for 2011 I posted over the weekend. I hope to post some thoughts on each of those questions before the New Year, but it sure seems another blowup is likely in Europe.

Monday, December 20, 2010

Streitfeld: Homes at Risk, and No Help From Lawyers

by Calculated Risk on 12/20/2010 11:44:00 PM

From David Streitfeld at the NY Times: Homes at Risk, and No Help From Lawyers

Lawyers throughout California say they have no choice but to reject clients ... because of a new state law that sharply restricts how they can be paid. Under the measure ... lawyers who work on loan modifications cannot receive any money until the work is complete. ...The problem was widespread modification fraud:

The law, which has few parallels in other states, was devised to eliminate swindles in which modification firms made promises about what their lawyers could do, charged hefty fees and then disappeared. But foreclosure specialists say there has been an unintended consequence: the honest lawyers can no longer afford to assist [borrowers] ...

Two years ago, the state bar association had seven complaints of misconduct in loan modifications. By March 2009, there were more than 100 complaints, and a task force was formed to deal with the problem. Soon, there were thousands of complaints. ... The president of the bar association wrote in a column last year that “hundreds, and perhaps thousands, of California lawyers” were victimizing people “at the most vulnerable point in their lives.”Several lawyers emailed me about this possibility before the law passed, but no one seemed to have a good solution for the widespread fraud. Very sad.

ATA Truck Tonnage Index decreases slightly in November

by Calculated Risk on 12/20/2010 08:04:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Fell 0.1 Percent in November

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index edged 0.1 percent lower in November after increasing a revised 0.9 percent in October. In September and October, tonnage increased a total of 2.8 percent. The latest reduction put the SA index at 109.7 (2000=100) in November from 109.9 in October

...

ATA Chief Economist Bob Costello said that he is not overly concerned with the small decrease in tonnage during November. “Tonnage increased for two consecutive months in September and October and I don’t expect volumes to rise every month. Additionally, the decrease in November is much smaller than the gains during the previous two months.” Costello said he expects truck freight tonnage to grow modestly during the first half of 2011 before accelerating in the later half of the year into 2012.

Click on map for larger image.

Click on map for larger image.This graph from the ATA shows the Truck Tonnage Index since Jan 2006.

The line is added to show the index has been mostly moving sideways this year.

Moody's: Commercial Real Estate Prices increase in October

by Calculated Risk on 12/20/2010 03:29:00 PM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index increased 1.3% in October. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices and make the index very volatile.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are about 42% below the peak in 2007.

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.

Here is an article from Bloomberg: http://www.bloomberg.com/news/2010-12-20/u-s-commercial-property-rises-for-second-consecutive-month-moody-s-says.html

Analysis: Decline in home prices impacting small business borrowing

by Calculated Risk on 12/20/2010 02:16:00 PM

From Mark Schweitzer and Scott Shane at the Cleveland Fed: The Effect of Falling Home Prices on Small Business Borrowing

The researchers analyze small business borrowing, and note that homes equity borrowing is an "important source of capital for small business owners and that the impact of the recent decline in housing prices is significant enough to be a real constraint on small business finances."

Here is their conclusion:

Everyone agrees that small business borrowing declined during in the recession and has not yet returned to pre-recession levels. Lesser consensus exists around the cause of the decline. Decreased demand for credit, declining creditworthiness of small business borrowers, an unwillingness of banks to lend money to small businesses, and tightened regulatory standards on bank loans have all been offered as explanations.There is no easy replacement for this source of borrowing.

While we would agree that these factors have had an effect on the decline in small business borrowing through commercial lending, we believe that other limits on the credit of small business borrowers are also at play and could be harder to offset. Specifically, the decline in home values has constrained the ability of small business owners to obtain the credit they need to finance their businesses.

Of course, not all small businesses have been equally affected by the decline in home prices. While many small business owners use residential real estate to finance businesses, not all do. Those more likely do so to include companies in the real estate and construction industries, those located in the states with the largest increases in home prices during the boom, younger and smaller businesses, companies with lesser financial prospects, and those not planning to borrow from banks. These patterns are also evident in the data sources we examined.

The link between home prices and small business credit poses important challenges for policy makers seeking to improve small business owners’ access to credit. The solution is far more complicated than telling bankers to lend more or reducing the regulatory constraints that may have caused them to cut back on their lending to small companies. Returning small business owners to pre-recession levels of credit access will require an increase in home prices or a weaning of small business owners from the use of home equity as a source of financing. Neither of those alternatives falls into the category of easy and quick solutions.

DOT: Vehicle miles driven increased in October

by Calculated Risk on 12/20/2010 11:28:00 AM

The Department of Transportation (DOT) reported that vehicle miles driven in October were up 1.9% compared to October 2009:

Travel on all roads and streets changed by +1.9% (4.9 billion vehicle miles) for October 2010 as compared with October 2009. Travel for the month is estimated to be 259.5 billion vehicle miles.

Cumulative Travel for 2010 changed by +0.6% (16.0 billion vehicle miles).

Click on graph for larger image in new window.

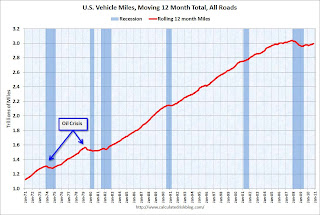

Click on graph for larger image in new window.This graph shows the rolling 12 month total vehicle miles driven.

On a rolling 12 month basis, vehicle miles driven have only increased 1.2% from the bottom of the recession.

Miles driven are still 1.4% below the peak in 2007. This is another indicator of a sluggish recovery.

Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 35 months - another record that will be broken soon.