by Calculated Risk on 12/22/2010 07:54:00 AM

Wednesday, December 22, 2010

MBA: Mortgage Refinance activity declines sharply

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 24.6 percent from the previous week. The Refinance Index has declined six straight weeks and is at its lowest level since the week ending April 30, 2010. The seasonally adjusted Purchase Index decreased 2.5 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.85 percent from 4.84 percent, with points decreasing to 0.96 from 1.33 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index is at about the levels of 1997 - and about 17% below the levels of April this year - suggesting weak existing home sales through January 2011.

Tuesday, December 21, 2010

Misc: Ernst & Young accused of fraud, Banks accused of illegal break-ins

by Calculated Risk on 12/21/2010 10:14:00 PM

Two stories: Lehman's accounting was fishy. The other is a real fish story ...

• From the NY Times DealBook: Cuomo Sues Ernst & Young Over Lehman

The New York attorney general on Tuesday sued Ernst & Young, accusing the accounting firm of helping Lehman Brothers, its client, “engage in a massive accounting fraud” by misleading investors about the investment bank’s financial health.• From Andrew Martin at the NY Times: In a Sign of Foreclosure Flaws, Suits Claim Break-Ins by Banks

In Texas, for example, Bank of America had the locks changed and the electricity shut off last year at Alan Schroit’s second home in Galveston, according to court papers. Mr. Schroit, who had paid off the house, had stored 75 pounds of salmon and halibut in his refrigerator and freezer, caught during a recent Alaskan fishing vacation.Not sure how you get that smell out.

“Lacking power, the freezer’s contents melted, spoiled and reeking melt water spread through the property and leaked through the flooring into joists and lower areas,” the lawsuit says. The case was settled for an undisclosed amount.

AIA: Architecture Billings Index shows expansion in November

by Calculated Risk on 12/21/2010 05:30:00 PM

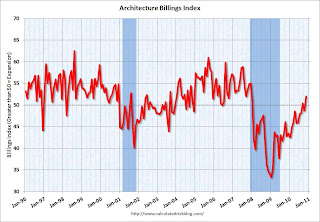

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From the American Institute of Architects: Firm Billings Rebound in November

At 52.0, the AIA’s Architecture Billings Index (ABI) recorded a three point gain from the previous month, and reached its strongest level since December 2007. With ABI scores above the 50 level in two of the past three months, the prospects of a sustainable recovery in design activity are enhanced.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index showed expansion in November (above 50) and this is the highest level since December 2007.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end next summer. This fits with other recent stories about a pickup in design activity.

Market Update

by Calculated Risk on 12/21/2010 04:05:00 PM

This has been a light week for economic news so far, but the next two days will be busy, with November existing home sales to be released on Wednesday (take the under), and November New Home sales on Thursday. Also the third estimate for Q3 GDP will be released tomorrow, and the Personal income and outlays report for November on Thursday. Here is the weekly schedule.

Another up day on Wall Street. Here is a market graph from Doug Short of dshort.com (financial planner).

Question #10 for 2011: Monetary Policy

by Calculated Risk on 12/21/2010 12:57:00 PM

Over the weekend I posted some questions for next year: Ten Economic Questions for 2011. I'll try to add some predictions, or at least some thoughts for each question - working backwards - before the end of year.

Remember, I have no crystal ball and I'm sure many people will disagree. Also many of the questions are interrelated. The question on monetary policy depends on inflation (question #9) and the unemployment rate (question #6). And the unemployment rate is related to GDP growth (question #4), and on and on ...

10) Monetary Policy: Will the Fed expand QE2? Will the Fed reverse any of the Large Scale Asset Purchases? Will the Fed raise the Fed Funds rate?

The choices for monetary policy used to be easy. Will the Fed raise, lower, or keep rates the same? The Fed still has those choices - although they can't lower the Fed Funds rate materially - and several new options: Will they expand "QE2" beyond $600 billion (Large Scale Asset Purchases, LSAP)? Will they stop short of the $600 billion in purchases? Will they continue to reinvest principal payments? Will the Fed sell assets in 2011?

The key is the Fed's dual mandate on employment and inflation. From Chairman Ben Bernanke in November:

The Federal Reserve's objectives - its dual mandate, set by Congress - are to promote a high level of employment and low, stable inflation. Unfortunately, the job market remains quite weak; the national unemployment rate is nearly 10 percent, a large number of people can find only part-time work, and a substantial fraction of the unemployed have been out of work six months or longer. The heavy costs of unemployment include intense strains on family finances, more foreclosures and the loss of job skills.Unless the unemployment rate falls substantially in 2011 - say below 8% - or inflation rises rapidly (well above 2%), I doubt the Fed will tighten policy in 2011 (except halting principal reinvestment).

Today, most measures of underlying inflation are running somewhat below 2 percent, or a bit lower than the rate most Fed policymakers see as being most consistent with healthy economic growth in the long run.

...

[W]ith unemployment high and inflation very low, further support to the economy is needed. ... The Fed is committed to both parts of its dual mandate ...

Since I don't think the unemployment rate will fall drastically (I'd like to be wrong!) or inflation rise sharply in 2011, I think selling assets or raising the Fed funds rate in 2011 is very unlikely.

The more likely debates will be:

• Will the Fed end LSAP (QE2) early? Currently the program is scheduled to purchase $600 billion in assets through June. It is very unlikely with the Fed's current outlook (and mine) for inflation and unemployment that this program will end early.

• Will the Fed expand the LSAP beyond June (and beyond $600 billion)? This is a harder call. Based on Bernanke's comments above - and the current projections - it would seem the Fed could do more. However it is very data dependent, and the Fed might hesitate in July and wait for more data.

• What is the likely order when the Fed does start to exit? I think the Fed will halt QE2 first (perhaps after June), and then stop the reinvestment of principal. But will they eventually sell assets or raise rates first? Based on some comments from NY Fed's Brian Sack, I think they will raise the Fed funds rate before selling assets although it could go either way.

The exit strategy that is ultimately implemented will have to take into account the size and structure of the balance sheet at that time. However, in all potential circumstances the Federal Reserve should be able to tighten financial conditions to a sufficient degree when appropriate. The ability to pay interest on reserves, in combination with the ability to drain reserves as needed, will give us sufficient control of short-term interest rates. On that front, it is worth noting that both of the Fed’s reserve draining tools—the reverse repurchase program and the term deposit facility—are already operational, and their capacity to drain reserves will continue to expand. In addition, the Federal Reserve could always sell assets to reduce the size of its balance sheet if it desired.To summarize my views:

• I don't think the Fed will raise rates in 2011.

• Although data dependent, it is likely the Fed will halt QE2 in June and take a wait and see attitude.

• The only "exit" this year will be stopping the reinvestment of principal payments.

Also I've heard some people suggest the dual mandate might be changed to only tracking inflation. That is an easy prediction: Not. Gonna. Happen.

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Census 2010 Data

by Calculated Risk on 12/21/2010 10:30:00 AM

UPDATE: U.S. Census Bureau Announces 2010 Census Population Counts

The U.S. Census Bureau announced today that the 2010 Census showed the resident population of the United States on April 1, 2010, was 308,745,538.Original post: At 11 AM ET, the Census Bureau will release the "resident population for the nation and the states as well as the congressional apportionment totals for each state".

The resident population represented an increase of 9.7 percent over the 2000 U.S. resident population of 281,421,906.

...

The most populous state was California (37,253,956); the least populous, Wyoming (563,626). The state that gained the most numerically since the 2000 Census was Texas (up 4,293,741 to 25,145,561) and the state that gained the most as a percentage of its 2000 Census count was Nevada (up 35.1% to 2,700,551).

Regionally, the South and the West picked up the bulk of the population increase, 14,318,924 and 8,747,621, respectively. But the Northeast and the Midwest also grew: 1,722,862 and 2,534,225.

Here is a cool graphic from the Census Bureau (that will be updated with the 2010 data). Note: Census page is here for larger version.

I'm looking forward to the data on housing units (not released today).