by Calculated Risk on 12/25/2010 02:45:00 PM

Saturday, December 25, 2010

Schedule for Week of December 26th

This will be a light week for economic news. The Case-Shiller house price index will be released on Tuesday, and several regional manufacturing surveys will be released during the week.

10:30 AM: Dallas Fed Manufacturing Survey for December. The Texas survey showed expansion last month (at 13.1), and is expected to show expansion again in December.

The regional Fed surveys provide a hint about the ISM manufacturing index, as the following graph shows. Both the Philly Fed, and Empire State indexes showed improvement in December.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through December), and averaged five Fed surveys (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

The ISM manufacturing index will released on Monday, Jan 3, 2011.

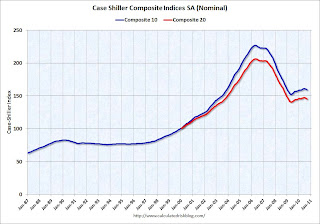

9:00 AM: S&P/Case-Shiller Home Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October. The consensus is for prices to decline about 0.4% in October; the fourth straight month of house price declines.

This graph shows the seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000) through September.

This graph shows the seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000) through September.Prices are falling again, although still above the lows set in early 2009.

Prices in October might show a year-over-year decline for the composite indexes for the first time since 2009.

10:00 AM: Conference Board's consumer confidence index for December. The consensus is for an increase to 57.4 from 54.1 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December. The consensus is for a reading of 11 (expansion), a slight increase from 9 last month.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly since then.

8:30 AM: The initial weekly unemployment claims report will be released. The number of initial claims has been trending down over the last couple of months. The consensus is for the same as last week at 420,000.

9:45 AM: Chicago Purchasing Managers Index for December. The consensus is for the same as in November at 62.5.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 1% increase in contracts signed. It usually takes 45 to 60 days to close, so this will provide an early indication of closings in January.

11:00 AM: Kansas City Fed regional Manufacturing Survey for December. The index was at 14 in November.

Markets will be open on New Year's Eve.

12:00 AM: Happy New Year!

Happy Holidays!

by Calculated Risk on 12/25/2010 08:50:00 AM

Happy Holidays and Merry Christmas to all!

• First some news: From the WSJ: China Raises Rates Amid Inflation Fight

The People's Bank of China said Saturday that effective Sunday, it will raise the one-year yuan lending rate by a quarter of a percentage point to 5.81% from 5.56% ...• For your enjoyment, here are the galleries of most of the graphs I post. The Galleries are grouped by Employment, New Home Sales, Existing Home Sales, Housing (like starts), Manufacturing, GDP, and much more. There are tabs for each gallery at the top.

Clicking on a tab will load a gallery. Then thumbnails will appear below the main graph for all of the graphs in the selected gallery. Clicking on the thumbnails will display each graph. Enjoy!

• And a little gift ... a common question, using excel, is how do you get from this:

Thanks to all. Happy Holidays!

Friday, December 24, 2010

Question #8 for 2011: Europe and the Euro

by Calculated Risk on 12/24/2010 06:15:00 PM

Last weekend I posted some questions for next year: Ten Economic Questions for 2011. I'll try to add some predictions, or at least some thoughts for each question - working backwards - before the end of year.

8) Europe and the Euro: What will happen in Europe? When will the next blowup happen? How much of a drag will the problems in Europe have on U.S. growth?

The situation in Europe is fluid. Just look at the bond yields - Greece, Ireland, Portugal, Spain - all near record highs. It seems the question is when, not if, another "blowup" will happen. By blowup, I mean another set of emergency weekend meetings, and another Sunday "bailout" announced.

The European Financial Stability Facility (EFSF) is large enough to handle Portugal, but that is about it. So I guess that means Portugal is next.

Michael Pettis offered some thoughts on 2011, and he focused on Europe: In 2011, the euro zone will hang together or hang separately

DURING 2011 Europe should confront and decide the issue of fiscal union. If it chooses union, the euro will survive. If not, the euro will almost certainly break up. 2011 is important because in most European countries the leaders of all the major political parties tend to be emotionally and ideologically committed to the euro project.So Pettis thinks 2011 is the make or break year for the euro. Either way some countries will probably eventually default (haircuts for the bond holders).

However over the next two to three years as the debate over how to apportion the costs of the necessary adjustments intensifies—should workers pay in the form of wage deflation and rising unemployment? should countries abandon the euro and default, and so force the adjustment costs onto creditors? should taxes be raised or expenditures slashed, and which ones?—the political consensus will break apart and domestic politics will become increasingly unstable. In that case there will be almost no way to avert defaults and currency break up.

Note: Some Investor Guy wrote a great Sovereign Debt Series earlier this year covering a history of defaults and reviewing some possible scenarios.

Although my crystal ball is real cloudy on Europe, I think:

• The euro will somehow survive another year without losing any countries.

• The next blowup will be in the first couple of months. There is another round of stress tests scheduled for February, although there is still no agreement on criteria.

• There are two main channels that could impact the U.S. economy: trade, and financial spillover / credit tightening. The impact on trade will probably be minimal, even if the euro falls sharply against the dollar (a small percentage of U.S. GDP is from exports to Europe (edit)). The financial channel is much more of an unknown, and there is significant downside risk.

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Hotels: RevPAR up 14% compared to same week in 2009

by Calculated Risk on 12/24/2010 02:51:00 PM

A weekly update on hotels from HotelNewsNow.com: STR: US performance for week ending 18 Dec.

In year-over-year measurements, the industry’s occupancy rose 9.4 percent to 46.5 percent, average daily rate increased 4.1 percent to US$91.66, and revenue per available room went up 14.0 percent to US$42.61.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 7.3% compared to last year and 3.3% below the median for 2000 through 2007. RevPAR (revenue per available room) was up 7.7% compared to the same week two years ago (in 2008).

This is the slow season for hotels, and the key will be if business travel picks up early next year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Update on Personal Saving Rate

by Calculated Risk on 12/24/2010 11:38:00 AM

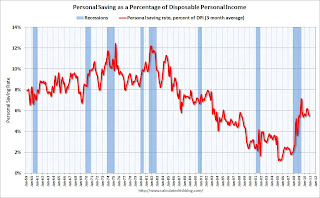

According to the BEA, the personal saving rate declined in November to 5.3%:

Personal saving -- DPI less personal outlays -- was $614.8 billion in November, compared with $622.8 billion in October. Personal saving as a percentage of disposable personal income was 5.3 percent in November, compared with 5.4 percent in October.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the November Personal Income report.

When the recession began, I expected the saving rate to rise to 8% or more. With a rising saving rate, consumption growth would be below income growth. But that 8% rate was just a guess.

It is possible the saving rate has peaked, or it might rise a little further, but either way most of the adjustment has already happened and consumption will probably mostly keep pace with income growth next year.

Home Sales: Distressing Gap

by Calculated Risk on 12/24/2010 08:45:00 AM

Thanks to everyone for reading and providing me feedback!

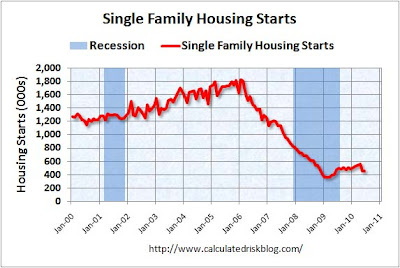

Here is an update to a graph I've been posting for several years. This graph shows existing home sales (left axis) and new home sales (right axis) through November. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Initially the gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The two spikes in existing home sales were due primarily to the homebuyer tax credits (the initial credit in 2009, followed by the 2nd credit in 2010). There were also two smaller bumps for new home sales related to the tax credits.

Note: it is important to note that existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

In a few years - when the excess housing inventory is absorbed and the number of distressed sales has declined significantly - I expect existing home-to-new home sales to return to this historical relationship.

I've guessed before at the eventual levels: The median turnover for existing homes is just over 6% of all owner occupied homes per year, and with about 75 million owner occupied homes that would suggest close to 5 million sales per year (no one should expect existing home sales to be over 7 million units per year any time soon!). And that would suggest new home sales at just over 800 thousand per year when the market eventually recovers (not 1.2 or 1.3 million per year).

Best to all!