by Calculated Risk on 12/27/2010 10:35:00 AM

Monday, December 27, 2010

Dallas Fed: Manufacturing Activity Continues to Grow

From the Dallas Fed: Texas Manufacturing Activity Continues to Grow

The production index, a key measure of state manufacturing conditions, was positive for the fourth consecutive month.This is not strong growth, but activity is increasing - and the labor indicators are good news.

Other indicators of current activity also remained positive, signaling continued growth in manufacturing. The shipments index held steady at a reading of 8, and the capacity utilization index rose from 10 to 15, with 29 percent of manufacturers reporting an increase. The new orders index declined in December but stayed in positive territory, with more than three-fourths of firms noting increased or unchanged order volumes.

Measures of general business conditions remained positive in December. The general business activity index came in at 13, with nearly a quarter of respondents noting improved activity. The company outlook index edged down to 15, although the share of manufacturers who said their outlook improved rose to its highest level since May.

Labor market indicators improved notably this month. The employment index rose from 6 in November to 15 in December, reaching its highest level since early 2007. Twenty-four percent of firms reported hiring new workers, compared with 9 percent reporting layoffs. Hours worked increased again this month, and the wages and benefits index rose from 5 to 10.

Foreclosure: Eviction "the weary epilogue"

by Calculated Risk on 12/27/2010 09:09:00 AM

From Megan Woolhouse at the Boston Globe: At housing court, final pleas to head off evictions

If foreclosure is the final chapter of homeownership, a court eviction hearing is the weary epilogue.I'm surprised by how many former homeowners are fighting eviction - and by some of the numbers in the article like a homeowner making $32,000 per year who had a monthly mortgage payment of $3,200 - how was that supposed to work? And a retiree whose mortgage interest rate jumped from 11.3% to 17.3%. Really? Who was the mortgage lender and what kind of loan did he have?

Just two years ago, hearings involving foreclosed homeowners were relatively rare, occurring once a month or less. But soaring foreclosures, which have continued to rise in recent months, have flooded the court with such eviction requests.

...

On this Thursday at Boston Housing Court, there were nearly 30 cases, involving people from many walks of life, from a single working mother to a 75-year-old retiree to a city police officer.

Some manage to postpone eviction, while others are not so lucky.

...

Usually, foreclosure is a kind of death sentence for homeowners. While state law protects renters living in foreclosed apartments from sudden eviction, banks are under no legal obligation to let former owners stay.

Sunday, December 26, 2010

Unofficial Problem Bank list at 919 Institutions

by Calculated Risk on 12/26/2010 11:37:00 PM

Earlier:

• Schedule for Week of December 26th

• Summary for Week ending December 25th

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 24, 2010.

Changes and comments from surferdude808:

The FDIC did not release its enforcement actions for November 2010 nor did they close any institutions this week, which contributed to a quiet week for the Unofficial Problem Bank List. There were three removals and two additions this week leaving the list at 919 institutions with assets of $407.9 billion.CR Note: The FDIC is probably finished closing banks for the year. The total was 157 failures in 2010, up from 140 failures in 2009.

The removals include the failed Community National Bank, North Branch, MN ($32 million), which was an oversight as they had moved their headquarters to Lino Lakes. In a press release, AB&T National Bank, Albany, GA ($142 million Ticker: ALBY) said the OCC had terminated the Formal Action it had been operating under since 2006. The other removal was Bank Midwest, National Association, Kansas City, MO ($3.9 billion) as it merged with Armed Forces National Bank, NA, Fort Leavenworth, KS ($811 million), which is also operating under a Consent Order from the OCC.

The two additions are Provident Community Bank, National Association, Rock Hill, SC ($429 million Ticker: PCBS); and Security Federal Savings Bank, Logansport, IN ($191 million). The other change is a Prompt Corrective Action Order issued by the OTS against Liberty Federal Savings Bank, Enid, Ok ($148 million).

Perhaps next week the FDIC will release its actions for November 2010.

Vehicle Sales: Fleet Turnover Ratio

by Calculated Risk on 12/26/2010 07:40:00 PM

Way back, during the darkest days of the recession, I wrote a couple of optimistic posts about auto sales - Vehicle Sales (Jan 2009) and Looking for the Sun (Feb 2009). By request, here is an update to the U.S. fleet turnover graph.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate through November 2010 - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age or the composition of the fleet).

The wild gyrations in 2009 were due to the cash-for-clunkers program.

Note: Number of registered vehicles estimated. This is for total vehicles, not just light vehicles.

The estimated ratio for November was just under 20 years - still very high, but well below the peak of 26 years. The turnover ratio will probably decline to 15 or so over the next few years.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate. The current sales rate is still near the bottom of the '90/'91 recession - when there were fewer registered drivers and a smaller population.

Light vehicle sales were at a 12.22 million seasonally adjusted annual rate (SAAR) in November. To bring the turnover ratio down to more normal levels, unit sales will have to rise to 14 or 15 million SAAR. Of course cars are lasting longer - note the general uptrend in the first graph - so the turnover ratio probably will not decline to the previous level. Also this says nothing about the composition of the fleet (perhaps smaller cars).

Earlier:

• Schedule for Week of December 26th

• Summary for Week ending December 25th

Question #7 for 2011: State and Local Governments

by Calculated Risk on 12/26/2010 03:29:00 PM

Last weekend I posted some questions for next year: Ten Economic Questions for 2011. I'm working through the questions and trying to add some predictions, or at least some thoughts for each question before the end of year.

7) State and Local Governments: How much of a drag will state and local budget problems have on economic growth and employment? Will there be any significant muni defaults?

The good news is it appears state and local government revenue has stabilized. The bad news is the budget gaps will still be huge in 2011. The National Conference of State Legislatures (NCSL) released a report earlier this month, "State Budget Update: November 2010," forecasting

an increasing majority of state legislative fiscal directors are reporting that the revenue outlook for the remaining seven months of FY 2011 looks promising. At the same time, however, most states also are forecasting significant budget gaps in FY 2012. ... Funds from the American Recovery and Reinvestment Act (ARRA) have helped support state budgets since FY 2009. States will face a $37.9 billion loss in federal funds in FY 2012 compared to FY 2011, according to the Federal Funds Information for States. This is expected to make big holes in state budgets, what many state officials call the "ARRA cliff effect."Including the loss of the ARRA funds, the state budget gaps are expected to total around $110 billion in 2011, down from $174 billion in 2010. This suggests further budget cuts for states.

In a recent research note, "Amid Stronger Growth, State and Local Drag Persists", Goldman Sachs' Andrew Tilton wrote:

The ability of states to defer adjustment is waning, based on public comments from state officials and budget analyst reports. Most states have tapped rainy day funds, privatized assets, decreased pension fund contributions, delayed wage or contractor payments, and so on. While there are many possible tactics, the hardest-hit jurisdictions have already exhausted the most practical and politically attractive options, and so further budget adjustments are more likely to be made through spending cuts.And spending cuts means more state and local layoffs. So far in 2010 most of the government job cuts have been at the local level (about 200,000 jobs lost), and the cuts will probably be fewer in 2011 - but still a drag on employment. Goldman's estimate is the state and local government budget problems will be about a 0.5% drag on national GDP in 2011.

The other key issue is possible state and local defaults. Analyst Meredith Whitney has made headlines recently predicting widespread defaults. On 60 Minutes she said: "You could see 50 sizeable defaults. Fifty to 100 sizeable defaults. More. This will amount to hundreds of billions of dollars' worth of defaults."

Several analysts have disputed Whitney's statement. Bloomberg columnist Joe Mysak wrote: Meredith Whitney Overreaches With Muni Meltdown Call

If pressed, I would say that we might see between 100 and 200 municipal defaults next year, maybe totaling in the $5 billion or $10 billion range.And that is an important point that Bond Girl recently made at Self-evident.org: Default and bankruptcy in the municipal bond market (part one)

...

Most defaults in the modern era aren’t governmental or what we might call municipal at all. The majority are corporate or nonprofit borrowings in the guise of some municipal conduit -- nursing homes, housing developments, biofuel refineries -- so they could qualify for tax-free financing.

I am just writing this post to demystify a process that evidently needs demystifying. ...Bond Girl has followed up with another post about the Chapter 9 bankruptcy process: Default and bankruptcy in the municipal bond market (part two)

One of the more frustrating aspects of muni market coverage in the news and blogosphere is the tendency to talk about municipal debt as if only one type of bond is issued and traded. There is actually considerable diversity among borrowers in the muni market (e.g., they are not all government entities), and by extension, the types of commitments that are made for the repayment of the debt. Although the relative health of the muni market has macroeconomic consequences, this is in many ways a market that defies generalization. ...

Clearly Bond Girl disagrees with Whitney (I'll side with Bond Girl). There will be defaults, but they probably will not lead to anything on the scale that Whitney is predicting with "hundreds of billions of dollars' worth of defaults".

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Summary for Week ending December 25th

by Calculated Risk on 12/26/2010 08:29:00 AM

Note: here is the economic schedule for the coming week.

Below is a summary of the previous week, mostly in graphs.

• November Existing Home Sales: 4.68 million SAAR, 9.5 months of supply

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November 2010 (4.68 million SAAR) were 5.6% higher than last month, and were 27.9% lower than November 2009.

According to the NAR, inventory decreased to 3.71 million in November from 3.86 million in October. Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall. Although inventory decreased from October to November, inventory increased 5.4% YoY in November.

According to the NAR, inventory decreased to 3.71 million in November from 3.86 million in October. Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall. Although inventory decreased from October to November, inventory increased 5.4% YoY in November.

The year-over-year increase in inventory is especially bad news because the reported inventory is very high (3.71 million), and the 9.5 months of supply in November is well above normal.

The bottom line: Sales were weak in November, and existing home sales will continue to be weak for some time. Inventory is very high, and the year-over-year increase in inventory is very concerning. The high level of inventory will continue to put downward pressure on house prices.

• New Home Sales weak in November

This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

The Census Bureau reported New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 290 thousand. This is up from a revised 275 thousand in October.

Months of supply decreased to 8.2 in November from 8.8 in October. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).

Months of supply decreased to 8.2 in November from 8.8 in October. The all time record was 12.4 months of supply in January 2009. This is still high (less than 6 months supply is normal).

The 290 thousand annual sales rate for November is just above the all time record low in August (274 thousand). This was the weakest November on record and below the consensus forecast of 300 thousand. This was another very weak report.

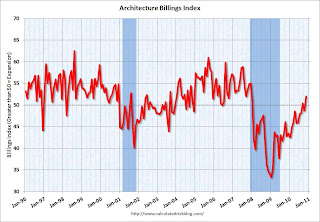

• AIA: Architecture Billings Index showed expansion in November

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996.

This graph shows the Architecture Billings Index since 1996.

From the American Institute of Architects: Firm Billings Rebound in November. "At 52.0, the AIA’s Architecture Billings Index (ABI) recorded a three point gain from the previous month, and reached its strongest level since December 2007."

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end next summer.

• Moody's: Commercial Real Estate Prices increased in October

Moody's reported this week that the Moody’s/REAL All Property Type Aggregate Index increased 1.3% in October. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices and make the index very volatile.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are about 42% below the peak in 2007.

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.

• Other Economic Stories ...

• From Reuters: Fitch cuts Portugal rating one notch on debt levels

• From Bloomberg: Hungary's Credit Rating Cut by Fitch on Budget; Debt Grade Nears `Abyss'

• From John Carney at CNBC: Bank of America Loses Key Battle In Mortgage Fraud Fight

• From the American Trucking Association: ATA Truck Tonnage Index Fell 0.1 Percent in November

• DOT: Vehicle miles driven increased in October

• From Tom Lawler: Overall Housing Stock Growth Likely to Slow Even Further in 2011

Best wishes to all!