by Calculated Risk on 12/28/2010 02:32:00 PM

Tuesday, December 28, 2010

Misc: Richmond Fed Manufacturing Survey, Consumer Confidence

A couple of earlier releases:

• From the Richmond Fed: Manufacturing Activity Expanded at a Solid Pace in December

In December, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — rose sixteen points to 25 from November's reading of 9. Among the index's components, shipments jumped twenty-three points to 30, new orders rose nineteen points to finish at 29, and the jobs index increased four points to 14.This was above expectations of an increase to 11. The last of the regional surveys (Kansas City) will be released on Thursday. I'll update the Fed-ISM graph then.

• The Conference Board reported their consumer confidence index was at 52.5 (1985=100), down from 54.3 in November. This was below expectations of an increase to 57.4. Confidence is a coincident indicator, but this shows consumers remain cautious.

Earlier:

• Case-Shiller: Home Prices Weaken Further in October

• House Prices and Months-of-Supply, and Real House Prices

House Prices and Months-of-Supply, and Real House Prices

by Calculated Risk on 12/28/2010 11:35:00 AM

This morning S&P/Case-Shiller released the monthly Home Price indexes for October (a three month average). Here is a look at house prices and existing home months-of-supply, and also real house prices (2nd graph).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

House prices are through October using the composite 20 index. Months-of-supply is through November.

We need to watch inventory and months-of-supply closely for hints about house prices. The recent surge in existing home inventory - and increase in the months-of-supply - is one of the reasons I expected house prices to fall another 5% to 10%. S&P is also forecasting additional price declines.

Note: there have been periods with high months-of-supply and rising house prices (see: Lawler: Again on Existing Home Months’ Supply: What’s “Normal?” ) so this is just a guide.

The following graph shows the Case-Shiller Composite 20 index, and the CoreLogic House Price Index in real terms (adjusted for inflation using CPI less shelter).

In real terms, both indexes are back to early 2001 prices. Also both indexes are at post-bubble lows.

In real terms, both indexes are back to early 2001 prices. Also both indexes are at post-bubble lows.

A few key points:

• This is worth repeating: the real price indexes are at post-bubble lows. Those who argued prices bottomed some time ago are already wrong in real terms, and will probably be wrong in nominal terms soon.

• Don't expect real prices to fall to '98 levels. In many areas - if the population is increasing - house prices increase slightly faster than inflation over time, so there is an upward slope in real prices.

• Real prices are still too high, but they are much closer to the eventual bottom than the top in 2005. This isn't like in 2005 when prices were way out of the normal range.

• With high levels of inventory, prices will probably fall some more. (I'll update my price forecast soon).

Case-Shiller: Home Prices Weaken Further in October

by Calculated Risk on 12/28/2010 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October (actually a 3 month average of August, September and October).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: U.S. Home Prices Weaken Further as Six Cities Make New Lows

Data through October 2010, released today by Standard & Poor’s for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show a deceleration in the annual growth rates in 18 of the 20 MSAs and the 10- and 20-City Composites in October compared to what was reported for September 2010. The 10-City Composite was up only 0.2% and the 20-City Composite fell 0.8% from their levels in October 2009. Home prices decreased in all 20 MSAs and both Composites in October from their September levels. In October, only the 10-City Composite and four MSAs – Los Angeles, San Diego, San Francisco and Washington DC – showed year-over-year gains. While the composite housing prices are still above their spring 2009 lows, six markets – Atlanta, Charlotte, Miami, Portland (OR), Seattle and Tampa – hit their lowest levels since home prices started to fall in 2006 and 2007, meaning that average home prices in those markets have fallen beyond the recent lows seen in most other markets in the spring of 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.7% from the peak, and down 0.9% in October(SA).

The Composite 20 index is off 30.5% from the peak, and down 1.0% in October (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 0.2% compared to October 2009.

The Composite 20 SA is down 0.8% compared to October 2009. This is the first year-over-year decline since 2009.

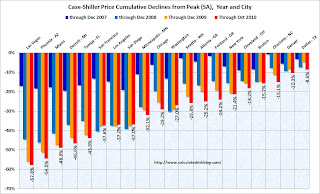

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in only 2 of the 20 Case-Shiller cities in October seasonally adjusted. Only Denver and Wash, D.C. saw small price increases (SA) in October, and prices fell in all cities NSA.

Prices increased (SA) in only 2 of the 20 Case-Shiller cities in October seasonally adjusted. Only Denver and Wash, D.C. saw small price increases (SA) in October, and prices fell in all cities NSA. Prices in Las Vegas are off 57.8% from the peak, and prices in Dallas only off 8.6% from the peak.

Prices are now falling - and falling just about everywhere. As S&P noted "six markets – Atlanta, Charlotte, Miami, Portland (OR), Seattle and Tampa – hit their lowest levels since home prices started to fall in 2006 and 2007". More cities will join them soon.

Monday, December 27, 2010

Evening Reading

by Calculated Risk on 12/27/2010 09:48:00 PM

I'm always skeptical of these early reports, but from the NY Times: Defying the Pessimists, Holiday Sales Rebound

After a 6 percent free fall in 2008 and a 4 percent uptick last year, retail spending rose 5.5 percent in the 50 days before Christmas, exceeding even the more optimistic forecasts, according to MasterCard Advisors SpendingPulse, which tracks retail spending.I'm still working my way through the Ten Economic questions for 2011:

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

Economic release schedule for tomorrow:

9:00 AM: S&P/Case-Shiller Home Price Index for October. The consensus is for prices to decline about 0.4% in October; the fourth straight month of house price declines.

10:00 AM: Conference Board's consumer confidence index for December. The consensus is for an increase to 57.4 from 54.1 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December. The consensus is for a reading of 11 (expansion), a slight increase from 9 last month.

Happy Holidays to All.

Freddie Mac: 90+ Day Delinquency Rate increases in November

by Calculated Risk on 12/27/2010 06:11:00 PM

Freddie Mac reported that the serious delinquency rate increased to 3.85% in November from 3.82% in October. The following graph shows the Freddie Mac serious delinquency rate (loans that are "three monthly payments or more past due or in foreclosure"):

Some of the rapid increase last year was probably because of foreclosure moratoriums, and from modification programs because loans in trial mods were considered delinquent until the modifications were made permanent. As modifications have become permanent, they are no longer counted as delinquent.

The increases in October and November are probably related to the new foreclosure moratoriums. The rate will probably start to decrease again in 2011.

Note: Fannie Mae reported the serious delinquency rate declined slightly in October (they are a month behind Freddie Mac).

Question #6 for 2011: Unemployment Rate

by Calculated Risk on 12/27/2010 01:16:00 PM

A week ago I posted some questions for next year: Ten Economic Questions for 2011. I'm working through the questions and trying to add some predictions, or at least some thoughts for each question before the end of year.

6) Unemployment Rate: The post-Depression record for consecutive months with the unemployment rate above 9% was 19 months in the early '80s. That record will be broken this month, and it is very possible that the unemployment rate will still be above 9% in December 2011. This high level of unemployment - and the number of long term unemployed - is an economic tragedy. The economy probably needs to add around 125 thousand payroll jobs per month just to keep the unemployment rate from rising (payroll jobs and unemployment rate come from two different surveys, so there is no perfect relationship, and the rate also depends on the participation rate). What will the unemployment rate be in December 2011?

First, here is a graph showing the current unemployment rate (red) and the participation rate (blue). The unemployment rate depends both on job creation and the labor force participation rate.

Click on graphs for large images in graphics gallery.

Click on graphs for large images in graphics gallery.

The unemployment rate is currently at 9.8%, and the Labor Force Participation Rate (blue) was at 64.5% in November. This is the percentage of the working age population in the labor force.

Although I expect the participation rate to decline over the next couple of decades as the population ages, I think the participation rate will rise over the next few years - perhaps as high as 66%.

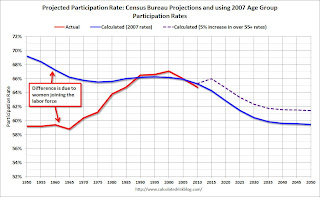

The following graph is a projection from a previous post: Labor Force Participation Rate: What will happen?

This graph uses the participation rates by age group for 2007, and historical data and age group population projections from the Census Bureau, to calculate a participation rate based on demographics.

This graph uses the participation rates by age group for 2007, and historical data and age group population projections from the Census Bureau, to calculate a participation rate based on demographics.

This graph shows the calculated participation rate (blue) through 2050, and the actual participation rate since 1950 (red). The calculated participation rate, using 2007 data, is far too high for the earlier periods. This is mostly because of women joining the labor force.

Without other shifts in the labor force, the blue line would indicate the participation rate over the next 40 years. The dashed purple line indicates the participation rate with a 5 percentage point increase in the 'over 55' labor force participation rate - something that appears likely.

If the participation rate does increases - say to 65% over the next year, from the current 64.5% - then the U.S. economy will need an additional 1 million jobs just to hold the unemployment rate steady (not counting population growth). Add in 125,000 per month more jobs to offset population growth, and the economy would have to add 2.5 million jobs in 2011 to hold the unemployment rate steady (assuming a 0.5 percentage point increase in the participation rate). This suggests any decline in the unemployment rate will be slow.

Another way to look at the unemployment rate is using Okun's Law.

This graph uses a version of Okun's law showing the annual change in real GDP (x-axis) vs. the annual change in the unemployment rate (y-axis) through Q3 2010.

This graph uses a version of Okun's law showing the annual change in real GDP (x-axis) vs. the annual change in the unemployment rate (y-axis) through Q3 2010.

Note: For this graph I used a rolling four quarter change - so all the data points are not independent. However - remember - this "law" is really just a guide.

The following table summarizes several scenarios over the next year using this relationship (starting from the current 9.8% unemployment rate):

| Real GDP Growth | Unemployment Rate in One Year |

|---|---|

| 0.0% | 11.2% |

| 1.0% | 10.7% |

| 2.0% | 10.2% |

| 3.0% | 9.8% |

| 4.0% | 9.3% |

| 5.0% | 8.9% |

| 6.0% | 8.3% |

Back in November, I took the "over" on GDP growth in 2011. Since then most forecasts have been revised up, but using this graph, real GDP growth would probably have to be above about 3% to see a reduction in the unemployment rate.

Although I'm still looking at GDP and employment for 2011, I think the unemployment rate will decline - but slowly. A couple of predictions.

• The participation rate will rise in 2011, perhaps to 65%.

• The unemployment rate will fall in 2011, but probably still be above 9% in December 2011 (I hope this is way too pessimistic).

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy