by Calculated Risk on 12/31/2010 04:20:00 PM

Friday, December 31, 2010

Question #1 for 2011: House Prices

Two weeks ago I posted some questions for next year: Ten Economic Questions for 2011. I'm working through the questions and trying to add some predictions, or at least some thoughts for each question before the end of year.

1) House Prices: How much further will house prices fall on the national repeat sales indexes (Case-Shiller, CoreLogic)? Will house prices bottom in 2011?

There is no perfect gauge of "normal" house prices. Changes in house prices depend on local supply and demand. Heck, there is no perfect measure of house prices!

That said, probably the three most useful measures of house prices are 1) real house prices, 2) the house price-to-rent ratio, and 3) the house price-to-median household income ratio. These are just general guides.

Real House Prices

The following graph shows the Case-Shiller Composite 20 index, and the CoreLogic House Price Index in real terms (adjusted for inflation using CPI less shelter).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

In real terms, both indexes are back to early 2001 prices. Also both indexes are at post-bubble lows.

As I've noted before, I don't expect real prices to fall to '98 levels. In many areas - if the population is increasing - house prices increase slightly faster than inflation over time, so there is an upward slope in real prices.

If real prices fall to 100 on this index (seems possible) that implies about a 10% decline in real prices. However what everyone wants to know is the change in nominal prices (not inflation adjusted). If real prices eventually fall 10%, that doesn't mean nominal prices will fall that far. House prices tend to be sticky downwards, except in areas with a large number of foreclosures. That is key a reason why prices have been falling for years, instead of adjusting immediately.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through October 2010 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph through October 2010 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

I'd expect this ratio to decline another 10% to 20%. That could happen with falling house prices or rents increasing (recent reports suggest rents are now increasing).

Price to Household Income

The third graph shows the Case Shiller National price index (quarterly) and the median household income (from the Census Bureau, 2010 estimated).

The third graph shows the Case Shiller National price index (quarterly) and the median household income (from the Census Bureau, 2010 estimated).

Once again this ratio is still a little high, and I'd expect this ratio might decline another 10%. That could be a combination of falling house prices and an increase in the median household income.

This isn't like in 2005 when prices were way out of the normal range by these measures, but it does appear prices are still a little too high.

House Prices and Supply

The final graph (repeat) shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

The final graph (repeat) shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

House prices are through October using the composite 20 index. Months-of-supply is through November.

We need to continue to watch inventory and months-of-supply closely for hints about house prices. Right now house prices are falling at about a 10% annual rate.

Note: there have been periods with high months-of-supply and rising house prices (see: Lawler: Again on Existing Home Months’ Supply: What’s “Normal?” ) so this is just a guide.

My guess:

I think national house prices - as measured by these repeat sales indexes - will decline another 5% to 10% from the October levels. I think it is likely that nominal house prices will bottom in 2011, but that real house prices (and the price-to-income ratio) will decline for another two to three years.

Ten Questions:

• Question #1 for 2011: House Prices

• Question #2 for 2011: Residential Investment

• Question #3 for 2011: Delinquencies and Distressed house sales

• Question #4 for 2011: U.S. Economic Growth

• Question #5 for 2011: Employment

• Question #6 for 2011: Unemployment Rate

• Question #7 for 2011: State and Local Governments

• Question #8 for 2011: Europe and the Euro

• Question #9 for 2011: Inflation

• Question #10 for 2011: Monetary Policy

House Price Predictions

by Calculated Risk on 12/31/2010 02:19:00 PM

Here are a few predictions on house prices (I'm working on mine):

• From Peter Schiff in the WSJ: Home Prices Are Still Too High

[The Case Shiller] index would need to decline an additional 20.3% from current levels just to get back to the trend line.So put Schiff down for another 30% or so.

...

With a bleak economic prospect stretching far out into the future, I feel that a 10% dip below the 100-year trend line is a reasonable expectation within the next five years ...

• From Gary Shilling: House Prices Will Now Drop Another 20%

• From Jan Hatzius at Goldman Sachs: Another 5% in 2011.

[W]e now expect house prices to fall another 5% during 2011. The reason is the still-large excess supply, as we have only unwound about one-third of the pre-bubble increase in the homeowner vacancy rate so far.I'll post my prediction soon.

Problem Banks: Stress by State

by Calculated Risk on 12/31/2010 10:25:00 AM

Some more interesting data from Surferdude808:

With the banking crisis ending its third year, it may prove useful to identify which states have experienced the most stress.

At year-end 2007, there were 8,536 insured institutions headquartered in the 50 states, D.C., and Puerto Rico. Since that time, 1,340 or 15.7 percent have either failed or made an appearance on the Unofficial Problem Bank List (see table below).

When ranking markets with a minimum of 15 institutions at year-end 2007, Arizona has experienced the most stress with 45.6 percent of its institutions having failed or being identified as a problem. Washington is a close second at 45.4 percent. The other stressed banking states that rank in the top ten include Nevada (43 percent), Oregon (40 percent), Florida (37 percent), Georgia (34 percent), California (34 percent), Utah (32 percent), Idaho (26 percent), and Colorado (25 percent).

The common theme among these is overexposure to commercial real estate lending, particularly residential construction & development loans, and the collapse of real estate markets. At the other end of the spectrum with comparatively little stress include Iowa (4.3 percent), New Hampshire (4.2 percent), and West Virginia (1.5 percent). Vermont is the only state that has not experienced a failed institution or one appearing on the Unofficial Problem Bank List.

| State | 2007 Count | 20101 | Removals2 | Failures3 | Total4 | % 5 | Rank |

|---|---|---|---|---|---|---|---|

| AK | 6 | 1 | 1 | 0.0% | 47 | ||

| AL | 160 | 24 | 4 | 28 | 17.5% | 16 | |

| AR | 150 | 14 | 2 | 2 | 18 | 12.0% | 25 |

| AZ | 57 | 15 | 2 | 9 | 26 | 45.6% | 1 |

| CA | 313 | 65 | 6 | 34 | 105 | 33.5% | 7 |

| CO | 159 | 33 | 4 | 3 | 40 | 25.2% | 10 |

| CT | 56 | 7 | 1 | 8 | 14.3% | 23 | |

| DC | 8 | 2 | 2 | 0.0% | 47 | ||

| DE | 33 | 3 | 3 | 9.1% | 33 | ||

| FL | 317 | 67 | 4 | 45 | 116 | 36.6% | 5 |

| GA | 352 | 64 | 4 | 51 | 119 | 33.8% | 6 |

| HI | 9 | 3 | 3 | 0.0% | 47 | ||

| IA | 391 | 14 | 2 | 1 | 17 | 4.3% | 44 |

| ID | 19 | 4 | 1 | 5 | 26.3% | 9 | |

| IL | 671 | 65 | 1 | 38 | 104 | 15.5% | 20 |

| IN | 162 | 13 | 3 | 1 | 17 | 10.5% | 27 |

| KS | 357 | 32 | 5 | 7 | 44 | 12.3% | 24 |

| KY | 206 | 16 | 3 | 1 | 20 | 9.7% | 29 |

| LA | 162 | 8 | 1 | 1 | 10 | 6.2% | 39 |

| MA | 181 | 8 | 1 | 1 | 10 | 5.5% | 41 |

| MD | 97 | 15 | 6 | 21 | 21.6% | 12 | |

| ME | 34 | 2 | 2 | 5.9% | 40 | ||

| MI | 164 | 22 | 3 | 10 | 35 | 21.3% | 13 |

| MN | 443 | 65 | 2 | 15 | 82 | 18.5% | 15 |

| MO | 361 | 26 | 3 | 11 | 40 | 11.1% | 26 |

| MS | 97 | 4 | 1 | 5 | 5.2% | 42 | |

| MT | 79 | 14 | 1 | 15 | 19.0% | 14 | |

| NC | 112 | 14 | 2 | 2 | 18 | 16.1% | 18 |

| ND | 97 | 4 | 1 | 5 | 5.2% | 42 | |

| NE | 248 | 10 | 5 | 2 | 17 | 6.9% | 38 |

| NH | 24 | 1 | 1 | 4.2% | 45 | ||

| NJ | 127 | 14 | 3 | 3 | 20 | 15.7% | 19 |

| NM | 53 | 7 | 2 | 9 | 17.0% | 17 | |

| NV | 44 | 8 | 1 | 10 | 19 | 43.2% | 3 |

| NY | 203 | 16 | 1 | 4 | 21 | 10.3% | 28 |

| OH | 265 | 19 | 2 | 4 | 25 | 9.4% | 31 |

| OK | 259 | 17 | 1 | 2 | 20 | 7.7% | 37 |

| OR | 40 | 9 | 1 | 6 | 16 | 40.0% | 4 |

| PA | 246 | 17 | 3 | 20 | 8.1% | 36 | |

| PR | 10 | 1 | 3 | 4 | 0.0% | 47 | |

| RI | 13 | 2 | 2 | 4 | 0.0% | 47 | |

| SC | 93 | 17 | 1 | 4 | 22 | 23.7% | 11 |

| SD | 89 | 7 | 1 | 8 | 9.0% | 34 | |

| TN | 203 | 17 | 1 | 18 | 8.9% | 35 | |

| TX | 659 | 48 | 7 | 8 | 63 | 9.6% | 30 |

| UT | 68 | 16 | 6 | 22 | 32.4% | 8 | |

| VA | 119 | 16 | 2 | 18 | 15.1% | 22 | |

| VT | 16 | 0 | 0.0% | 47 | |||

| WA | 97 | 28 | 2 | 14 | 44 | 45.4% | 2 |

| WI | 296 | 39 | 3 | 3 | 45 | 15.2% | 21 |

| WV | 68 | 1 | 1 | 1.5% | 46 | ||

| WY | 43 | 2 | 1 | 1 | 4 | 9.3% | 32 |

| Totals | 8,536 | 935 | 82 | 323 | 1,340 | 15.7% |

2 Unofficial Problem Bank List Removals (ex-Failures)

3 Failures (2008-2010)

4 Total Failures, UPBL, & UPBL Removals (ex-Failures)

5 Total failures, UBPL, and UPBL ex-failures to 2007 count (a percentage for states with less than 15 institutions is not determined because of possible skew to ranking).

Unofficial Problem Bank list increases to 935 Institutions

by Calculated Risk on 12/31/2010 09:05:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 31, 2010.

Changes and comments from surferdude808:

The FDIC finally released its enforcement actions for November 2010. After 18 additions and two removals, the Unofficial Problem Bank List finishes 2010 at 935 institutions and assets of $412.4 billion. The two removals were McClave State Bank, McClave, CO ($21 million) and First Resource Bank, Savage, MN ($17 million).

Among the 18 additions are Baylake Bank, Sturgeon, WI ($1.1 billion Ticker: BYLK); Signature Bank of Arkansas, Fayetteville, AR ($617 million); Regent Bank, Davie, FL ($471 million Ticker: RGTB); Grand Bank & Trust of Florida, West Palm Beach, FL ($463 million); United American Bank, San Mateo, CA ($344 million Ticker: UABK); Santa Lucia Bank, Atascadero, CA ($265 million Ticker: SLBA); and New Millennium Bank, New Brunswick, NJ ($246 million Ticker: NMNB).

Other changes include the Federal Reserve issuing a Prompt Corrective Action (PCA) order against BankEast, Knoxville, TN ($287 million). The FDIC terminated a PCA order against Bank 1st, Albuquerque, NM ($78 million).

Transition Matrix

With the passage of another quarter, it is time to update the transition matrix. The Unofficial Problem Bank List debuted on August 7, 2009 with 389 institutions with assets of $276.3 billion (see table below). Over the past 16 months, 163 institutions have been removed from the original list with 114 due to failure, 35 due to action termination, and 14 due to unassisted merger. Almost 30 percent of the 389 institutions on the original list have failed, which is substantially higher than the 12 percent figure usually cited by the media as the failure rate for institutions on the FDIC Problem Bank List. Failed bank assets have totaled $161 billion or nearly 59 percent of the $276.3 billion on the original list.

Since the publication of the original list, another 844 institutions have been added. However, only 709 of those 844 additions remain on the current list as 135 institutions have been removed in the interim. Of the 135 interim removals, 102 were due to failure, 23 were due to unassisted merger, 8 from action termination, and two from voluntary liquidation. In total, 1,296 institutions have made an appearance on the Unofficial Problem Bank List and 216 or 16.7 percent have failed. Of the 298 removals, failure is the primary form of exit (216 or 72 percent) while only 43 or 14.4 percent have been rehabilitated. The average asset size of removals because of failure is $1.1 billion. Currently, the average asset size of institutions on the current list is $441 million versus $710 million on the original list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 35 | (5,158,906) | |

| Unassisted Merger | 14 | (2,176,310) | |

| Failures | 114 | (161,735,942) | |

| Asset Change | (14,407,340) | ||

| Still on List at 7/02/2010 | 226 | 92,834,931 | |

| Additions | 709 | 319,519,339 | |

| End (12/31/2010) | 935 | 412,354,270 | |

| Interperiod Deletions1 | |||

| Action Terminated | 8 | 14,115,832 | |

| Unassisted Merger | 23 | 22,357,619 | |

| Voluntary Liquidation | 2 | 833,567 | |

| Failures | 102 | 75,345,146 | |

| Total | 135 | 112,652,164 | |

| 1Institution not on 8/7/2009 or 12/31/2010 list but appeared on a list between these dates. | |||

Thursday, December 30, 2010

Housing: Hank Paulson takes a loss

by Calculated Risk on 12/30/2010 10:45:00 PM

From Reuters: Ex-Treasury chief Paulson loses $1 mln on DC home

Paulson bought the home for $4.3 million in August 2006, and sold the home for $3.25 million on Dec 21st this year. A decline of almost 25%. Ouch.

That is about normal for D.C.

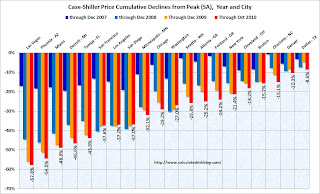

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the graph of the price declines for the 20 Case-Shiller cities.

Washington D.C. is off 27% from the peak. The price peak was in March 2006, and prices had already declined about 3% by August when Paulson bought.

He could have done worse. Prices in D.C. are up since March 2009.

Note: For those who missed it, yesterday I posted A few for Graphs for 2010. Enjoy!

Hotels: RevPAR up 3.6% compared to same week in 2009

by Calculated Risk on 12/30/2010 08:18:00 PM

A weekly update on hotels from HotelNewsNow.com: STR: US performance for week ending 25 Dec.

In year-over-year comparisons, occupancy increased 2.2 percent to 34.6 percent, average daily rate was up 1.4 percent to US$87.13, and revenue per available room finished the week up 3.6 percent to US$30.16.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

This is the slow season for hotels, and the key will be if business travel picks up early next year.

When 2010 started, hotel occupancy was running about the same rate as in 2009 - the worst year for hotels since the Great Depression. In the spring, the occupancy rate increased, and by mid-year occupancy had caught up with 2008 (2008 was weak year for hotels). For the last couple of months the occupancy rate has been running ahead of 2008. The year-over-year comparisons will look great in early 2011, but an important comparison will be with the median for '00 through '07.

A few comments from Jeff Higley at HotelNewsNow.com: There’s more than one way to describe 2010

I don’t fall in the camp that believes the United States hotel industry is in the midst of a full recovery just yet.Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Sure, there are signs the worst is over as hoteliers across the country are trying to dig out from the economic mess of the past two years. 2010 has been a year of extremes for the industry. It seems every week sends a different signal regarding the industry’s trek to recovery.

...

One full-service property I stayed at had a 7% occupancy rate on one of the nights of my visit; another property had 12 cars in the parking lot during the overnight hours. ... One the other hand, more roomnights were sold during July than any other month EVER, according to STR data.

...

In a nutshell, the hotel industry is seeing positive signs, but there’s still a long way to go before it can say it is in a true recovery. There are plenty of ways to measure success, but in this business there’s only one that truly counts: rates. When we see at least four months of year-over-year increases in rate and when the overall average daily rate gets to within five bucks of its $107 peak in 2008 (it’s about $10 off right now), it will be time to truly break out the recovery bubbly.